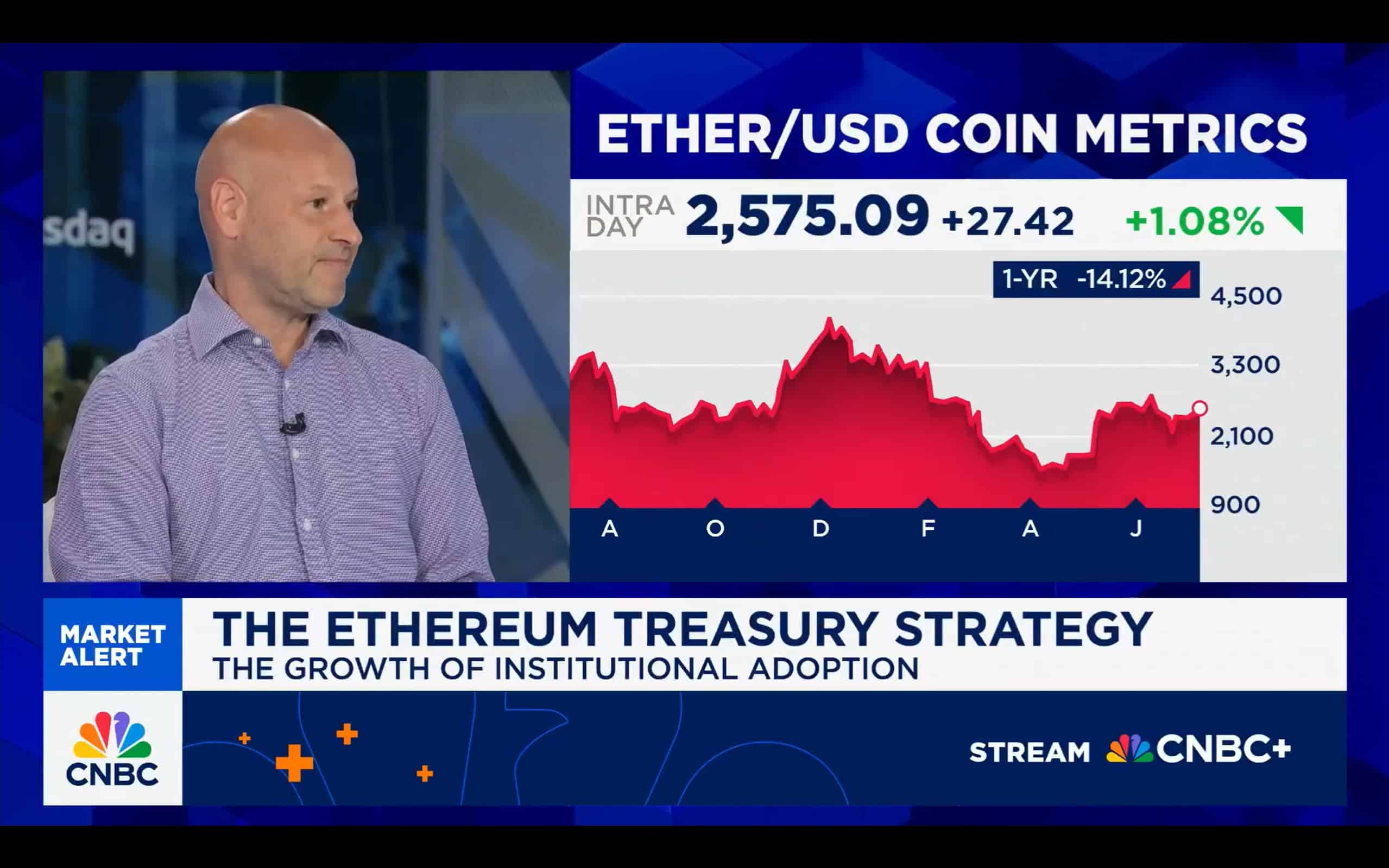

Ethereum price has moved into a strong bull run, a trend that may continue as its top metrics jump to a record high.

Summary

- Ethereum price is on the cusp of a strong bullish breakout.

- The stablecoin supply in the network has jumped to a record high.

- Spot ETH ETF inflows are still continuing this week.

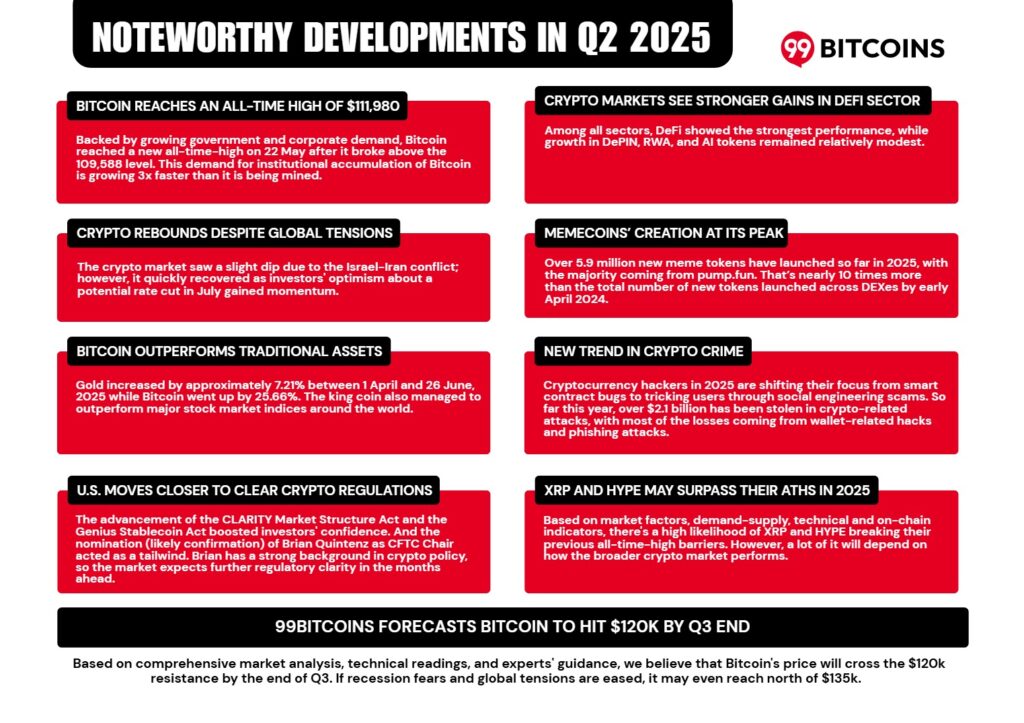

Ethereum (ETH) jumped over 3% to reach a high of $3,840, its highest level since July 31. The price has climbed 15% from this month’s low and is now up 175% from its April bottom.

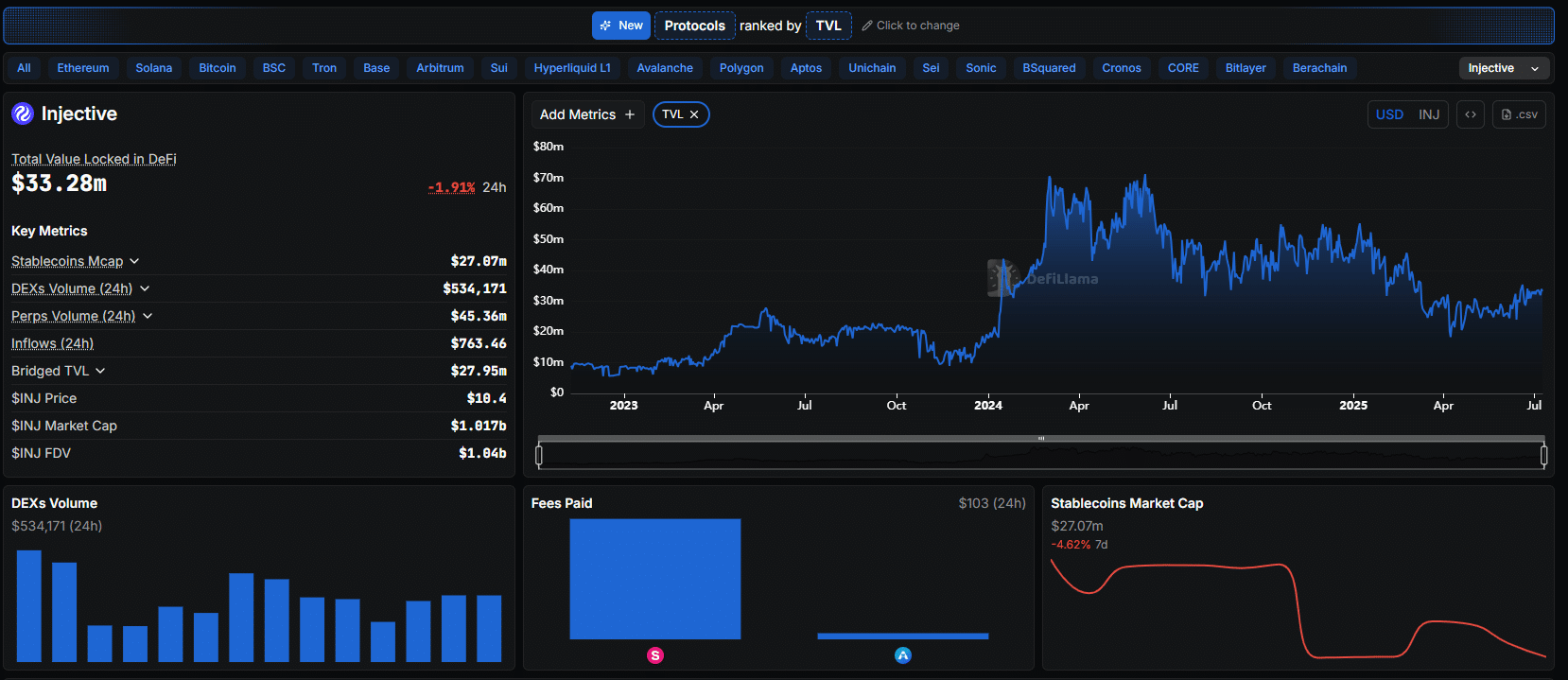

Top Ethereum metrics have surged to an all-time high

Third-party data shows that Ethereum is gaining momentum across multiple key indicators. According to Artemis, stablecoin supply on the network has risen 7% in the past 30 days to $138 billion, reinforcing Ethereum’s dominance as the leading chain for stablecoin activity.

Adjusted transaction volume surged 30% in the same period, hitting $766 billion, while the number of active addresses grew to 2.5 million. This growth comes in the wake of the GENIUS Act signed by President Donald Trump, which is widely seen as crypto-friendly legislation.

Additional data from Nansen reveals that transaction count on Ethereum rose 50% over the past month to 46.65 million. Active addresses increased 19% to 8.7 million, and total network fees climbed 41% to $48.2 million, highlighting elevated user engagement and activity.

Meanwhile, Ethereum’s decentralized finance sector is surging. Total value locked in the network has reached a record $187 billion. Top dApps like Lido, AAVE, EigenLayer, and EtherFi have all seen asset growth of more than 50% over the past 30 days.

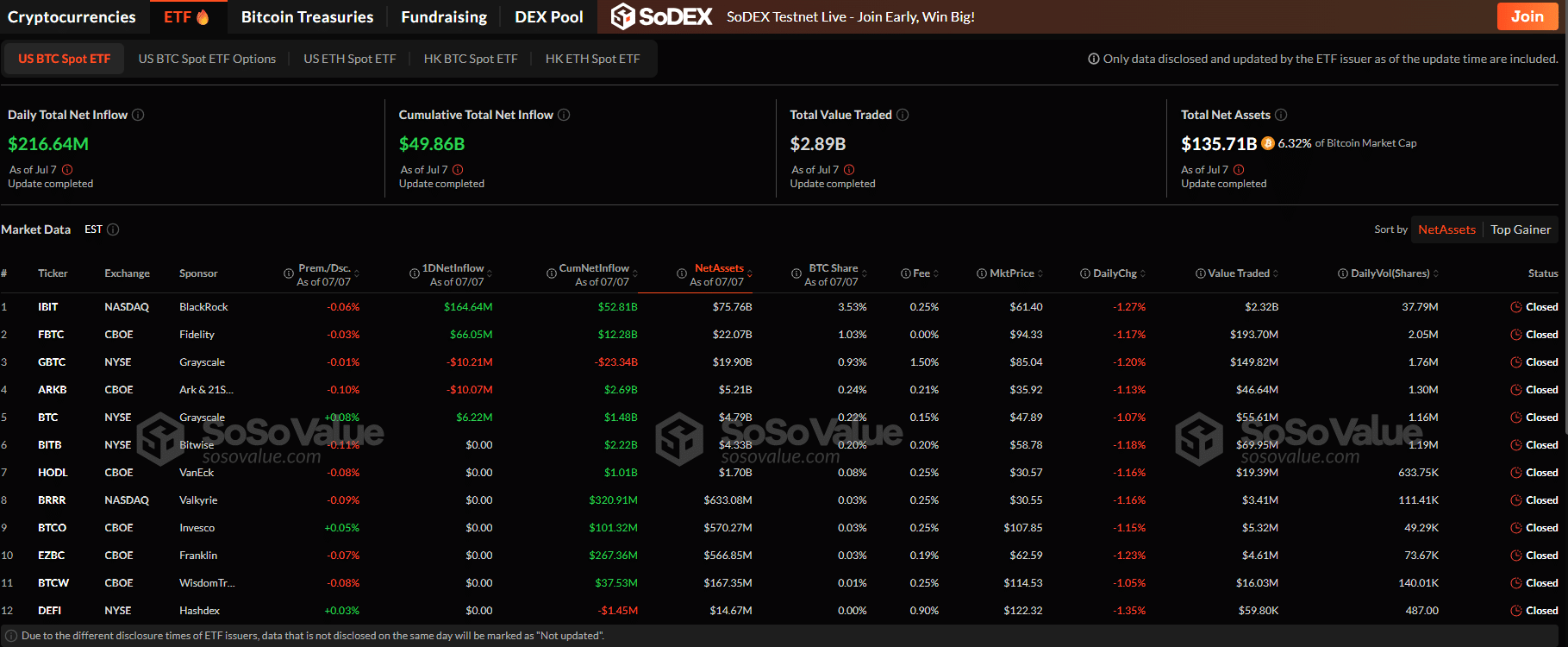

Wall Street investors continue accumulating ETH. Cumulative inflows into spot ETH ETFs have surpassed $9.2 billion. BlackRock’s ETHA now holds $10.8 billion in assets under management, making it a major institutional gateway to Ethereum exposure.

Ethereum may benefit when Trump signs an executive order to allow retirement funds to invest in crypto. Most of these 401 (k) funds will go to the most blue-chip coins like BTC and ETH.

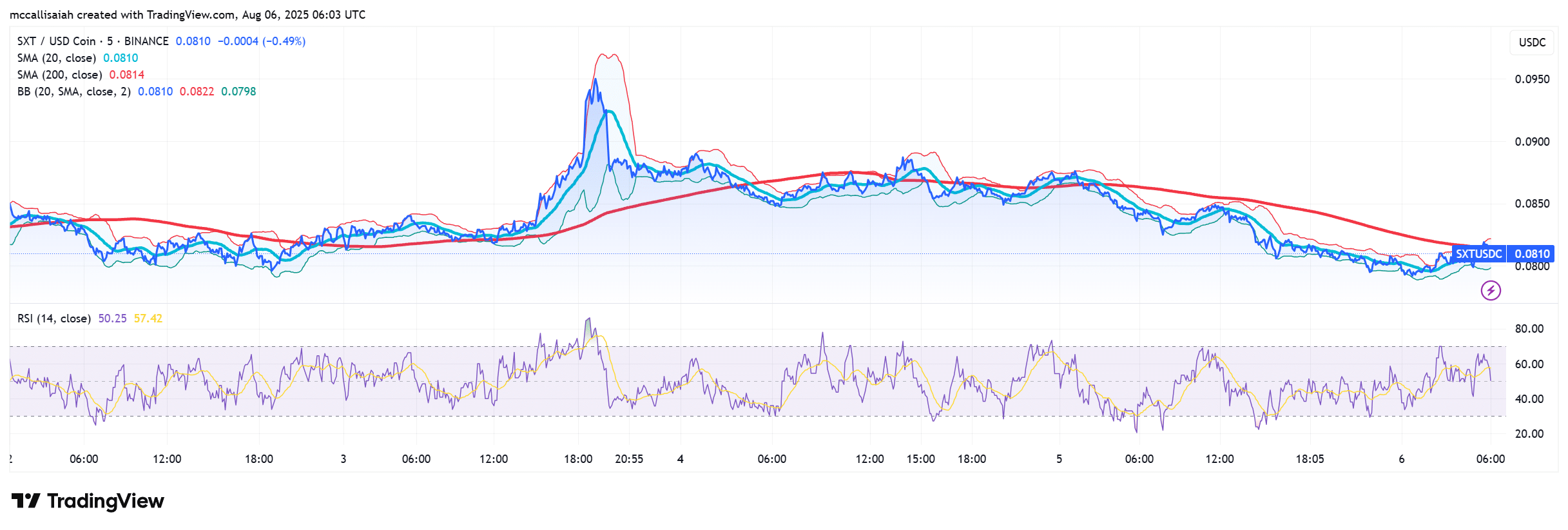

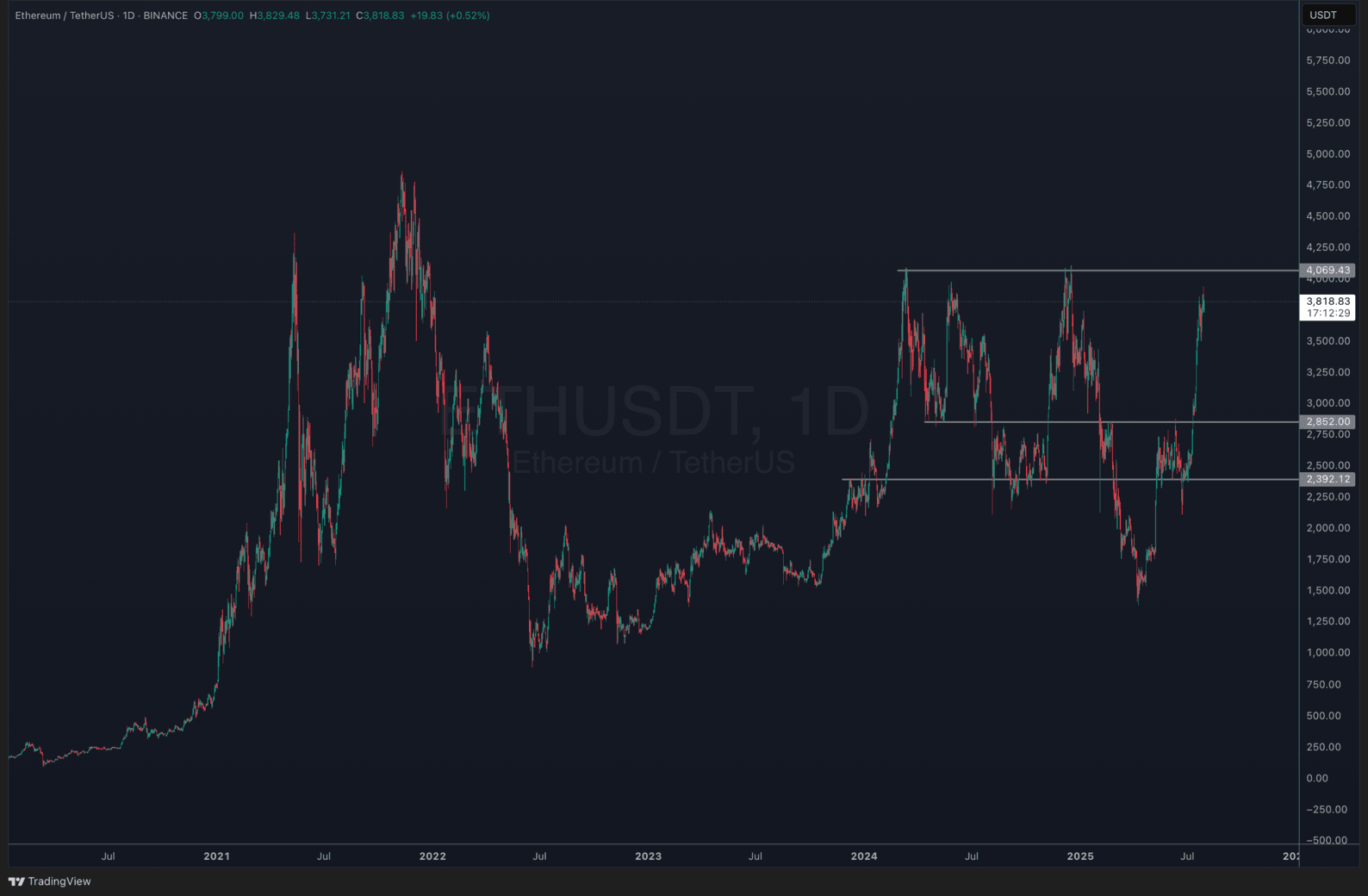

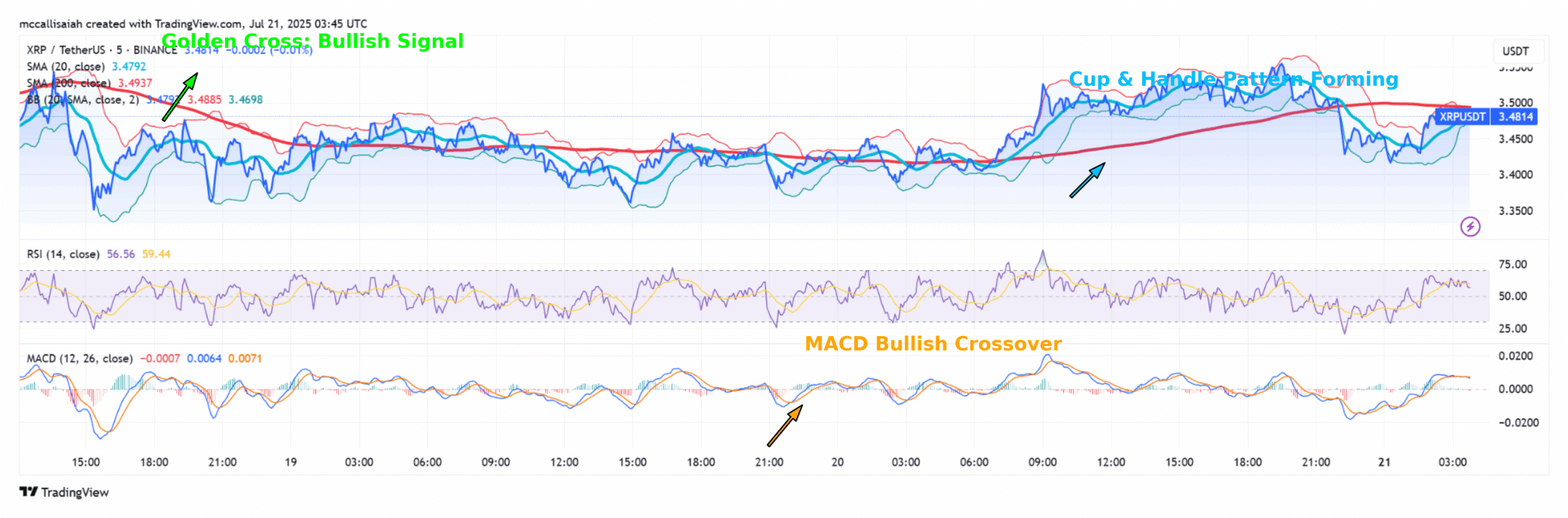

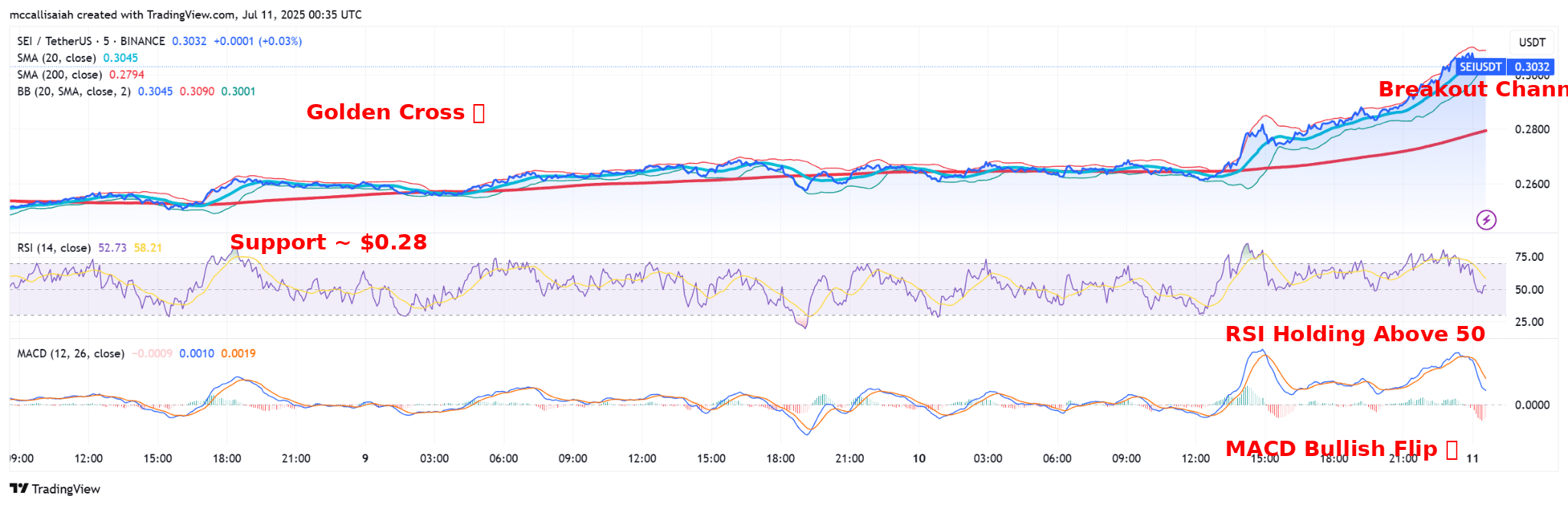

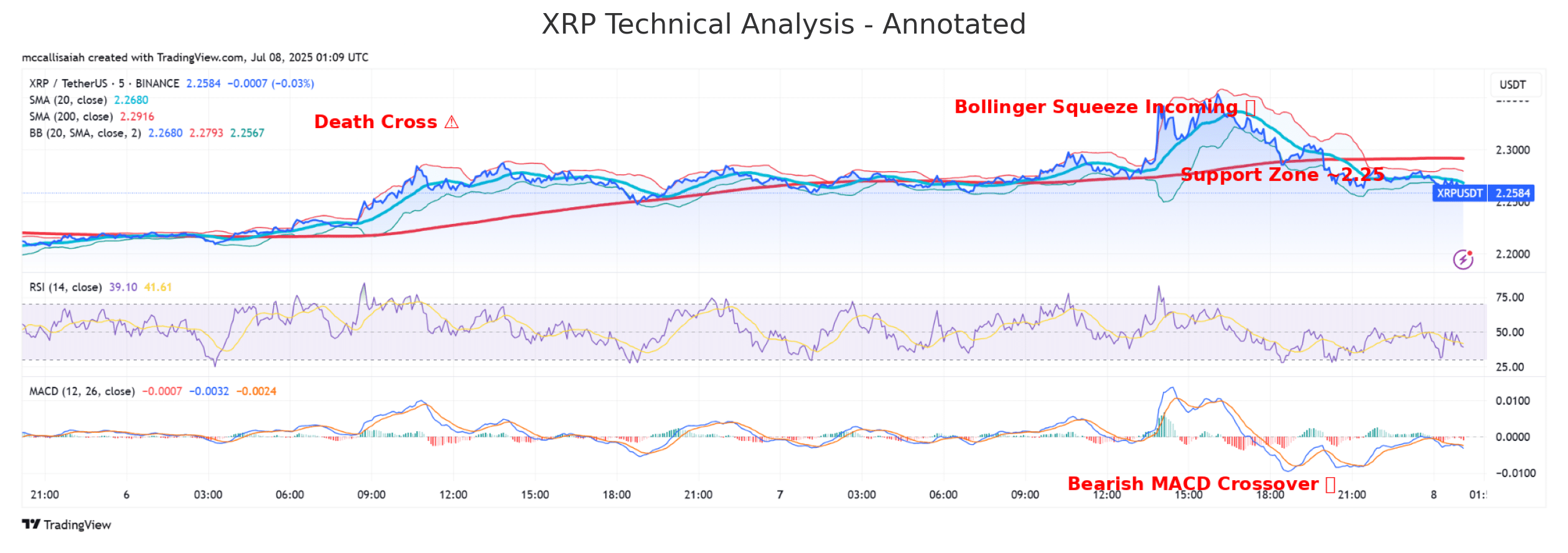

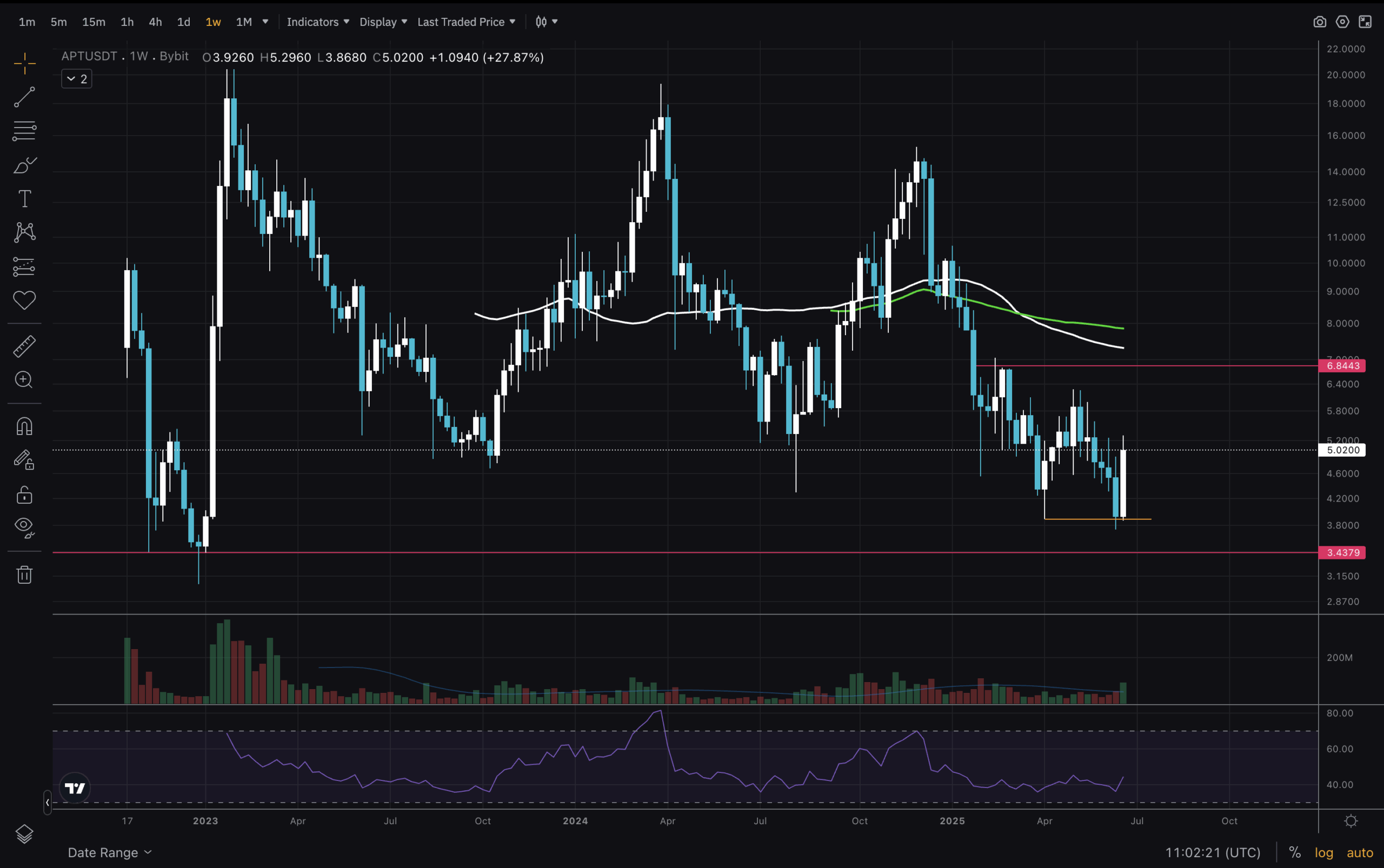

Ethereum price technical analysis

The daily chart shows that Ethereum has been in a strong uptrend since bottoming at $1,393 in April. It has since climbed to $3,815, approaching its year-to-date high of $3,945.

ETH remains above both the 50-day and 100-day Exponential Moving Averages and has broken above the 78.6% Fibonacci retracement level from the April low. With momentum building and on-chain activity strengthening, the most likely scenario is a continued push toward the 2024 high of $4,100.