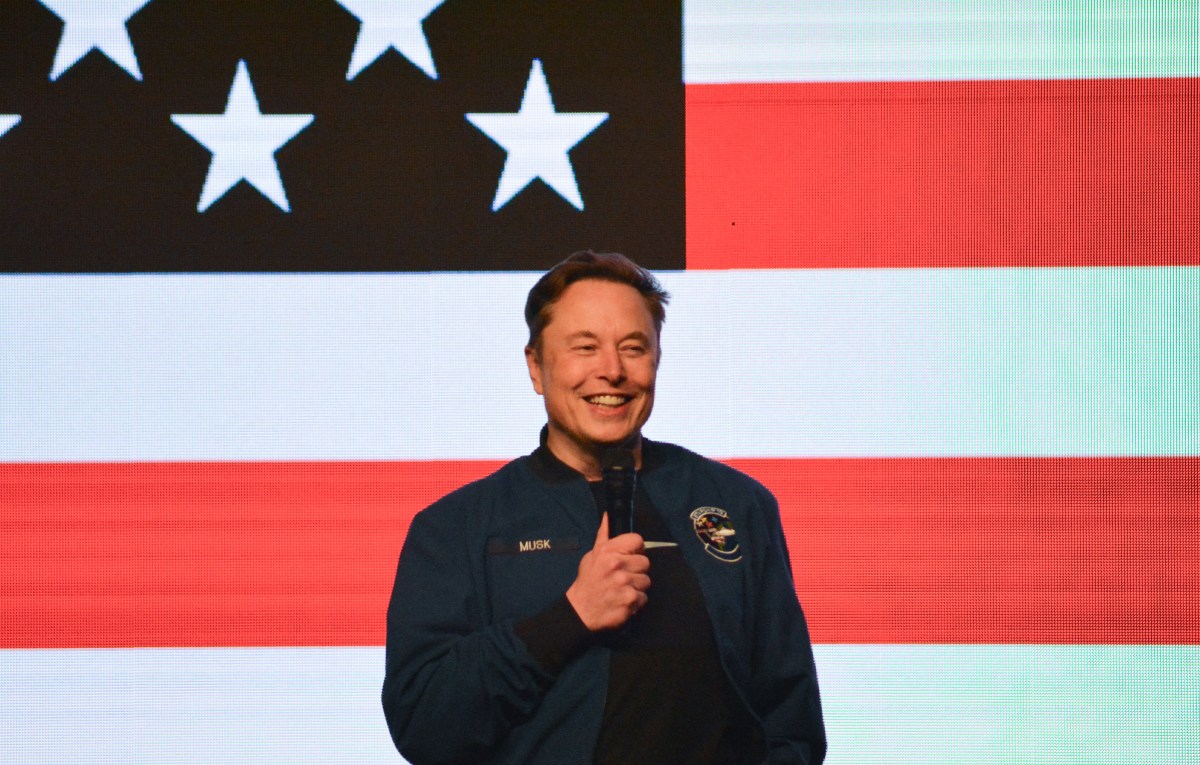

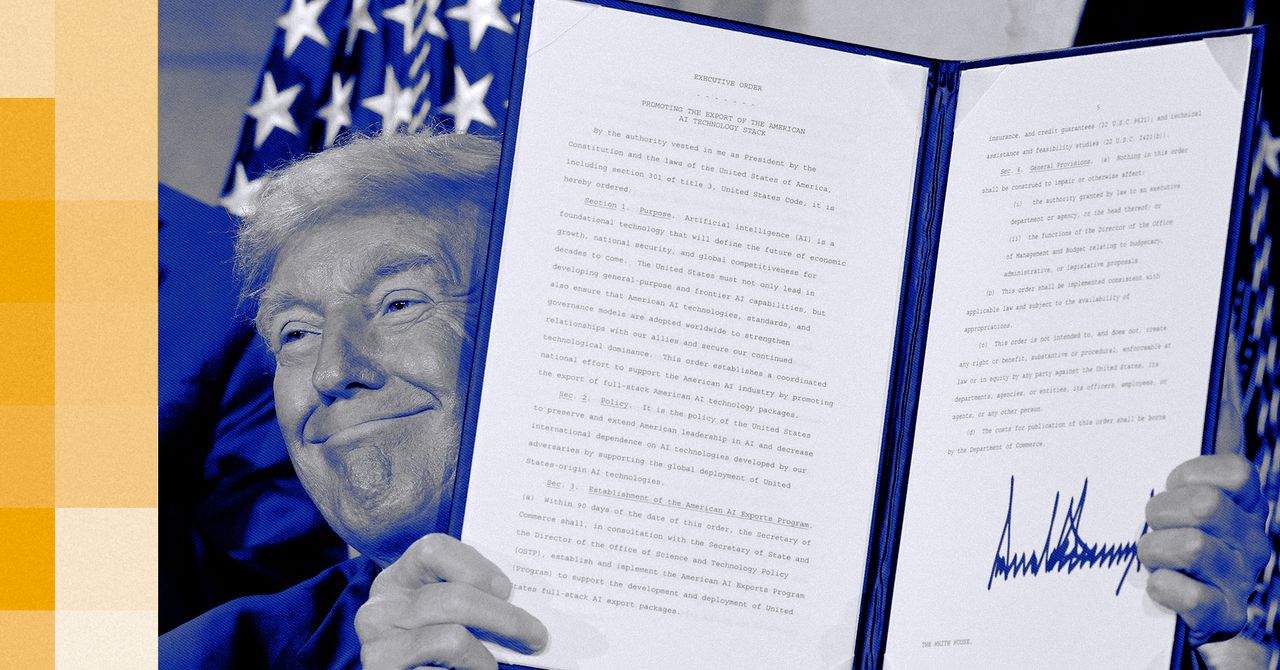

President Donald Trump has signed an executive order to make it easier to include cryptocurrency in Americans’ 401(k) retirement funds. It’s a potentially risky move that has been criticised by financial experts.

Announced on Thursday, Trump’s new executive order instructs the U.S. Department of Labor (DOL) to reexamine its guidance regarding 401(k) plans’ investment in alternative assets such as cryptocurrency, real estate, and private equity. Trump’s order further directs the Securities and Exchange Commission (SEC) to revise regulations and guidance in order to facilitate such alternative asset investment.

In short, this means that the U.S. government may soon overhaul regulations in order to help 401(k) funds invest in crypto. Cryptocurrency prices surged in the wake of Trump’s executive order, with investors anticipating it will lead to more widespread adoption of the currency.

While 401(k) plans weren’t explicitly banned from investing in cryptocurrency previously, in 2022 the DOL cautioned that those considering doing so should “exercise extreme care.” Expressing “serious concerns” about the wisdom of such investments, the DOL warned of a slew of hazards associated with cryptocurrency, including that such assets are highly speculative, extremely volatile, and face issues regarding recordkeeping and valuation.

Mashable Light Speed

The Trump administration subsequently rescinded this guidance this May, claiming that the DOL’s advice to be careful with highly risky financial investments was a case of “overreach” by the previous Biden administration. Instead, Trump’s DOL stated that it had a neutral stance toward 401(k) plans investing in cryptocurrency.

Thursday’s executive order to revise regulations now indicates a more supportive view of 401(k) cryptocurrency investment, with Trump pledging to transform the U.S. into the “crypto capital of the world.”

Though the White House claims assets such as cryptocurrency “offer competitive returns and diversification benefits,” financial experts have warned against relying on such assets to fund your retirement. Alicia H. Munnell, a senior advisor at Boston College’s Center for Retirement Research, called such 401(k) investment a “terrible idea,” likening it to gambling and noting that it is unlikely to improve returns.

“Participants don’t understand the product, it’s a speculative and volatile investment, straying from traditional investments is unlikely to enhance returns, and it’s probably not a prudent option for 401(k)s,” Munnell wrote in response to the DOL’s withdrawal of its 2022 guidance. “DOL should not be opening the door to this type of activity.”

Numerous cautionary tales of nosediving values, scams, hacks, and heists have made it clear that cryptocurrency is far from a safe investment. Despite this, tales of swift, dramatic gains continue to tempt investors and build significant hype. Trump’s executive order may encourage more people to venture into cryptocurrency, but whether it will be to their benefit remains to be seen.

Topics

Cryptocurrency

Donald Trump