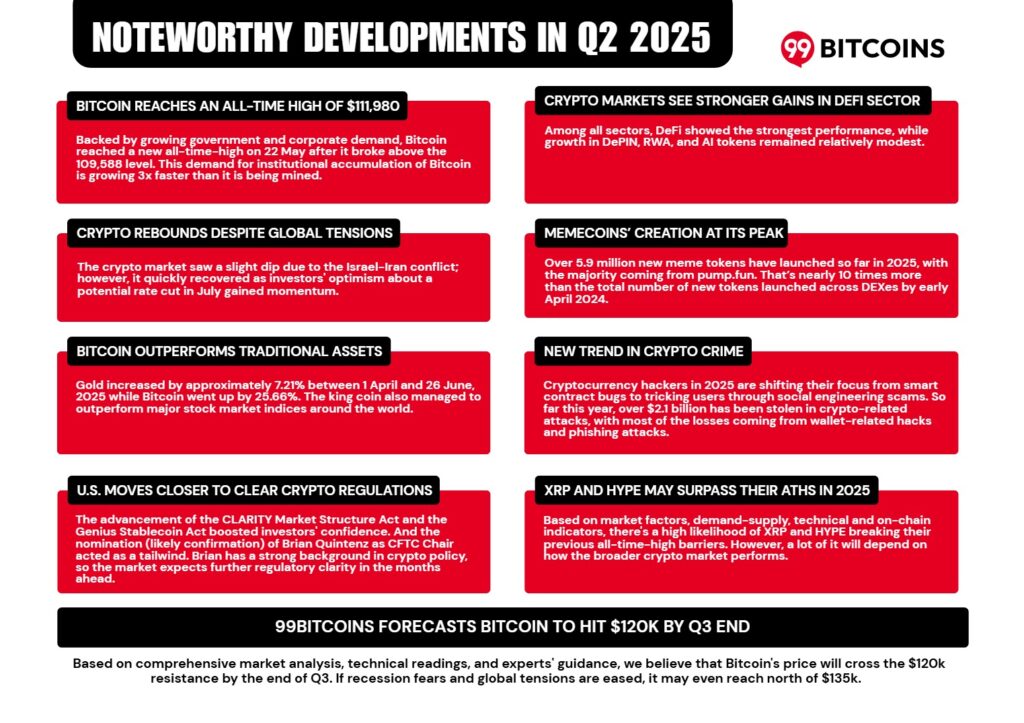

The Chainlink price just confirmed that this token is actually needed. Or at least, that’s what the LINK ▲11.07% Marine army is chanting about.

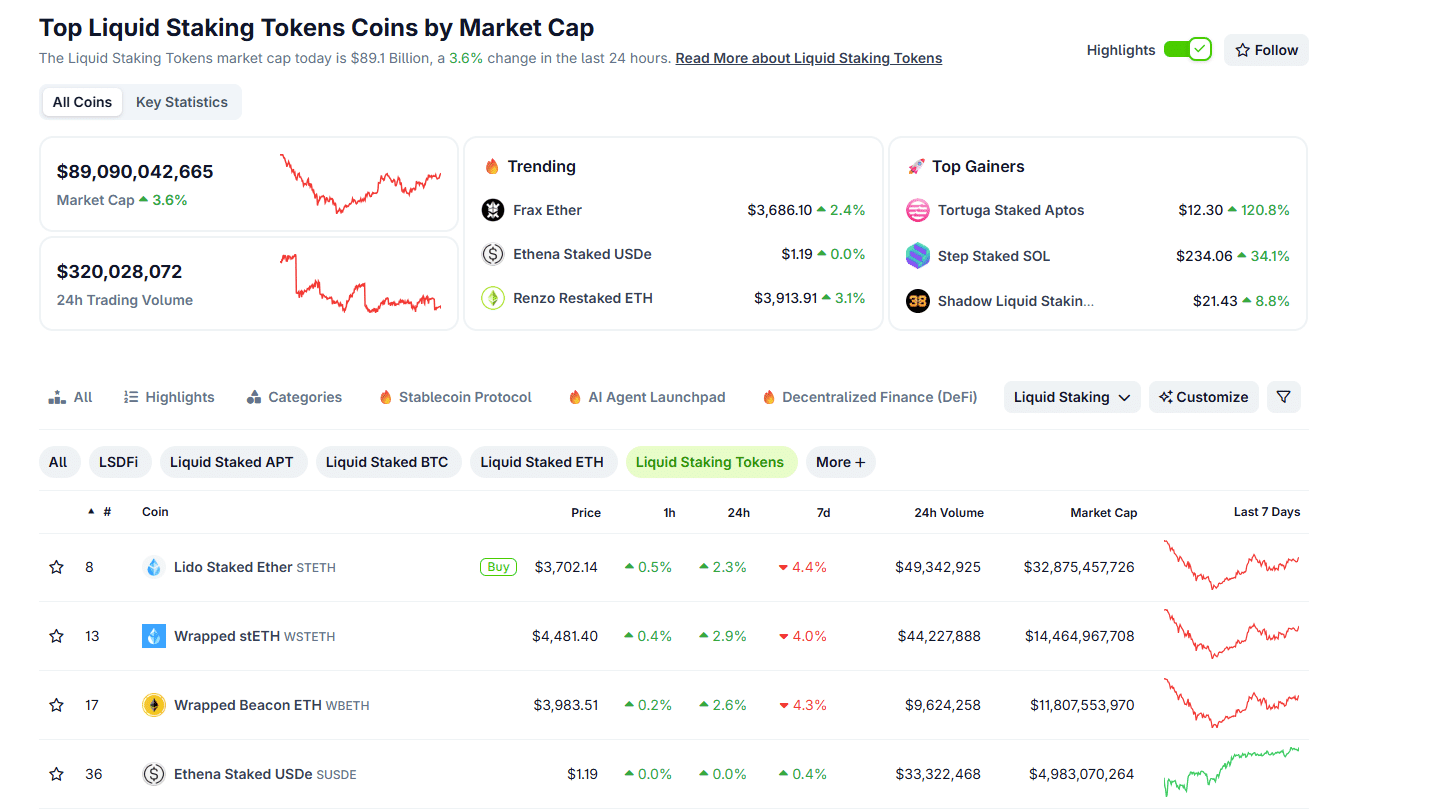

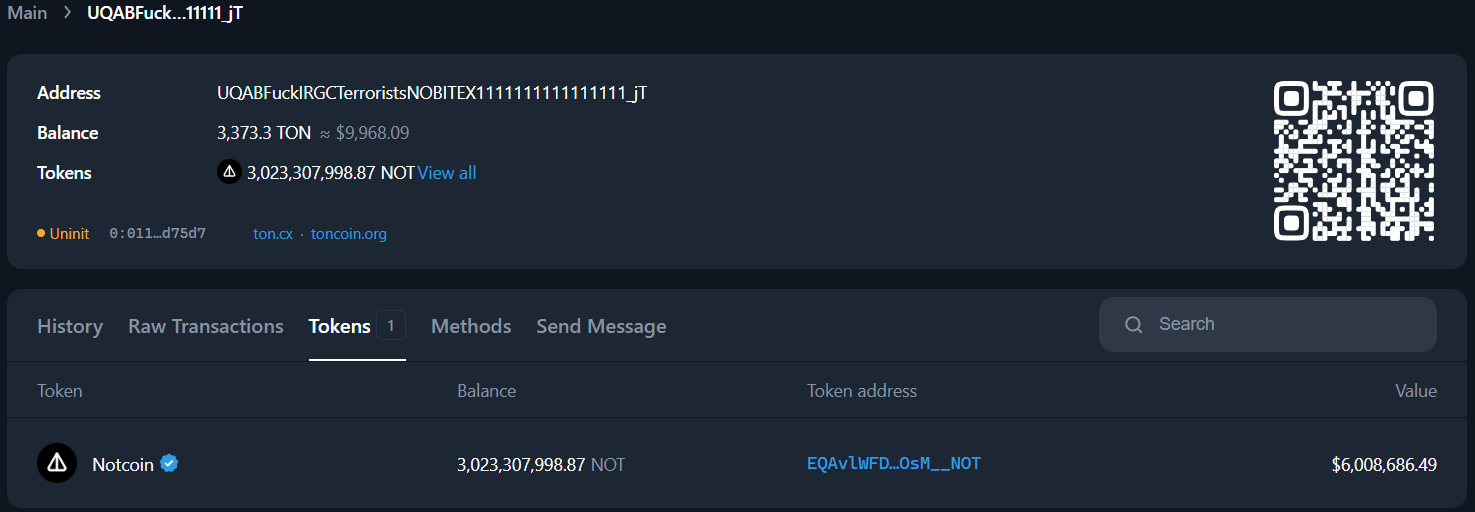

Chainlink has rolled out a strategic LINK reserve funded by both on-chain service fees and off-chain enterprise payments marking a structural shift in how the network sustains itself. The reserve has already accumulated over $1 million in LINK during its early phase, with no plans for withdrawals for “multiple years.”

Locking those tokens up is a good substitute for staking which is seem they’re slowly going up on. Here’s what else you need to know:

“The launch of the Chainlink Reserve marks a pivotal evolution in Chainlink, establishing a strategic LINK reserve funded using offchain revenue, as well as from onchain service usage,” – Sergey Nazarov, Chainlink co-founder

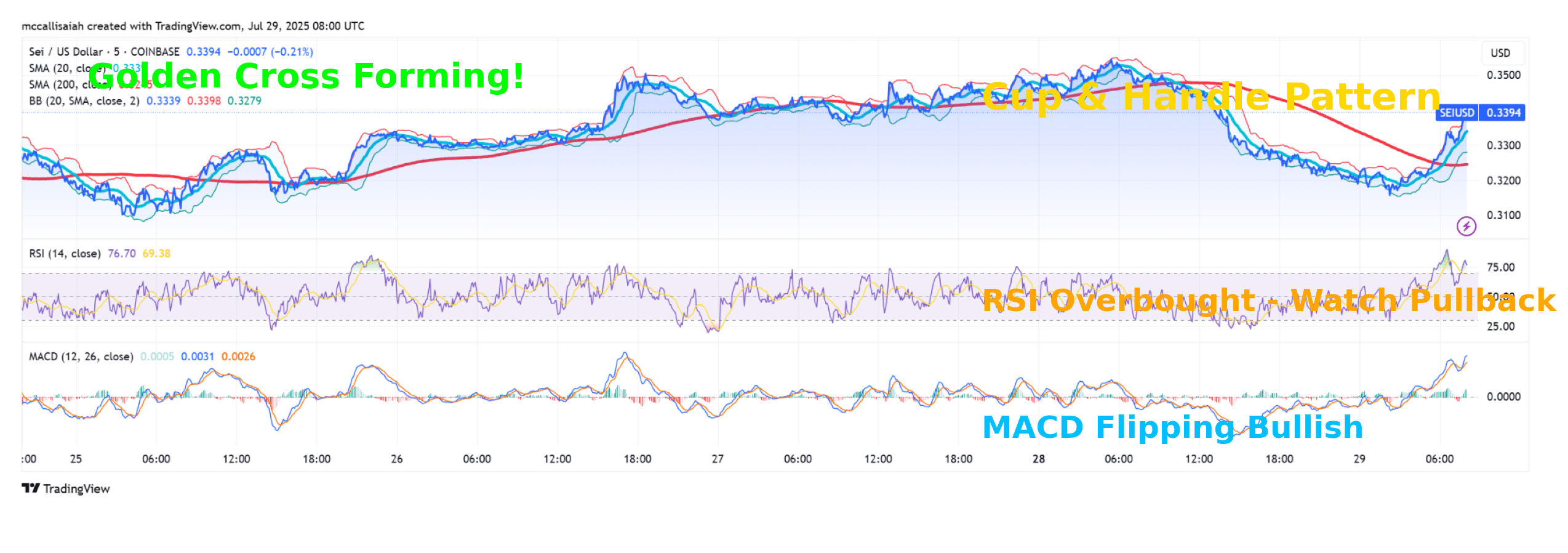

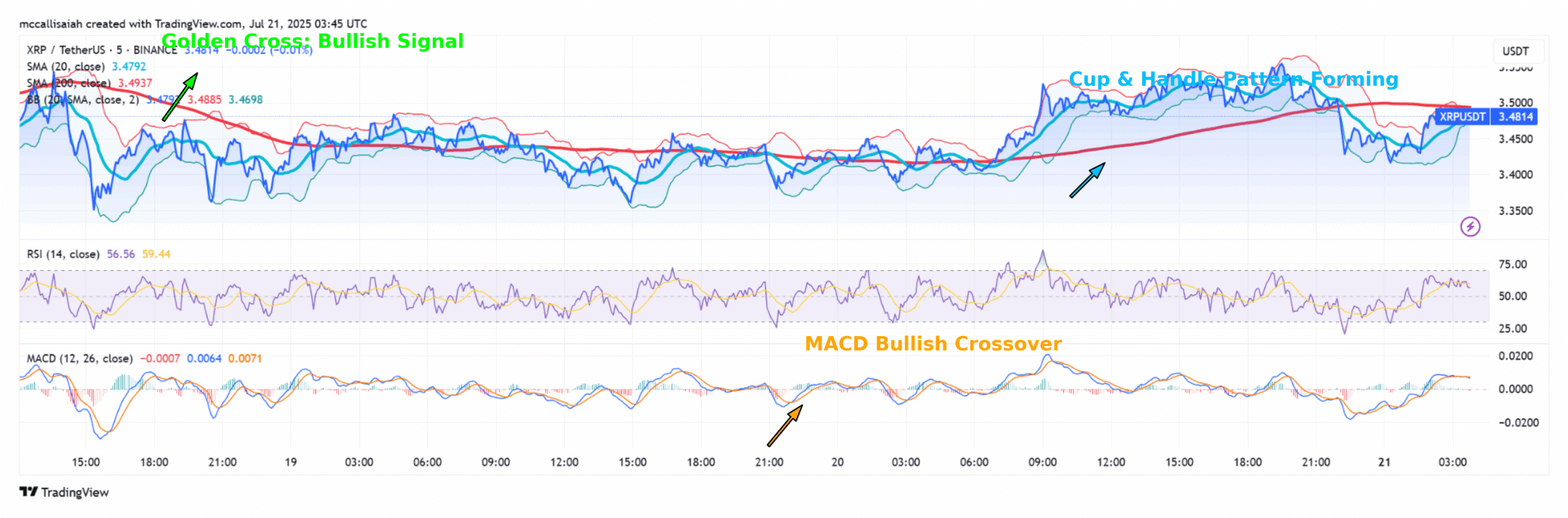

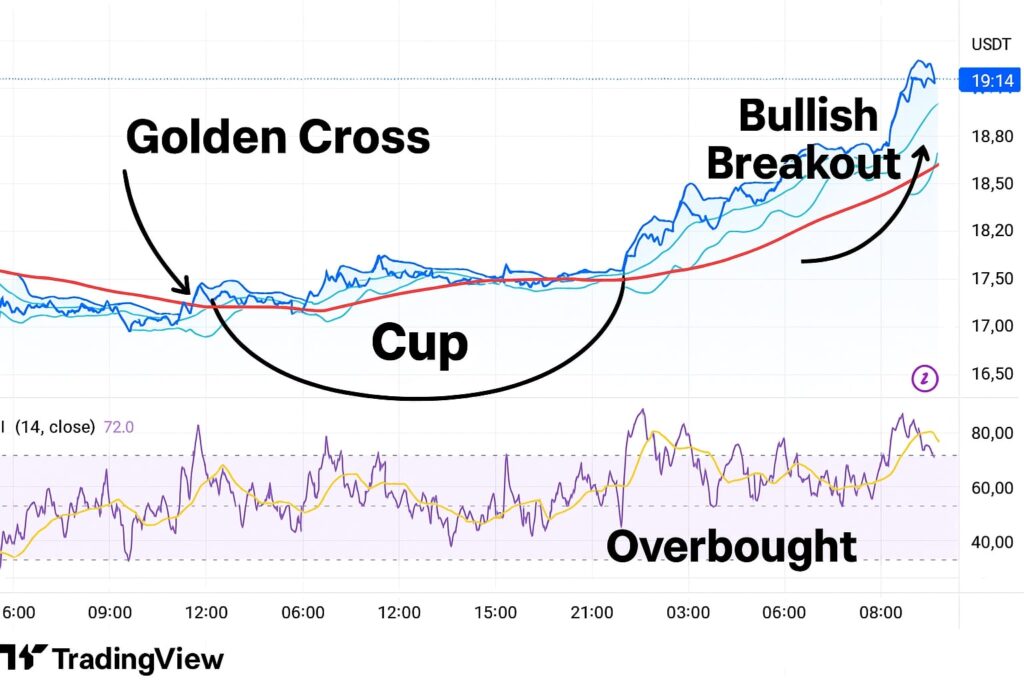

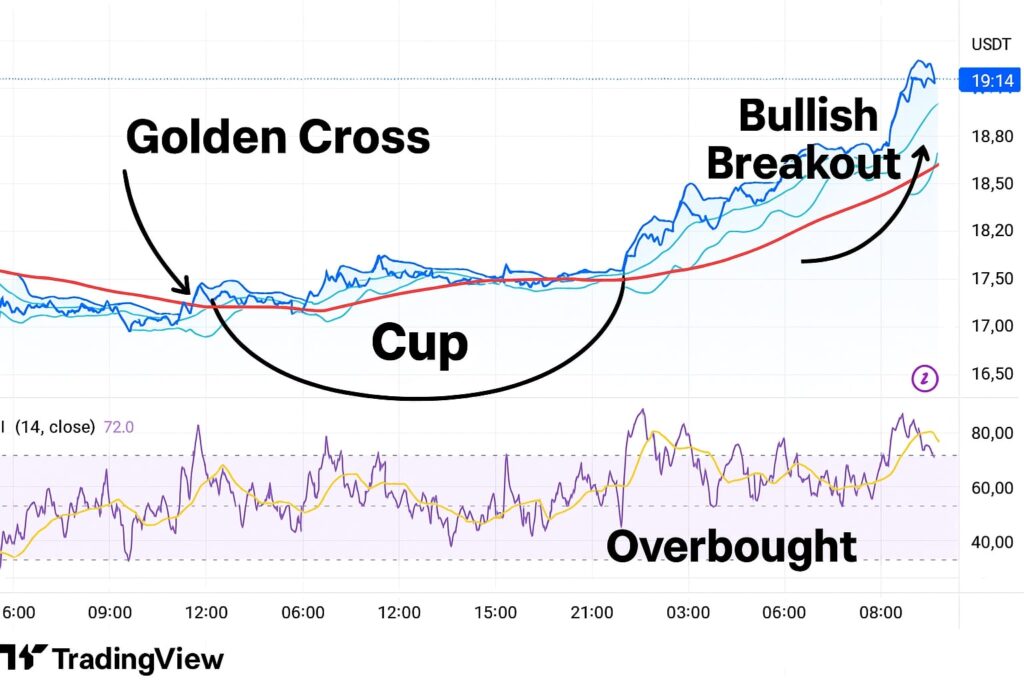

Chainlink Price Technical Setup: Bullish Momentum Builds

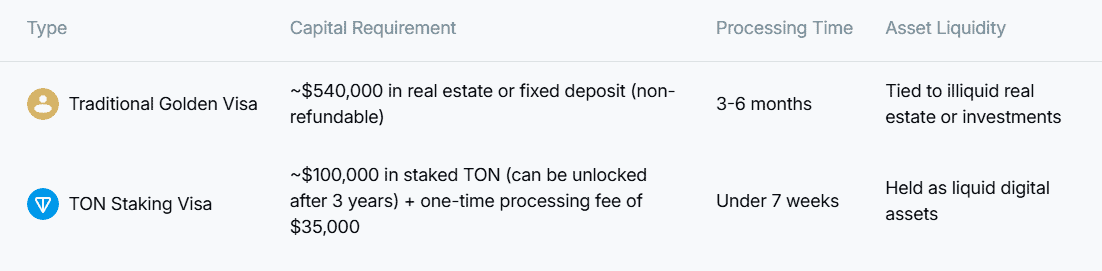

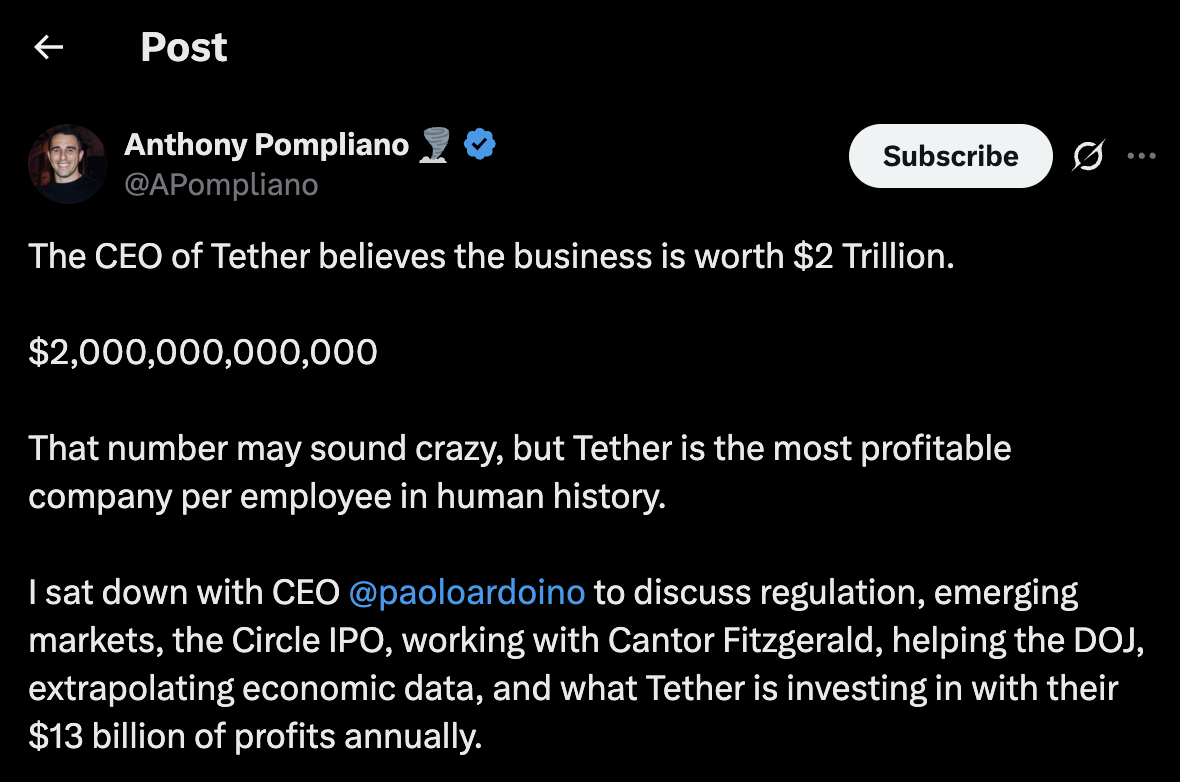

Following the LINK Reserve, revenue from enterprise partners like Mastercard, JPMorgan, and Swift—often paid in stablecoins —is automatically converted into LINK using Chainlink’s payment abstraction system.

This ensures a steady flow of tokens into the reserve without forcing customers to transact directly in LINK.

This is what produced hundreds of millions of dollars in revenue for chainlink so far. Do you get it yet? DO YOU UNDERSTAND? THIS IS ABOUT COMPLETE REGULARITY, CORPORATE AND FINANCIAL CAPTURE. POWERED BY CHAINLINK. THE END OF COEXISTENCE, NOVEMBER 2025

pic.twitter.com/sGgxsBZZtP

— reSDL (@SDLsaylor) August 7, 2025

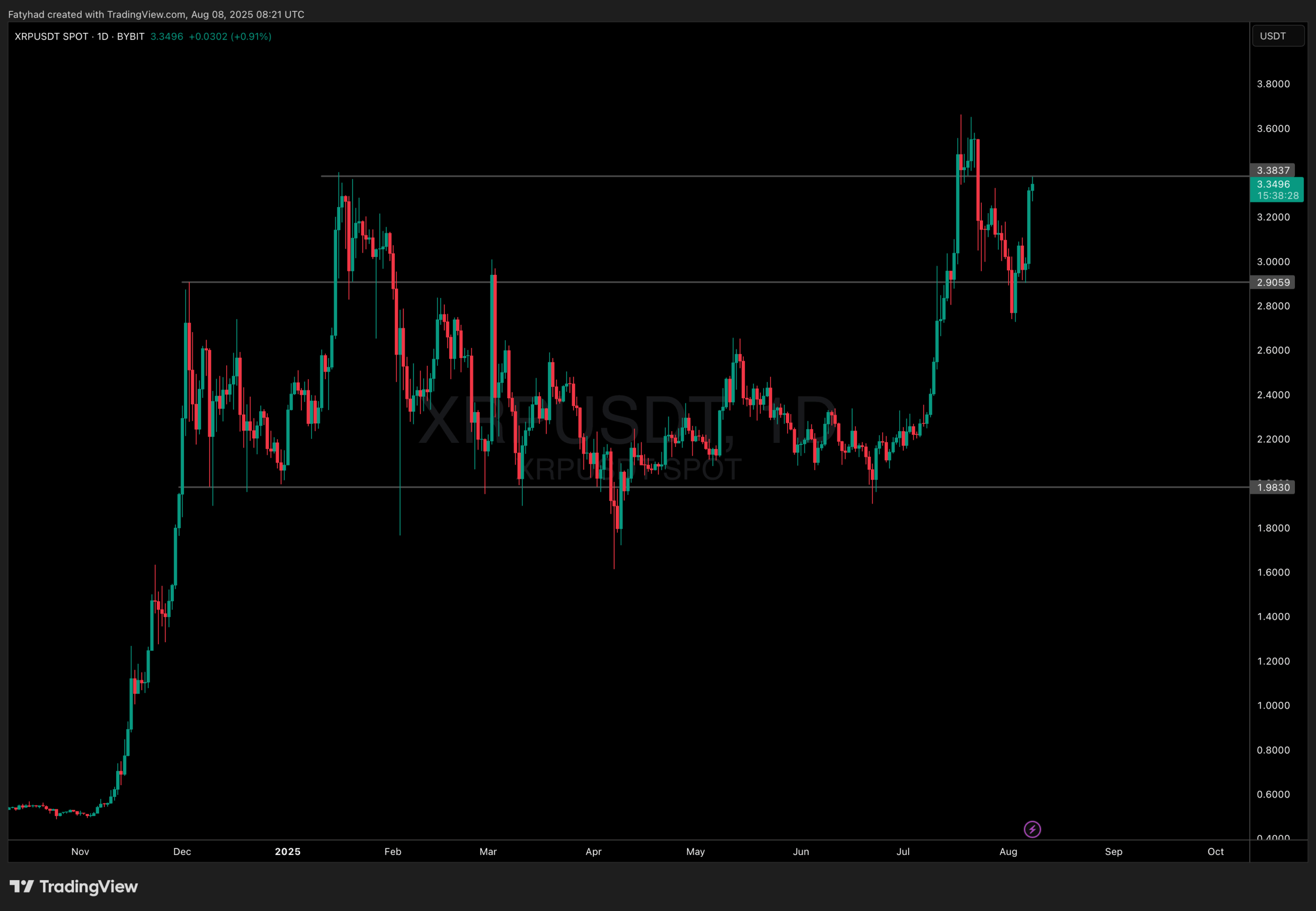

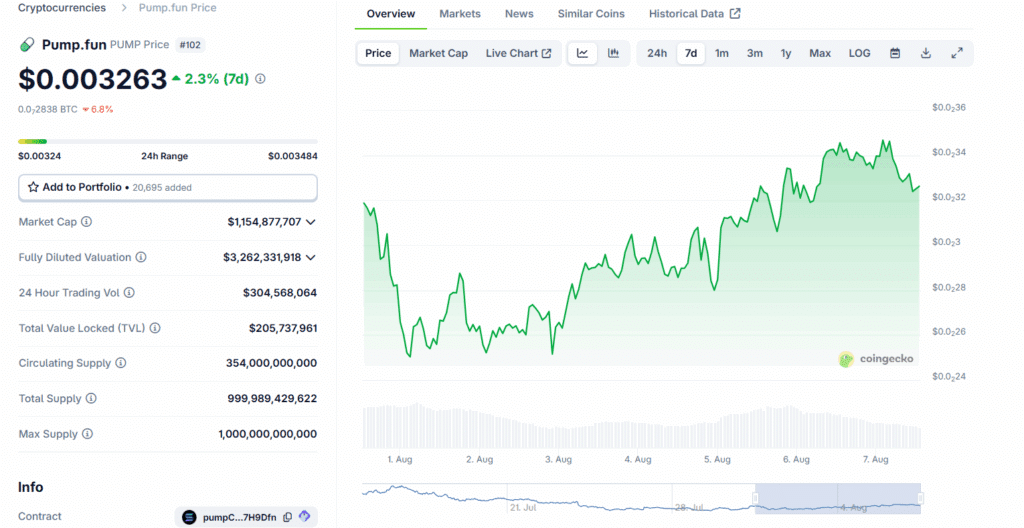

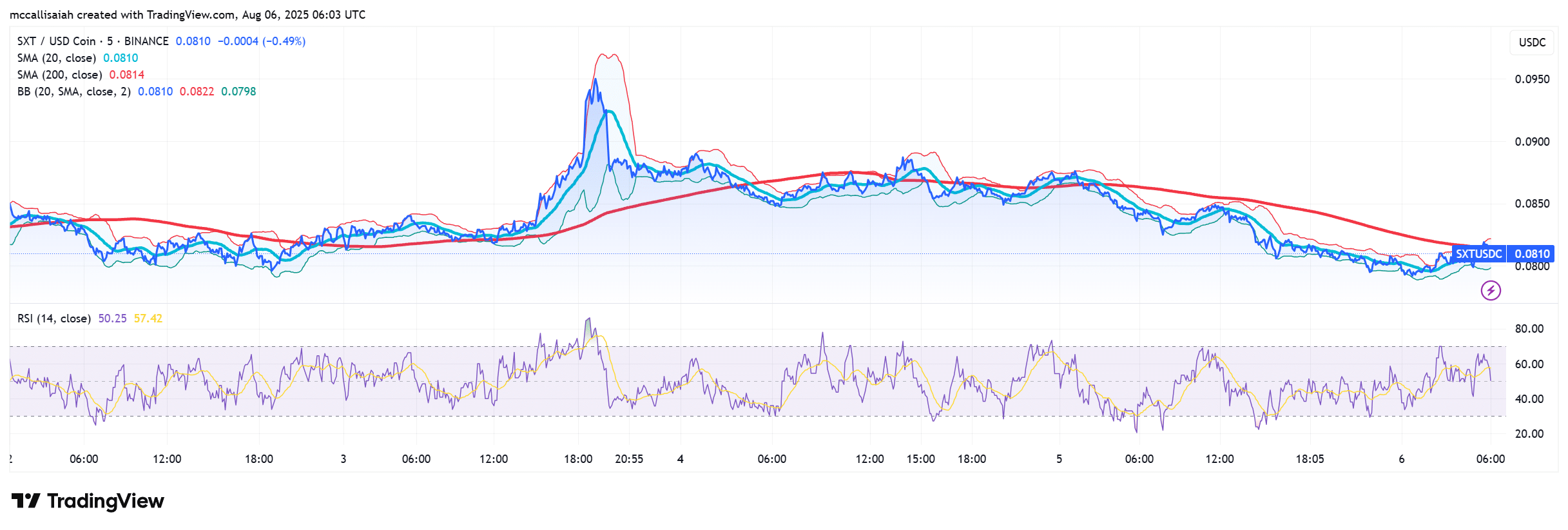

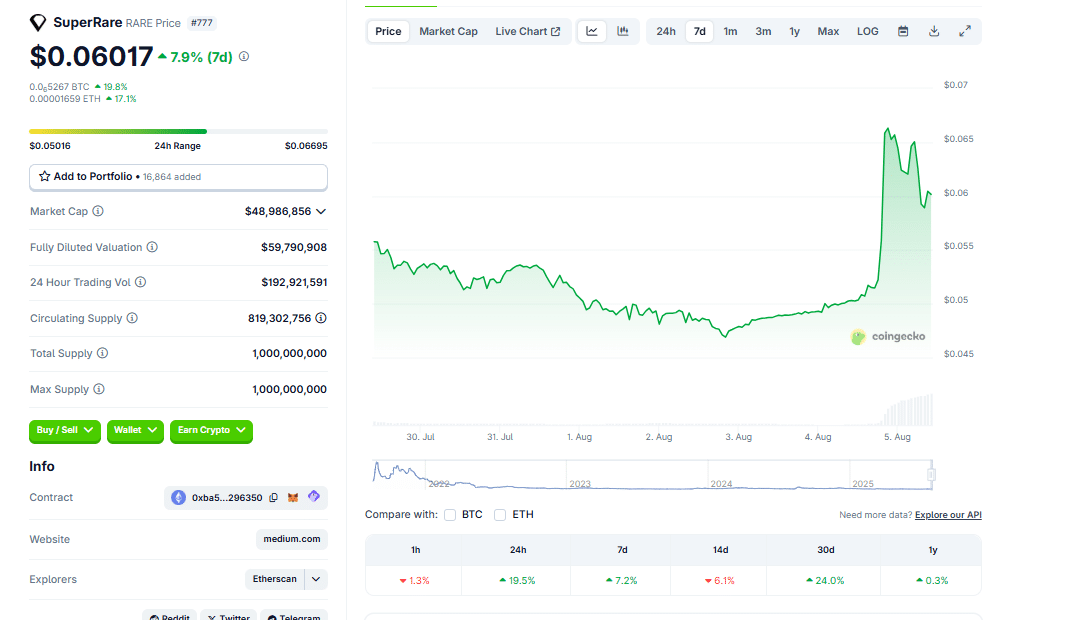

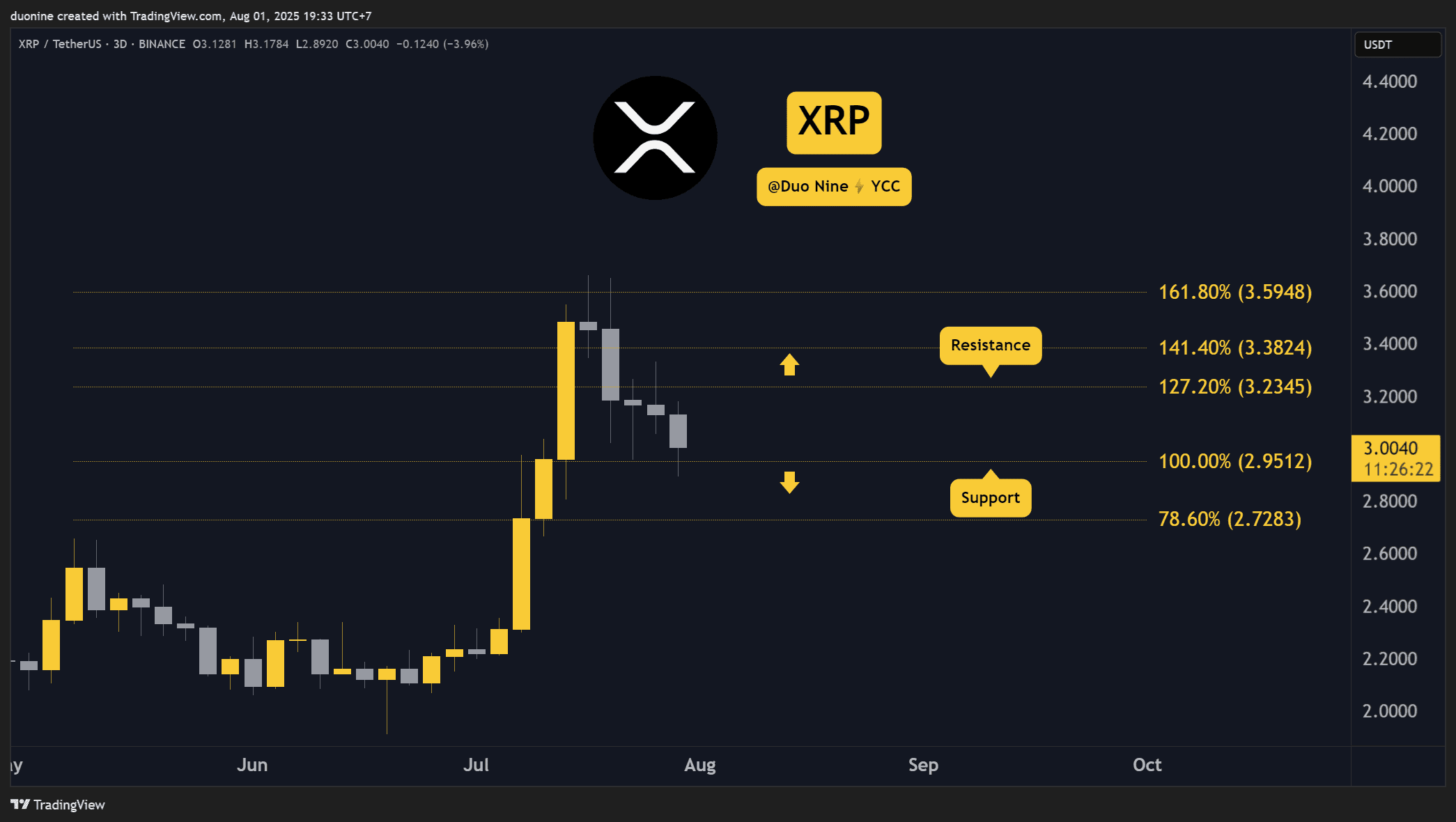

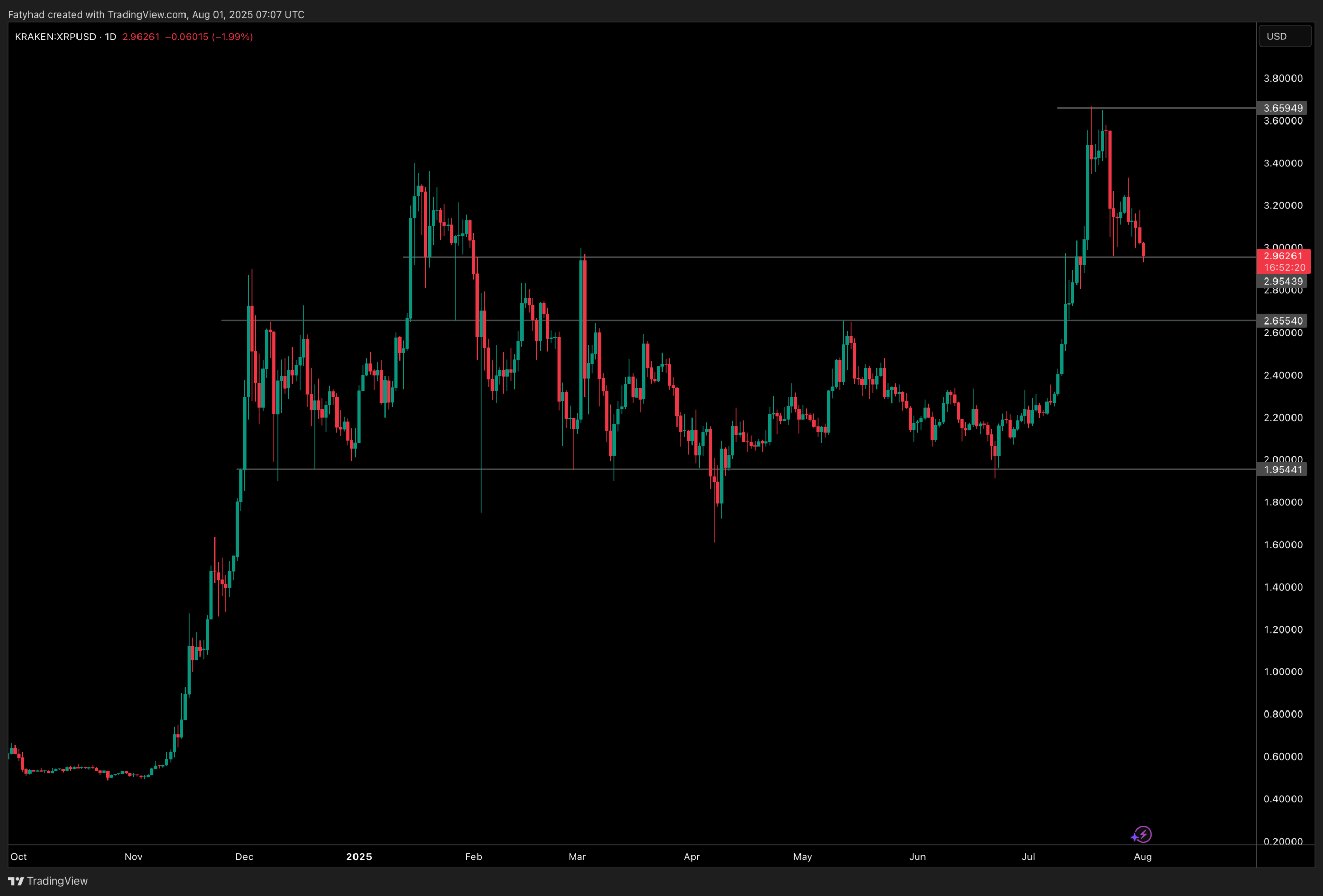

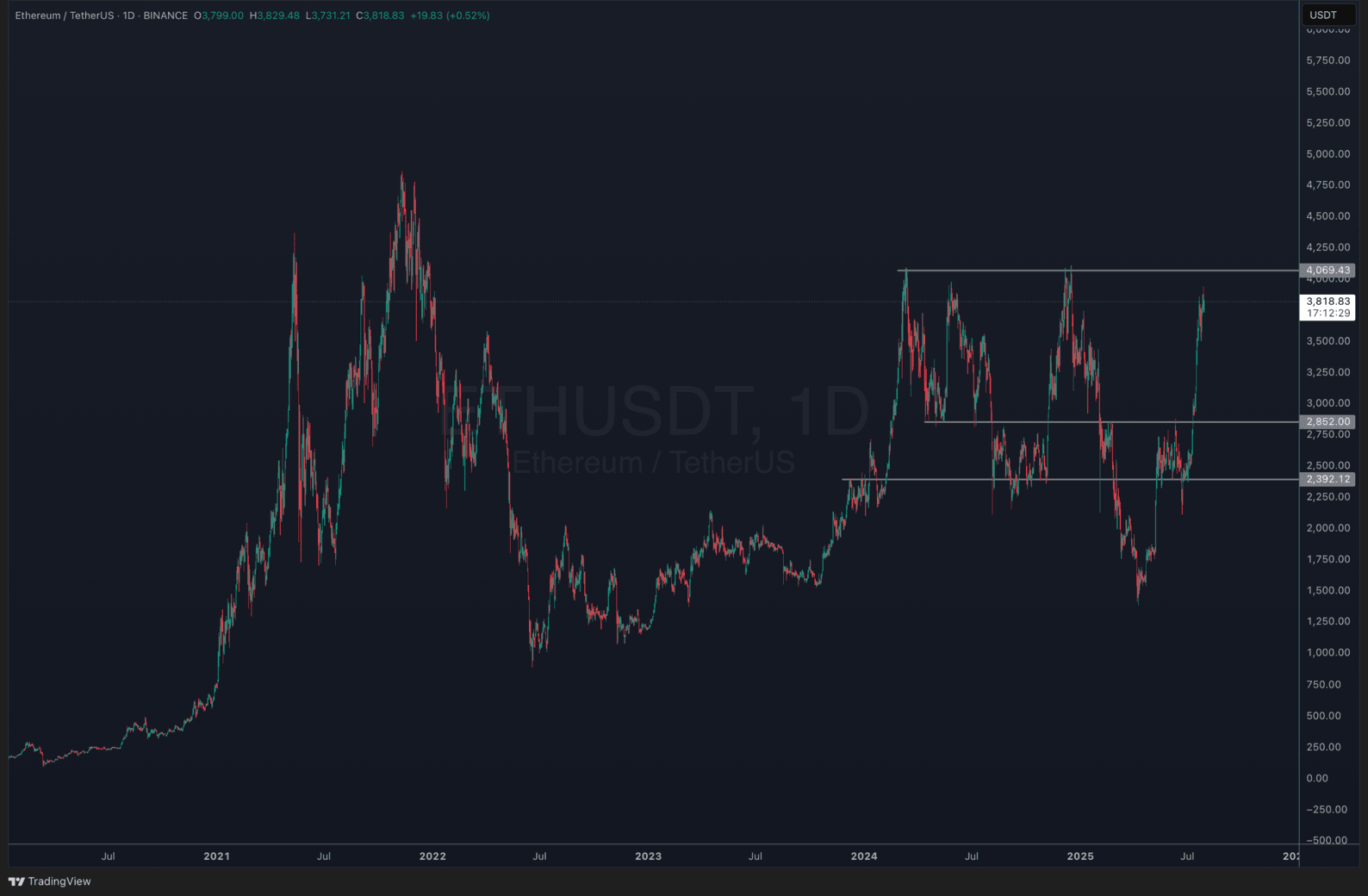

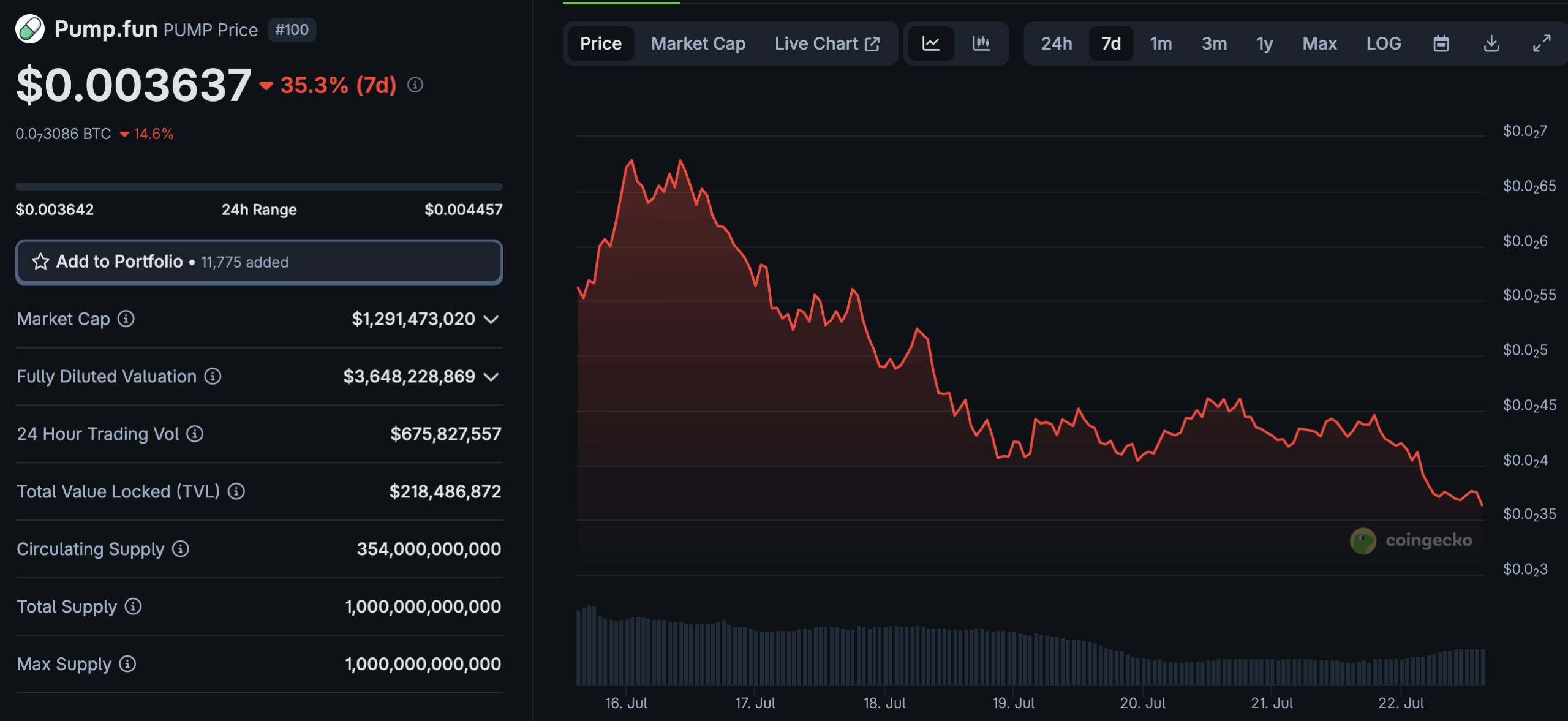

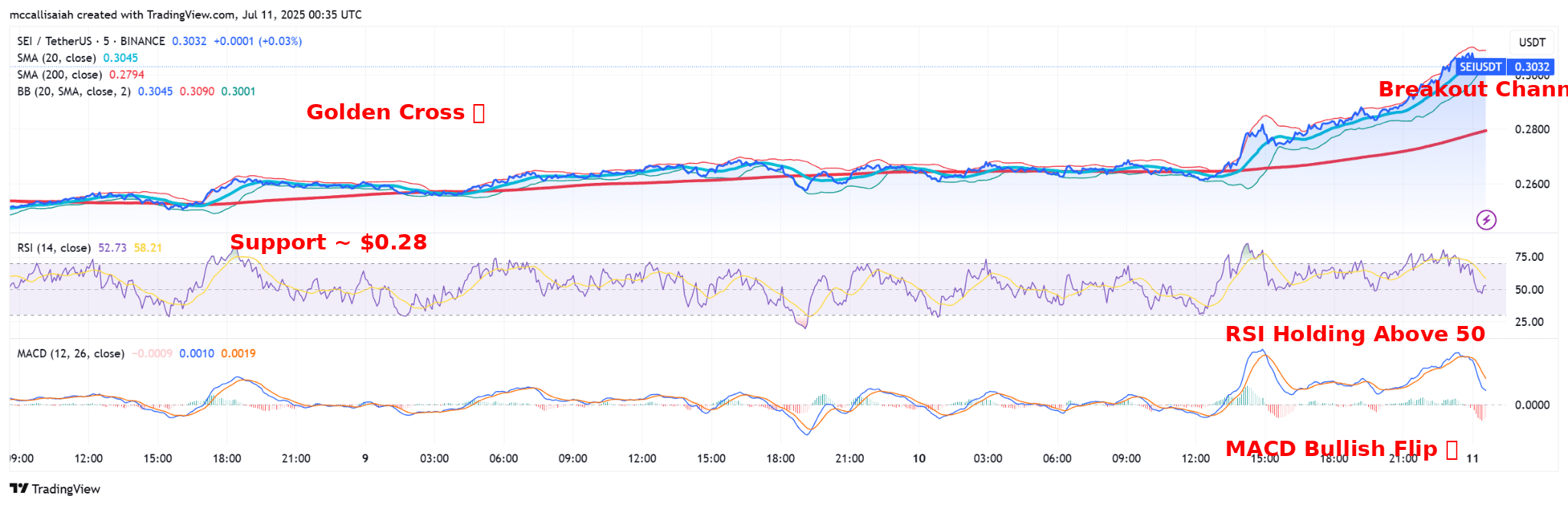

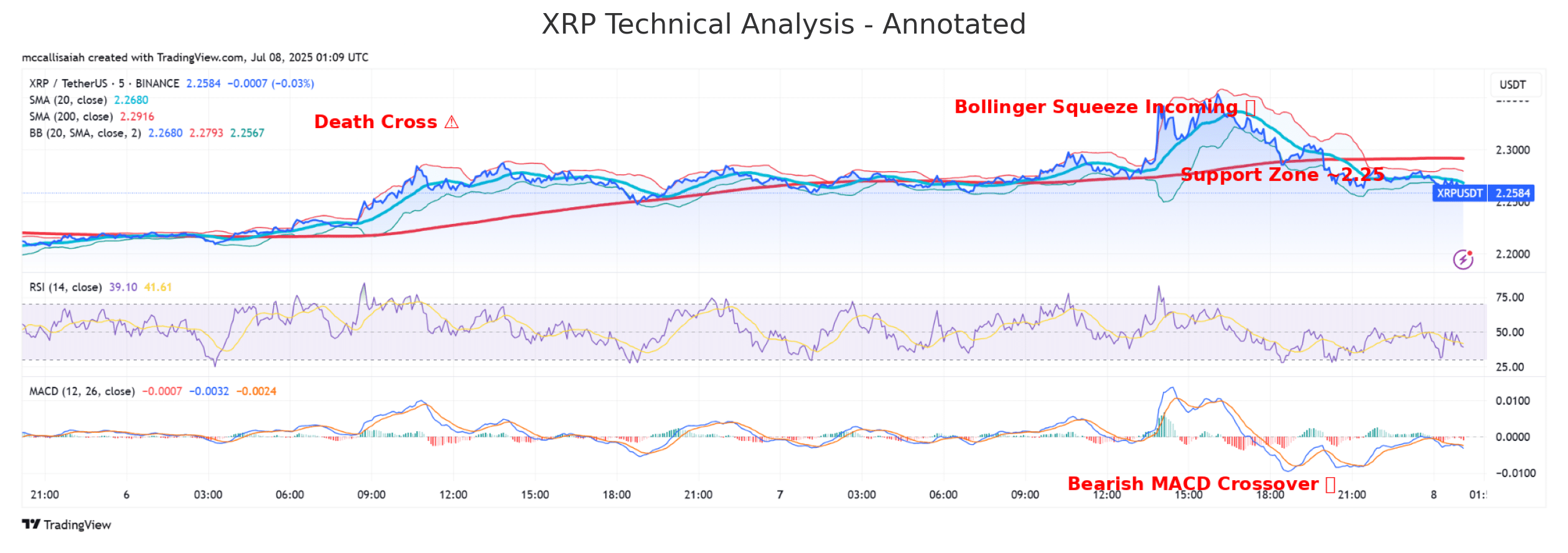

Support and resistance for Chainlink at $18.70 remains the key floor; $18.30 (200 SMA) offers deeper support. Resistance is clustered between $19.04 and $19.15 and as it stands LINK remains ready to challenge its previous ATHs.

Technical signals are stacked in the bulls’ favor:

- The 20-day SMA sits well above the 200-day in a confirmed golden cross

- Price is hugging the upper Bollinger Band and MACD momentum is firmly positive.

- RSI above 70 points to short-term overheating, but the breakout’s heavy volume shows that doesn’t matter.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

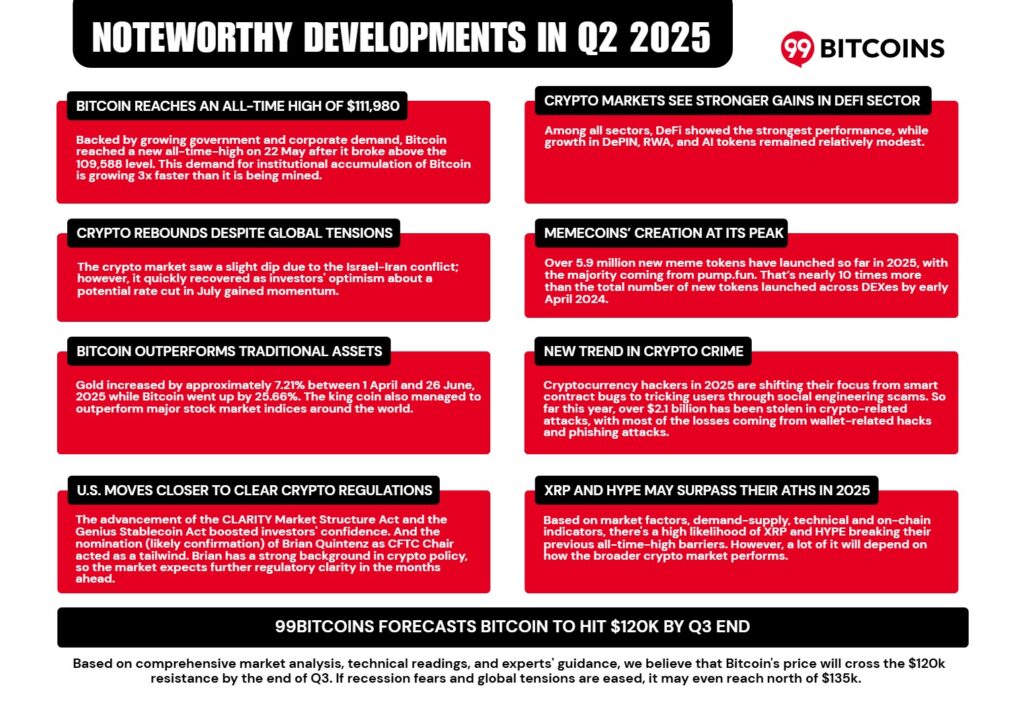

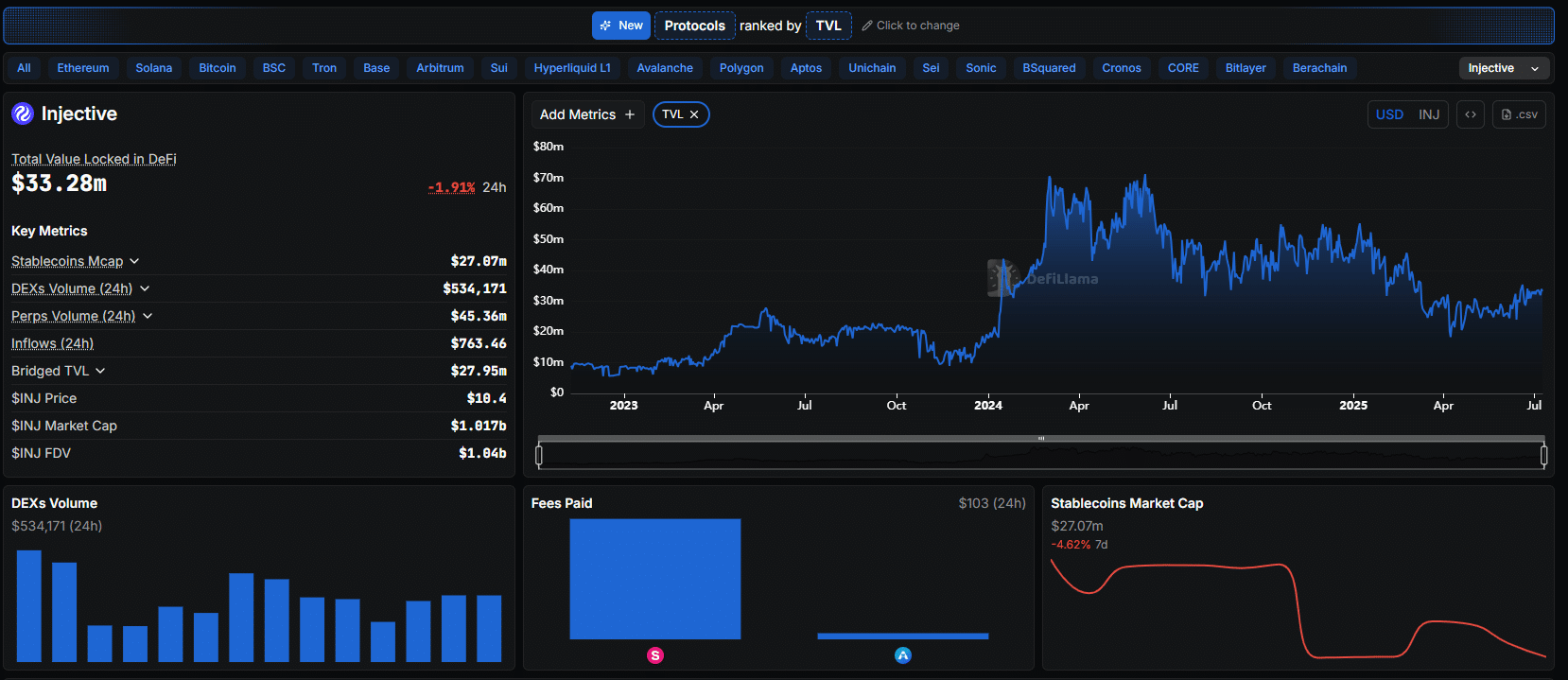

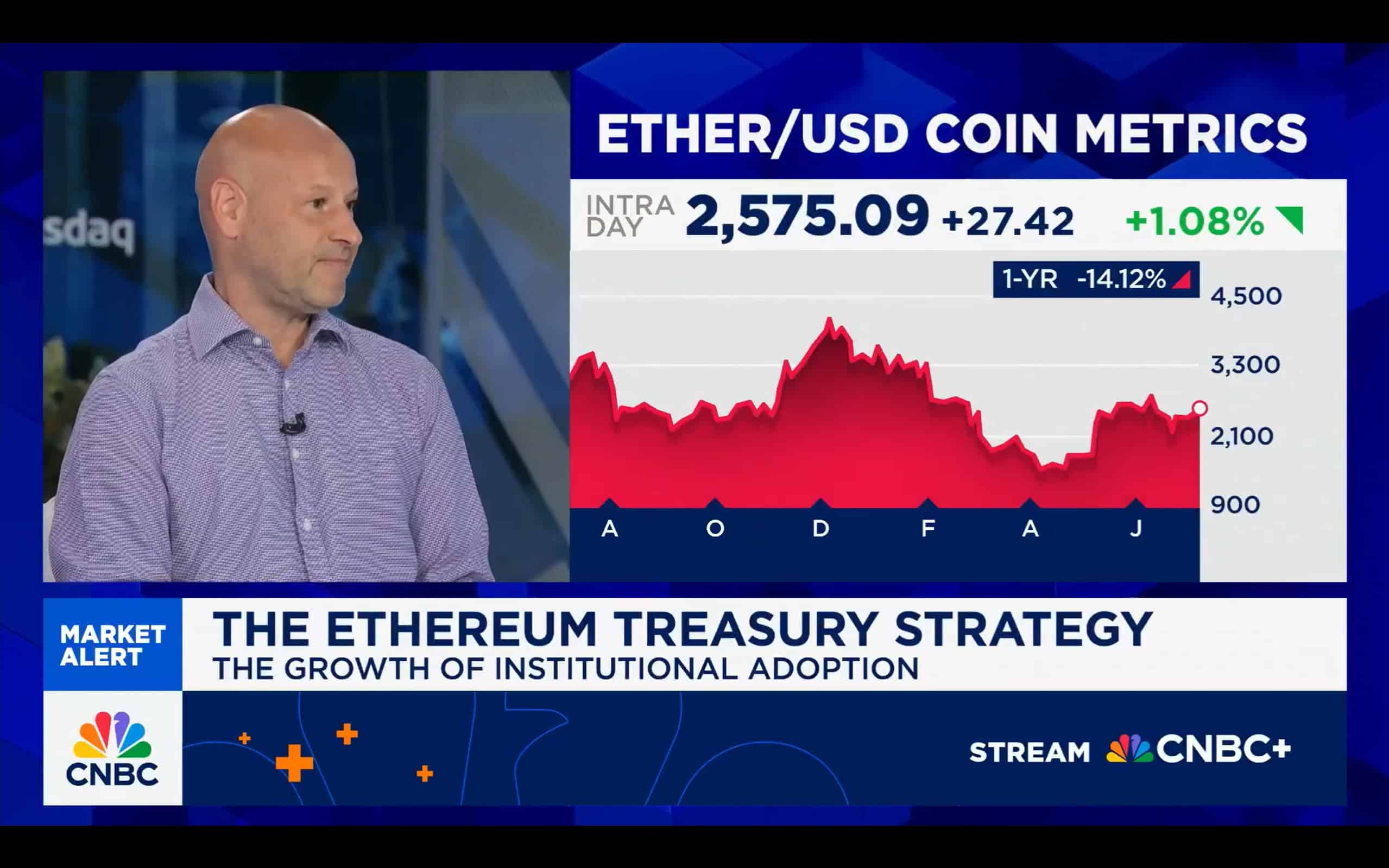

Fresh data from DeFi Llama highlights that enterprise revenue on-chain is at its highest in over a year, up 22% month-over-month.

Chainlink’s on-chain reserves and long-term treasury holdings now top $250 million. Cross-chain transaction volume through its oracles has climbed 18% since June, while institutional adoption is accelerating—driven by real-world asset tokenization and cross-chain payment flows.

DISCOVER: Top 20 Crypto to Buy in 2025

Is It Finally Time To Admit Linkies Were Right?

By pushing protocol fees and enterprise settlement flows into LINK, Chainlink is welding its token’s liquidity and security to the scale of its adoption.

In simple caveman terms: the bigger the network gets, the larger the reserve and the stronger the base for price stability.

LINK is hovering around $18-$19.22 with upward momentum still in play. If the breakout above resistance holds, Chainlink might be a star player for Q4.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Chainlink has rolled out a strategic LINK reserve funded by both on-chain service fees and off-chain enterprise payments.

- In simple caveman terms: the bigger the network gets, the larger the reserve and the stronger the base for price stability.

The post Chainlink Price: New $1M Token Reserve Ignites 14% Rally and Breakout Momentum appeared first on 99Bitcoins.