Key Takeaways

- Norway’s sovereign wealth fund increased its indirect Bitcoin holdings by 192% in Q2.

- The fund gains Bitcoin exposure primarily through investments in major Bitcoin-holding companies.

Share this article

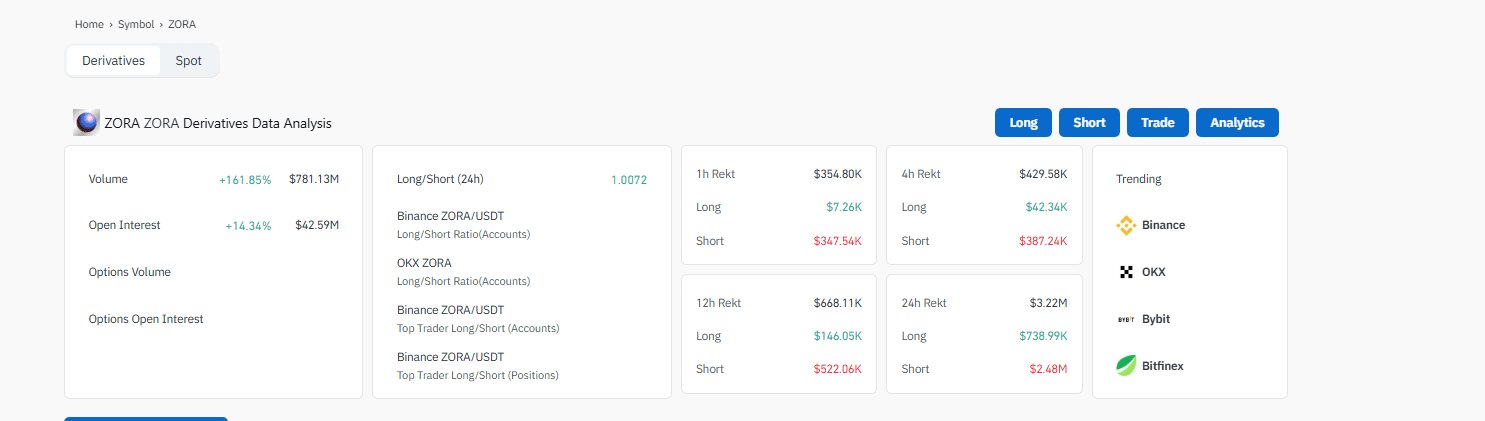

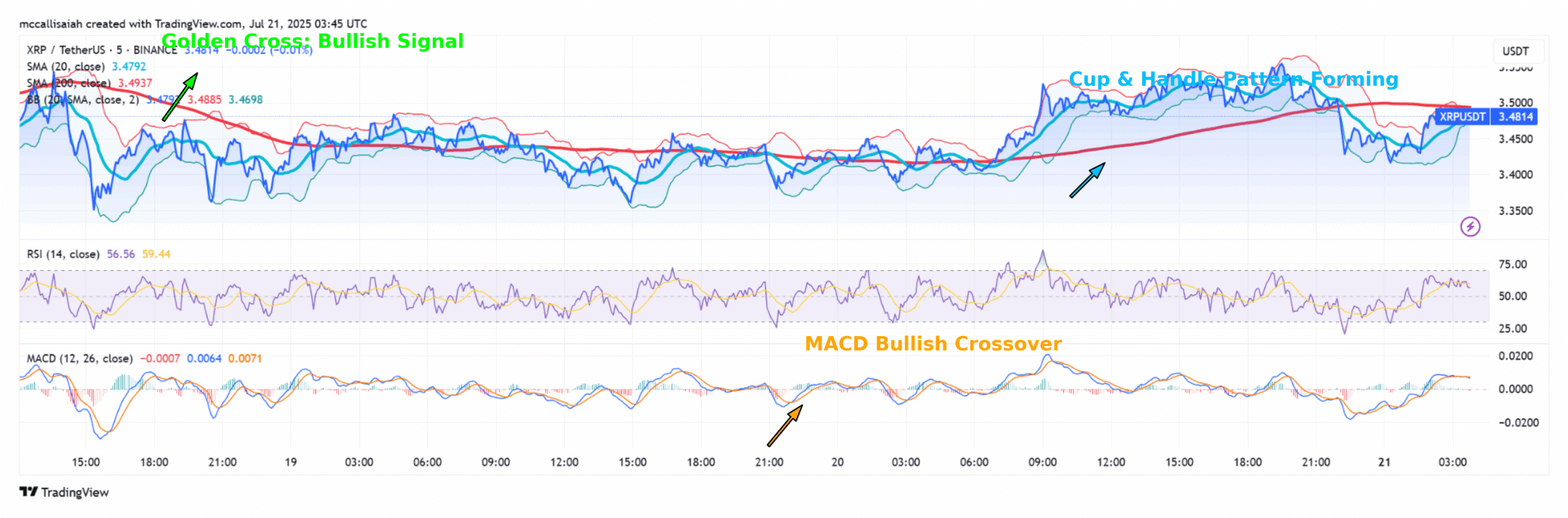

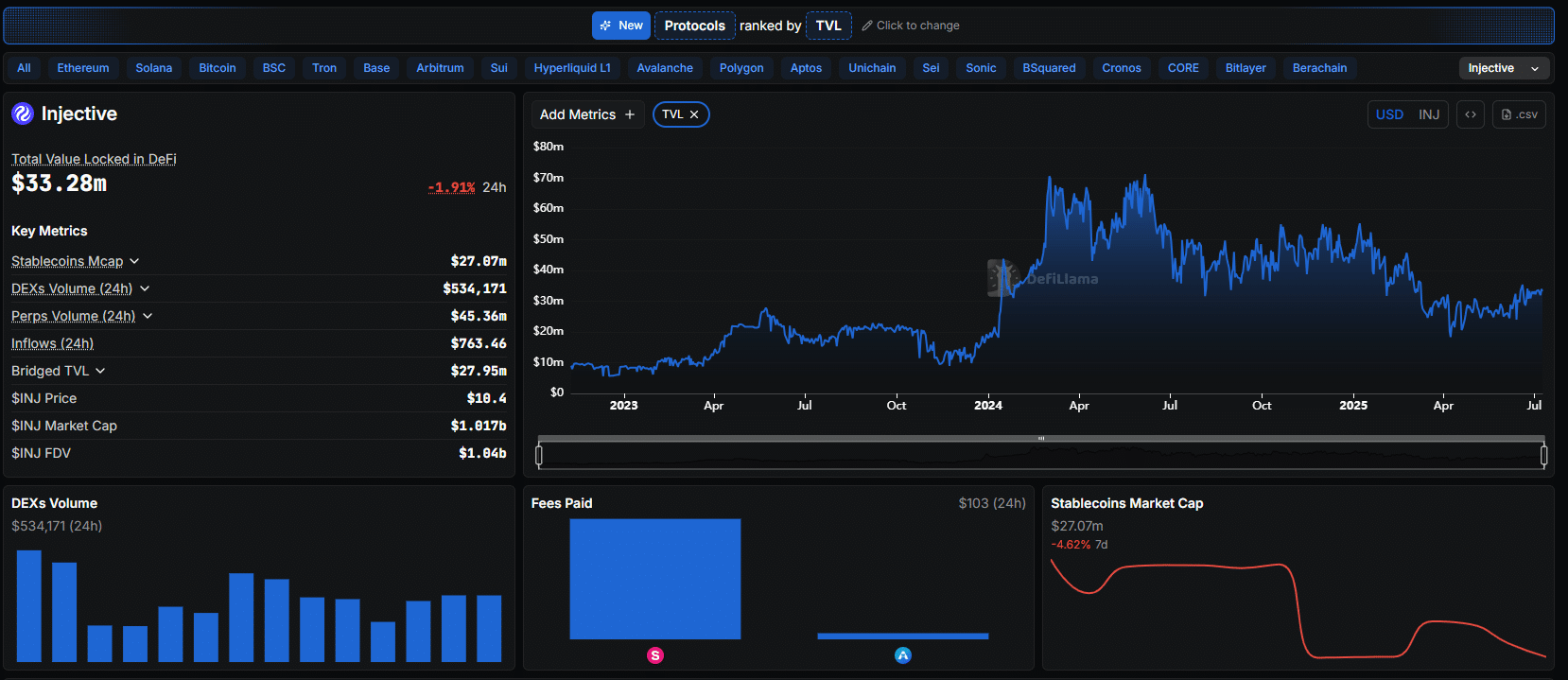

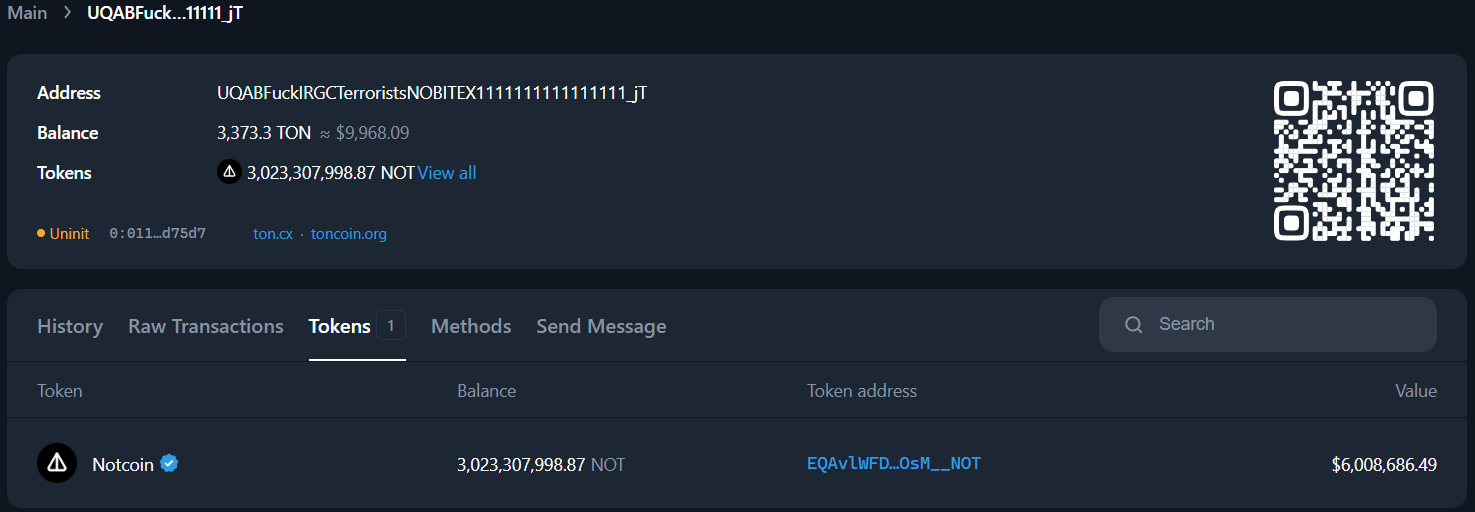

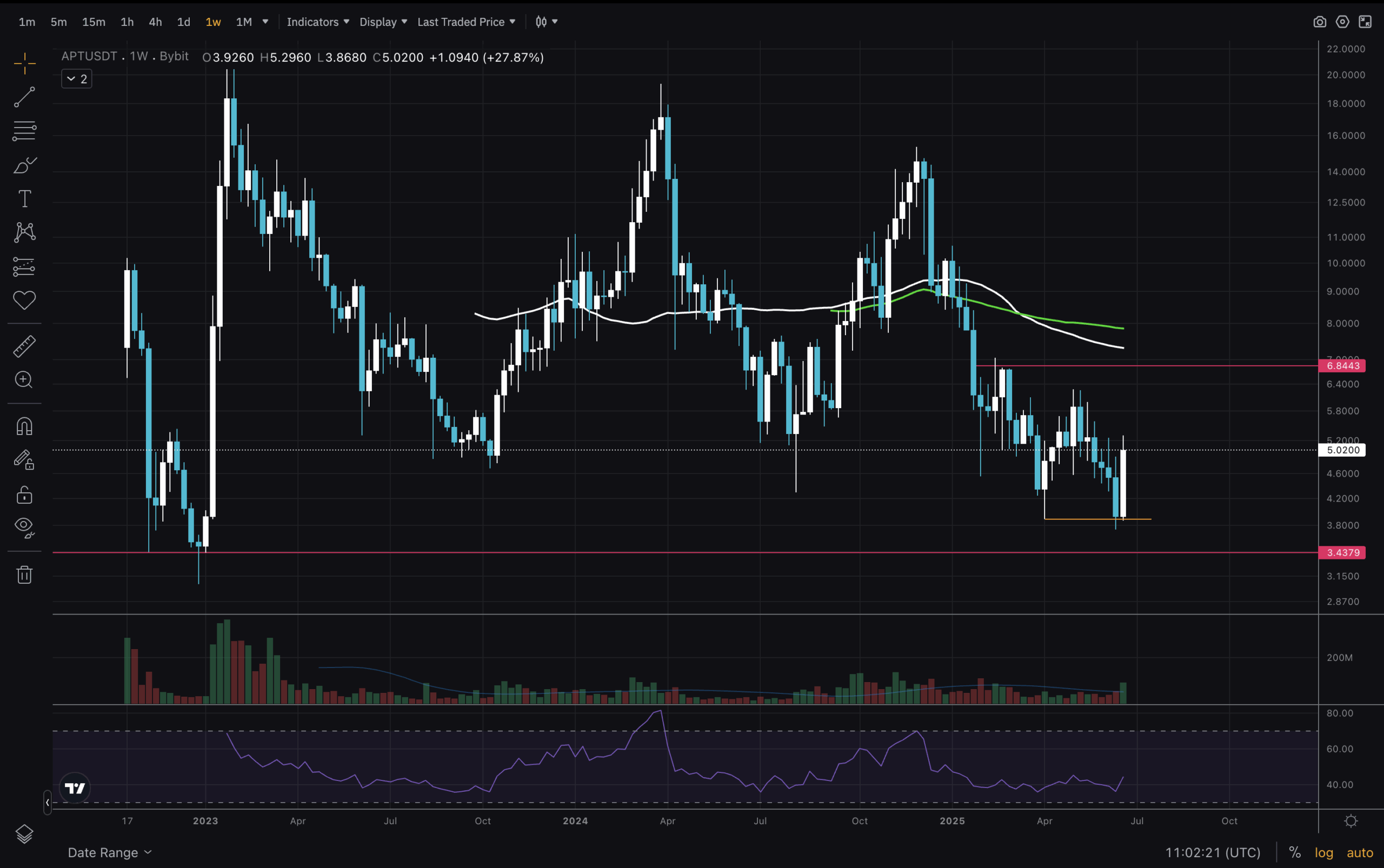

Norway’s $1.9 trillion sovereign wealth fund, run by Norges Bank Investment Management, hit 7,161 BTC in indirect Bitcoin exposure in the second quarter of this year, according to Vetle Lunde, Head of Research at K33. That’s up 192% from 2,446 BTC a year earlier.

NBIM’s indirect BTC exposure has hit new ATHs of 7,161 BTC.

This is my favorite chart to update whenever the world’s largest sovereign wealth fund discloses holdings. It efficiently shows that BTC is finding its way into any well-diversified portfolio, deliberate or not. pic.twitter.com/oLLtTMwhux

— Vetle Lunde (@VetleLunde) August 12, 2025

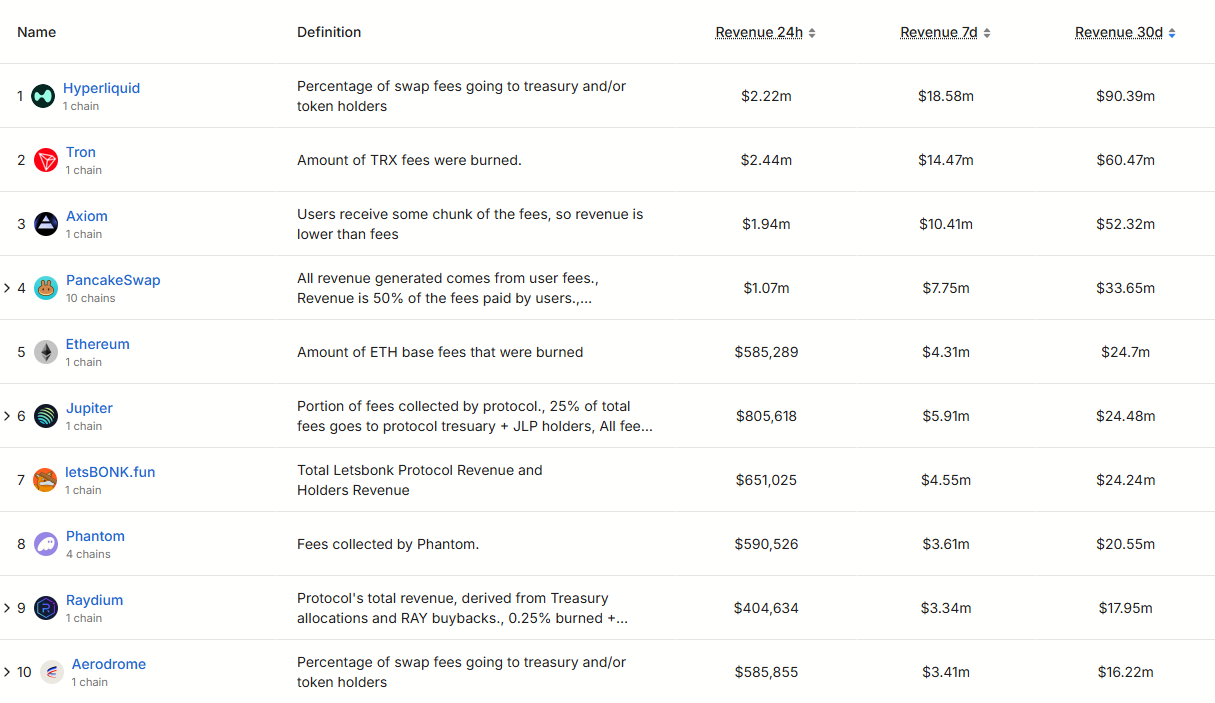

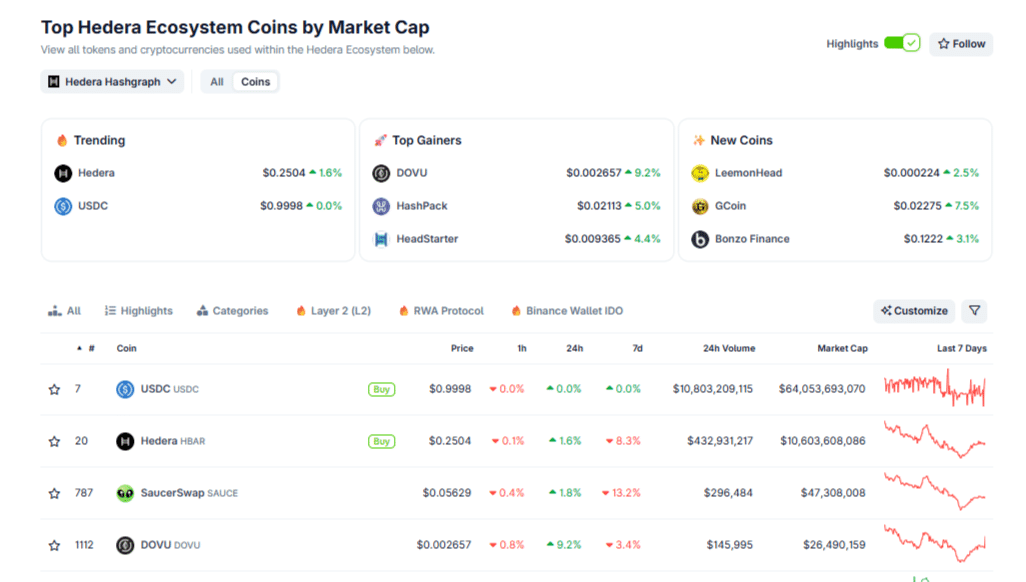

The fund’s increased Bitcoin exposure comes through investments in Bitcoin-heavy companies, primarily Strategy and Marathon Holdings, which are among the largest corporate players in the Bitcoin market.

NBIM also maintains positions in Block, Coinbase, and Metaplanet, Japan’s largest Bitcoin treasury holder.

Increased weights in core treasury vehicles such as @Strategy and @MARA and the overall strong BTC accumulation from treasury comps has fueled the H1 growth of 3,340 BTC.

Top 5 contributors to NBIMs increased BTC exposure:

1. MSTR

2. MARA

3. Block

4. Coinbase

5. Metaplanet pic.twitter.com/6zoGz6ZHuo— Vetle Lunde (@VetleLunde) August 12, 2025

Additional Bitcoin exposure comes from smaller holdings in Tesla, GameStop, and Mercado Libre, among other companies.

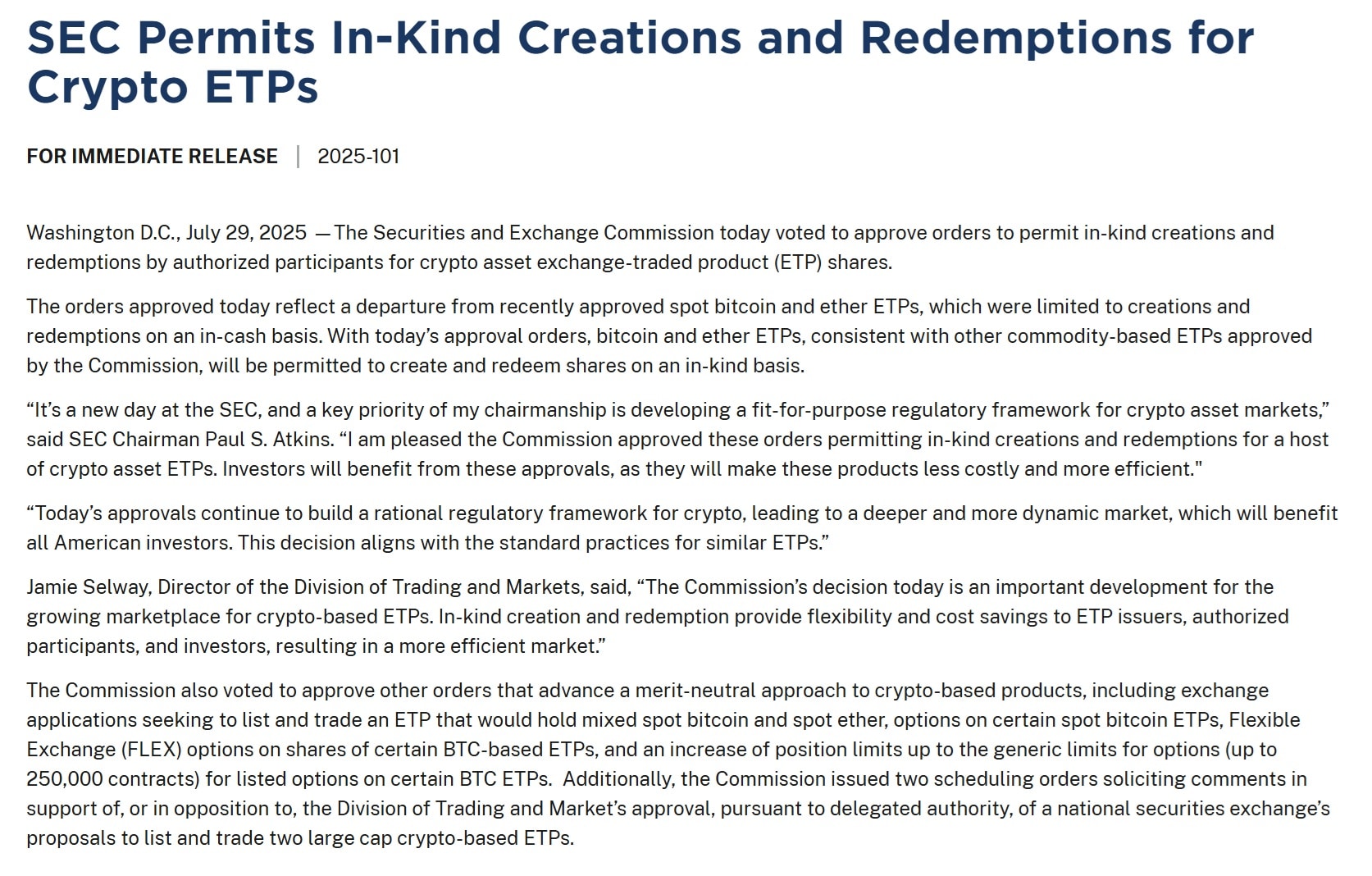

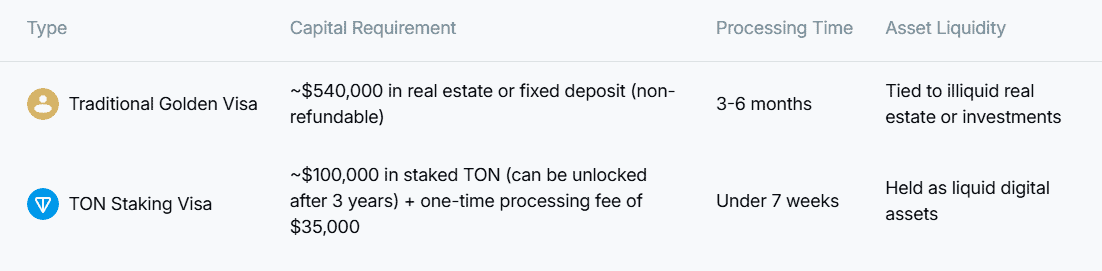

Unlike Abu Dhabi’s Mubadala Investment, which has invested in BlackRock’s spot Bitcoin ETF, NBIM builds its Bitcoin exposure indirectly through stakes in companies with sizable reserves, diversifying its portfolio without holding crypto directly.

Share this article