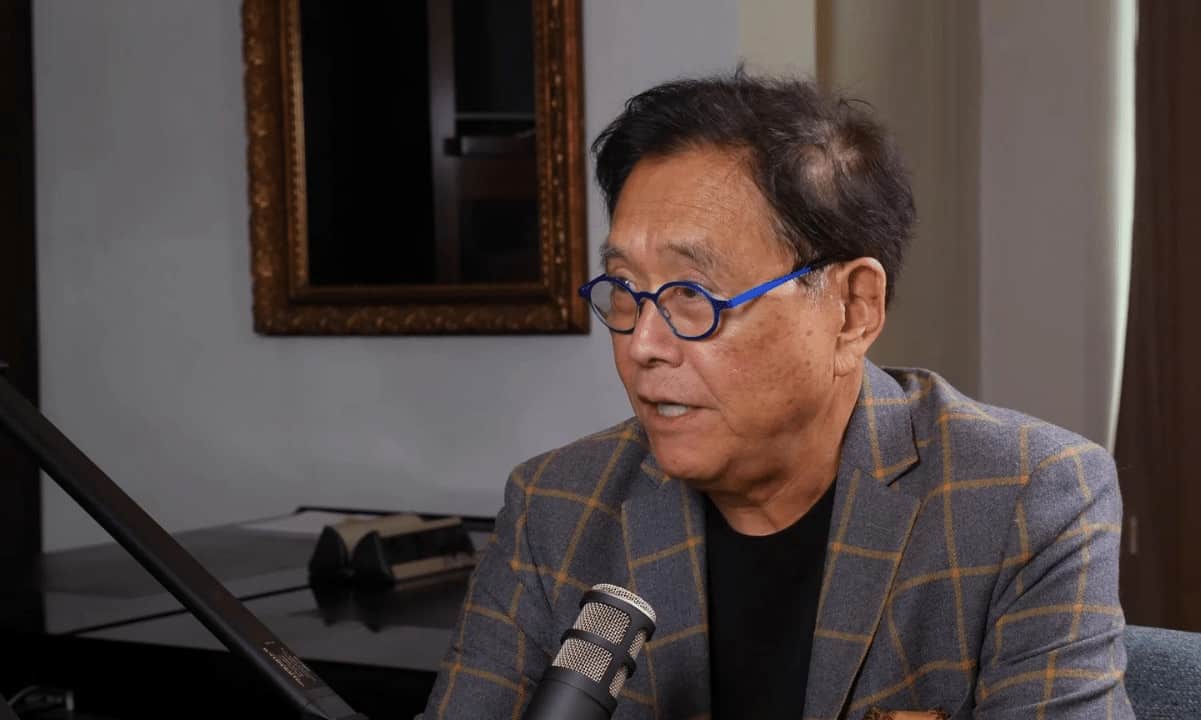

Speaking at the Wyoming Blockchain Symposium on Wednesday, central bank Governor Christopher Waller said, “the payment system is experiencing what I have called a ‘technology-driven revolution’.”

He added that this includes instant payments, digital wallets, mobile payment apps, stablecoins, and other digital assets, and AI. He specifically cited stablecoins, or fiat-pegged crypto assets, as the driver of this fintech revolution.

“I believe that stablecoins have the potential to maintain and extend the role of the dollar internationally. Stablecoins also have the potential to improve retail and cross-border payments.”

Nothing Scary About DeFi

Waller emphasized that blockchain technology complements rather than replaces traditional payment systems, noting many stablecoin operations still rely on legacy payment services.

JUST IN: Fed Governor Christopher Waller calls for the U.S. to embrace AI and stablecoins to modernize its payment systems – aiming for faster, cheaper, and more secure transactions.

He stresses that regulators must adapt or risk falling behind.

FOMO IS HERE pic.twitter.com/Wy3wfayOif

— Real World Asset Watchlist (@RWAwatchlist_) August 20, 2025

He explained how traditional payment transactions with something being bought and paid for, and technology facilitating the transaction and issuing a receipt. “The same process applies to the crypto world,” he said before adding:

“There is nothing scary about this, just because it occurs in the decentralized finance or DeFi world — this is simply new technology to transfer objects and record transactions.”

Waller added that there was also nothing to be afraid of when thinking about using smart contracts, tokenization, or distributed ledgers in everyday transactions.

The central banker echoed the SEC Chair’s recent comments praising the recently signed GENIUS stablecoin bill, calling it an important step that could help stablecoins reach their full potential.

“This was an important step for the payment stablecoin market and could help stablecoins reach their full potential.”

The speech also revealed the Fed is actively conducting technical research on real-world asset tokenization, smart contracts, and AI to understand trends and support private firms using banking infrastructure.

“It is my belief that the Federal Reserve could benefit from further engagement with innovators in industry, particularly as there is increased convergence between the traditional financial sector and the digital asset ecosystem.”

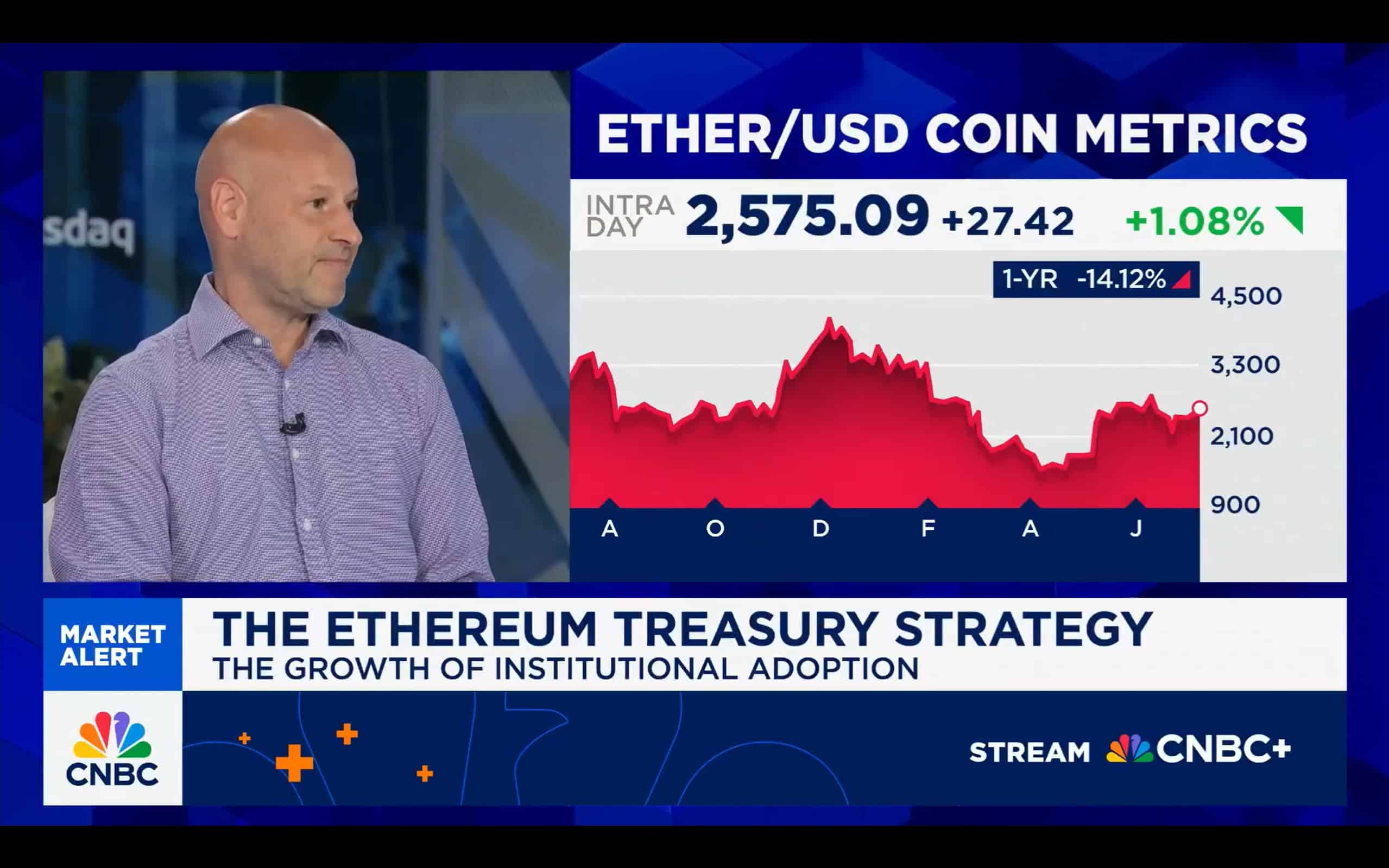

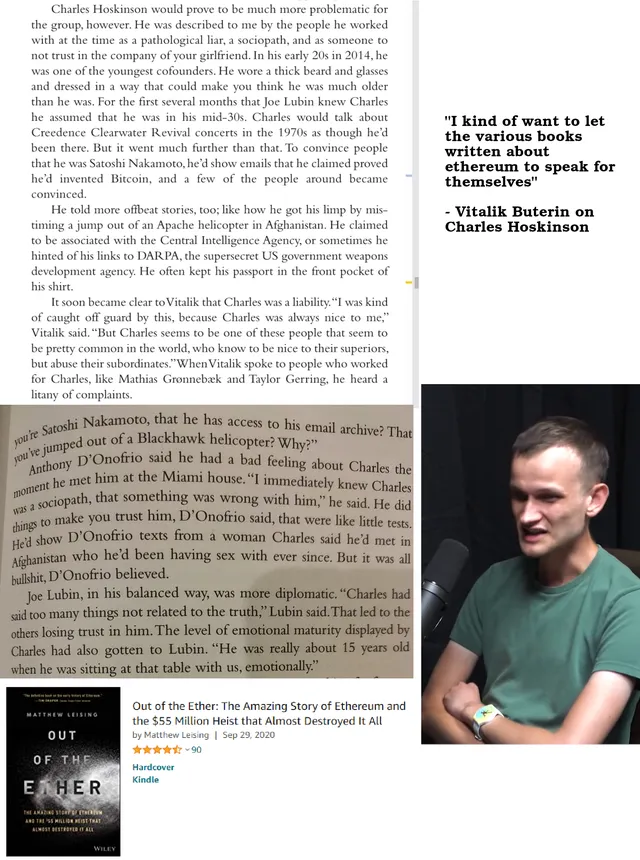

Christopher Waller’s comments reflect the central bank’s partial pivot toward embracing crypto, following April’s withdrawal of 2022 guidance that deterred banks from crypto activities.

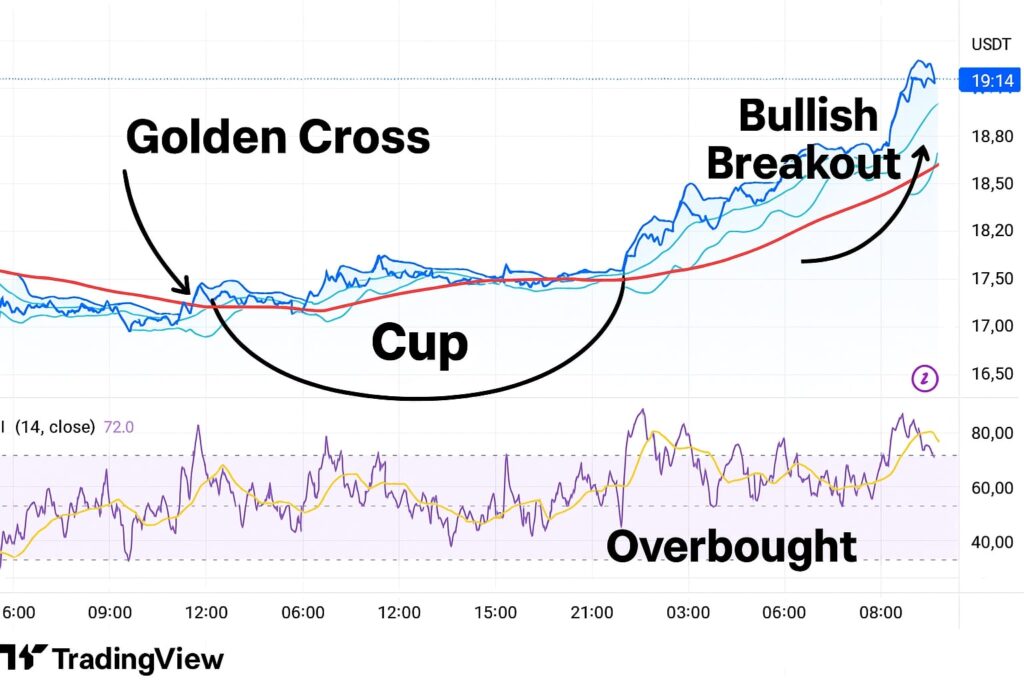

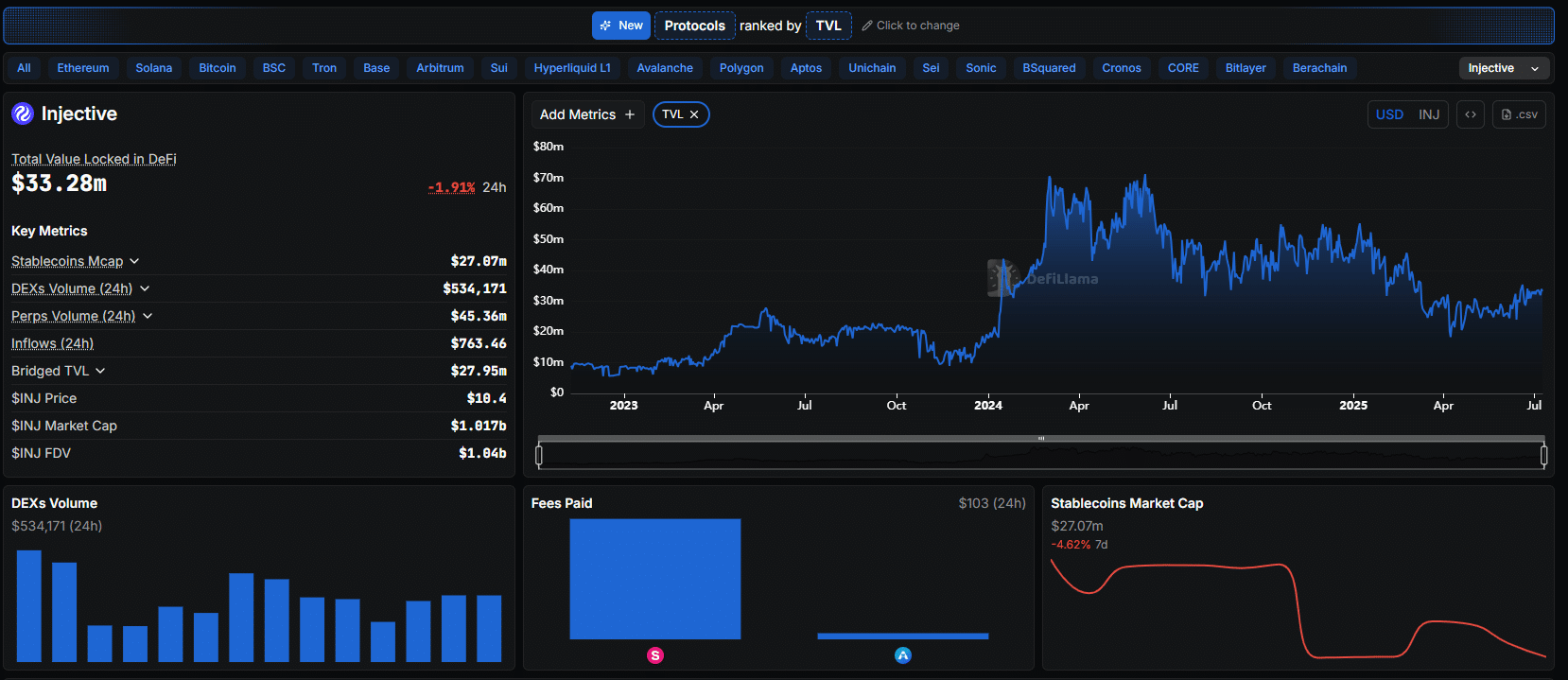

Stablecoin Ecosystem Outlook

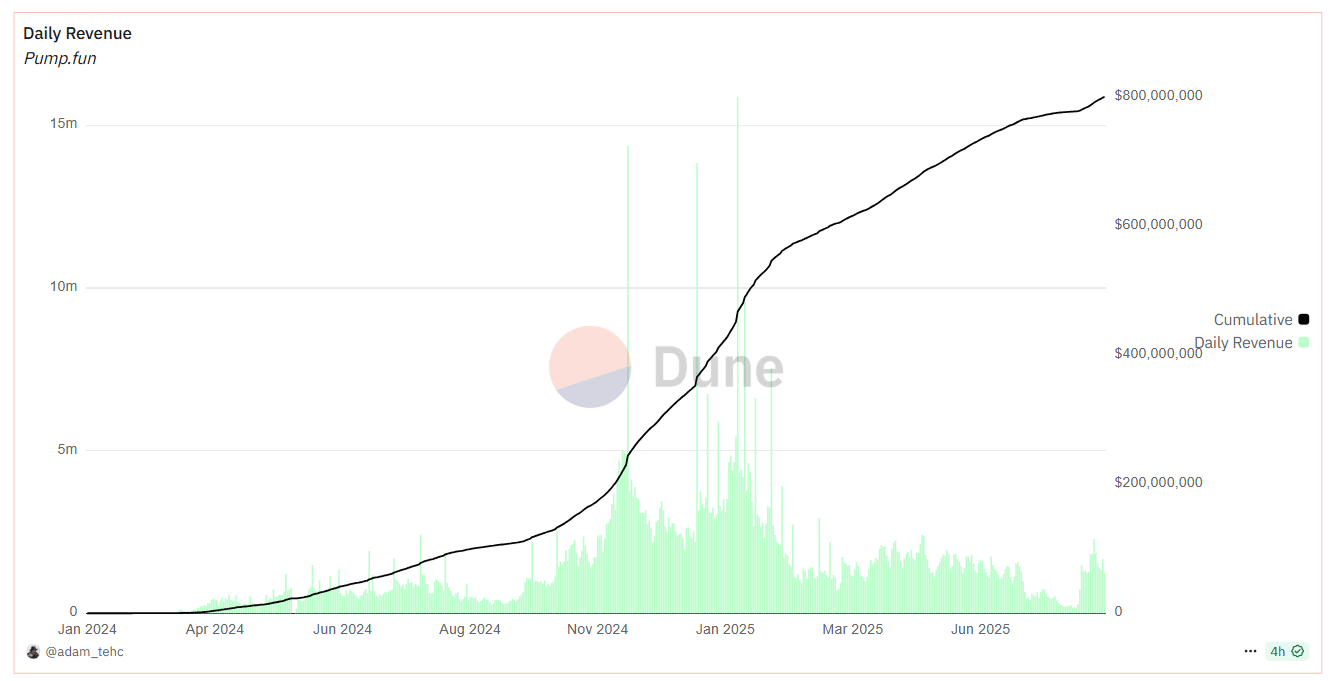

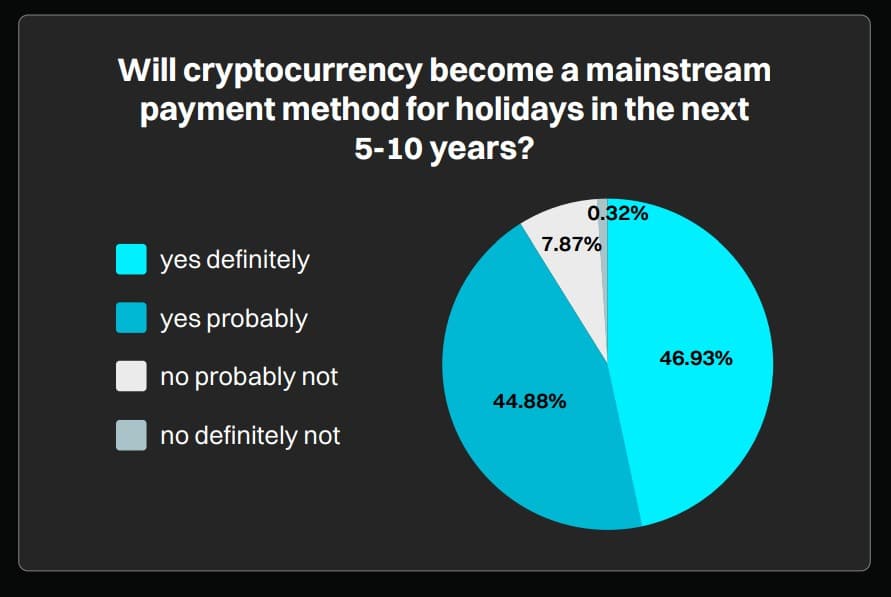

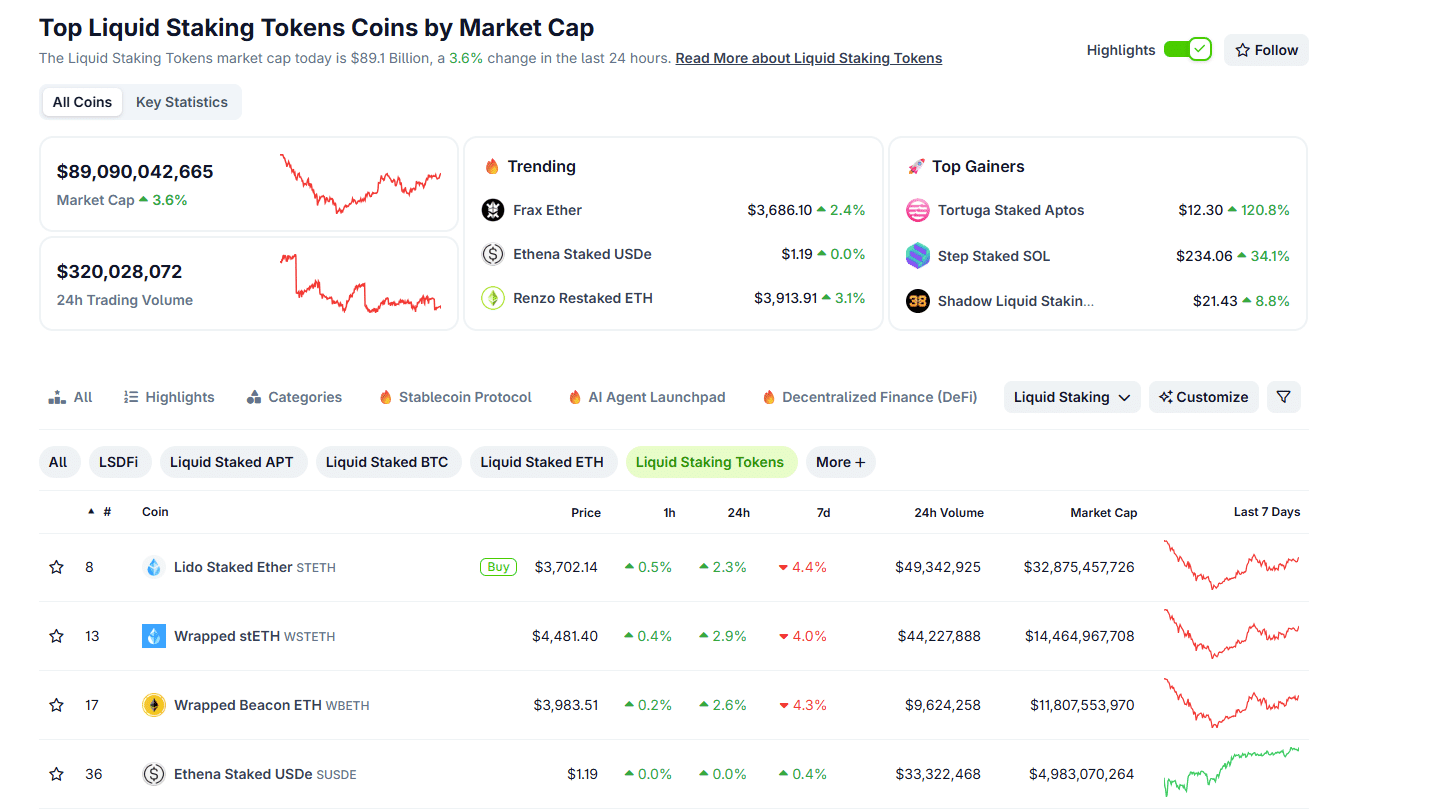

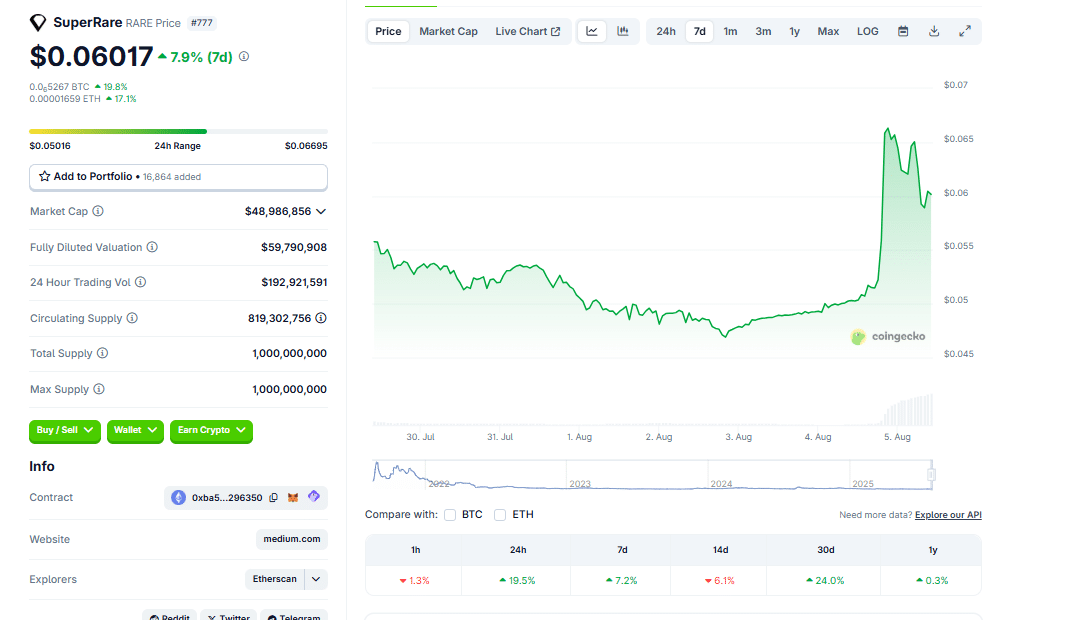

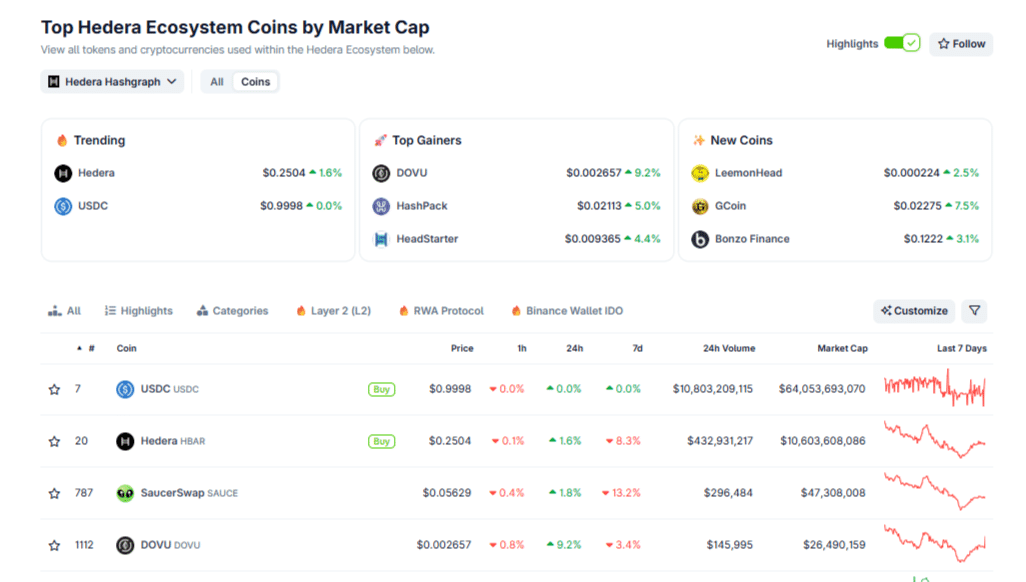

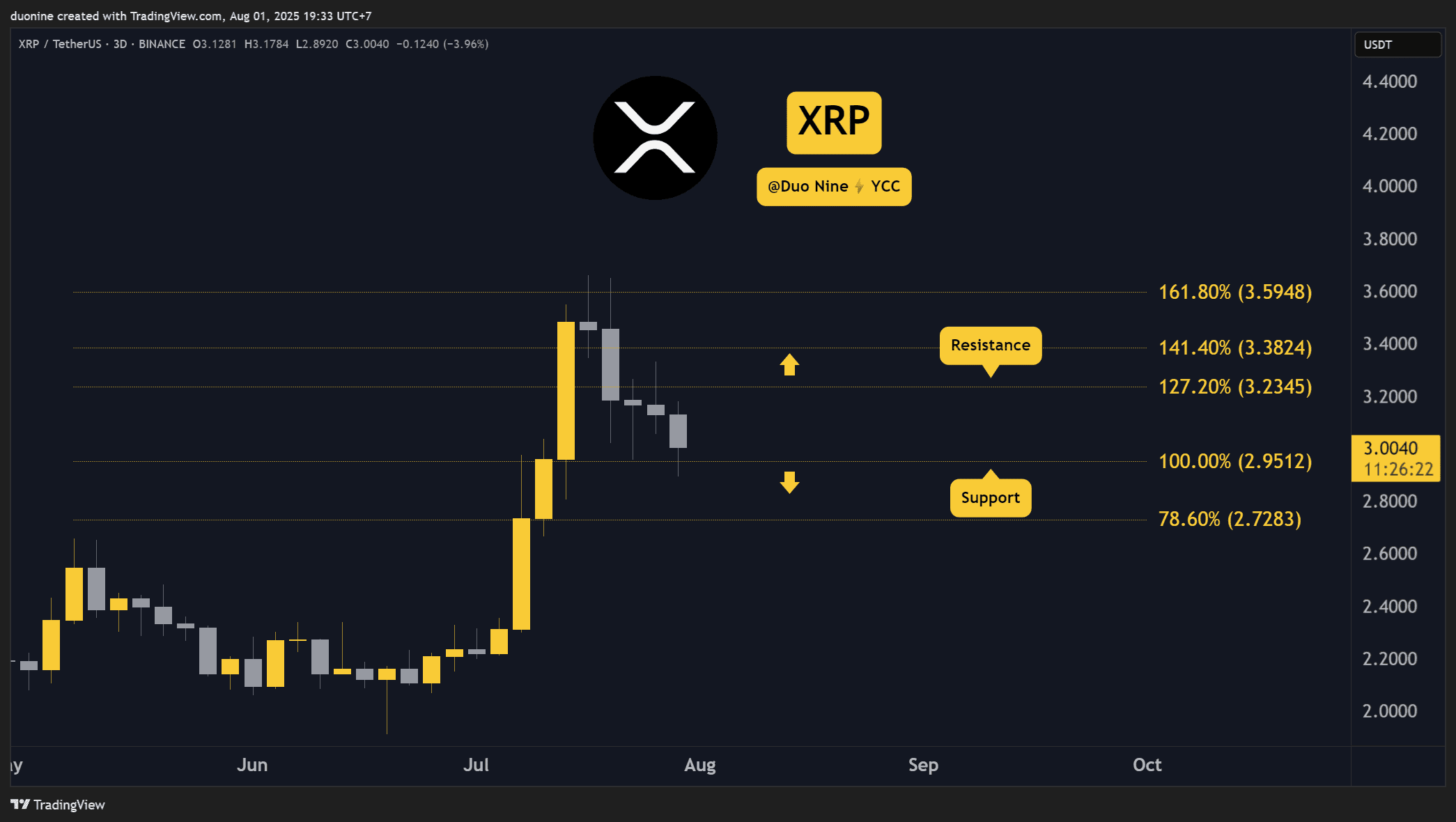

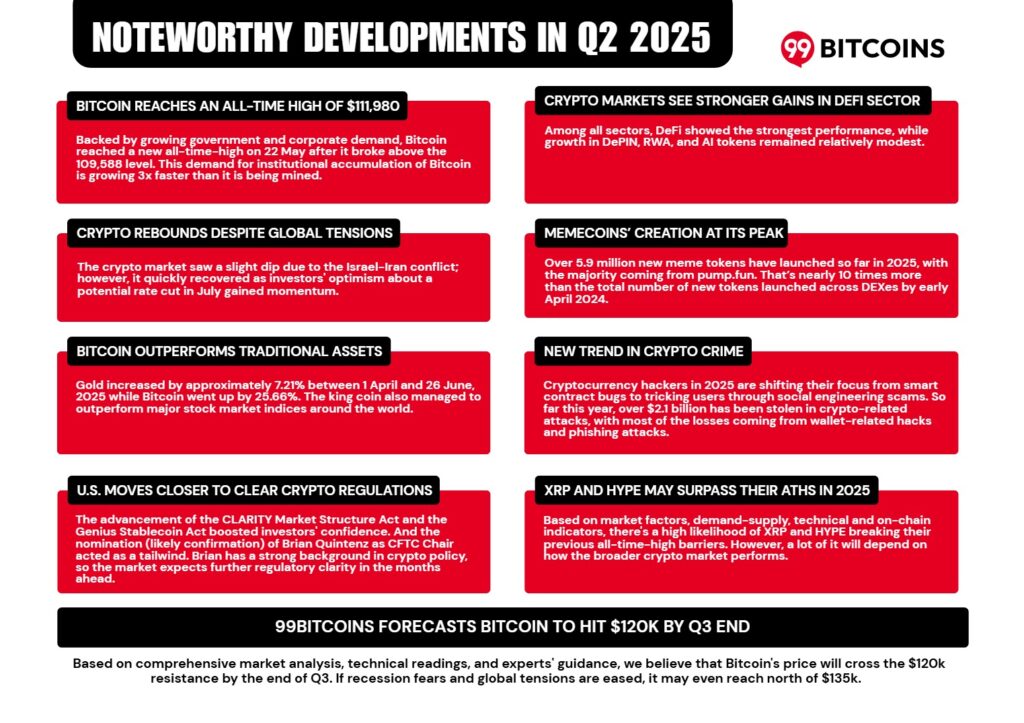

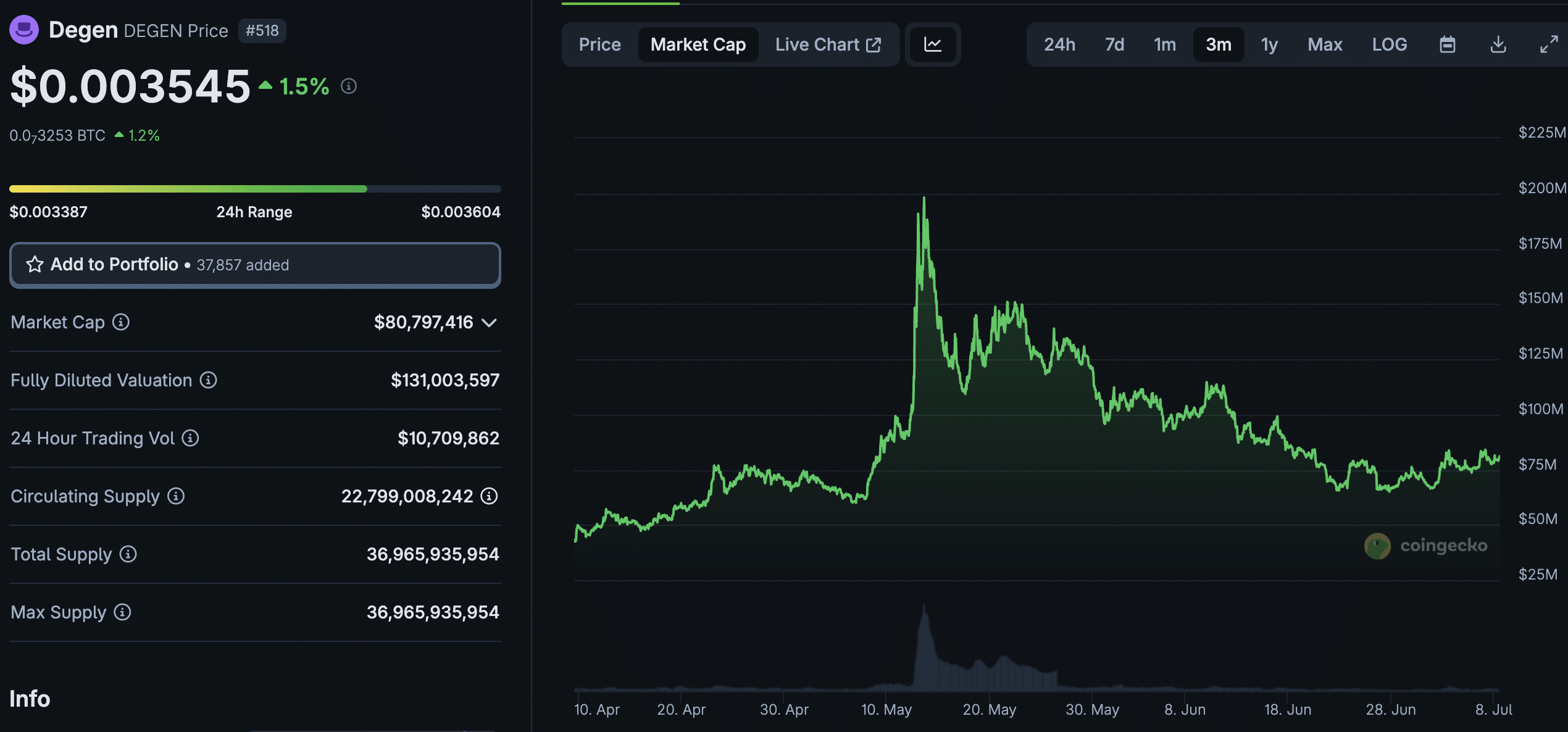

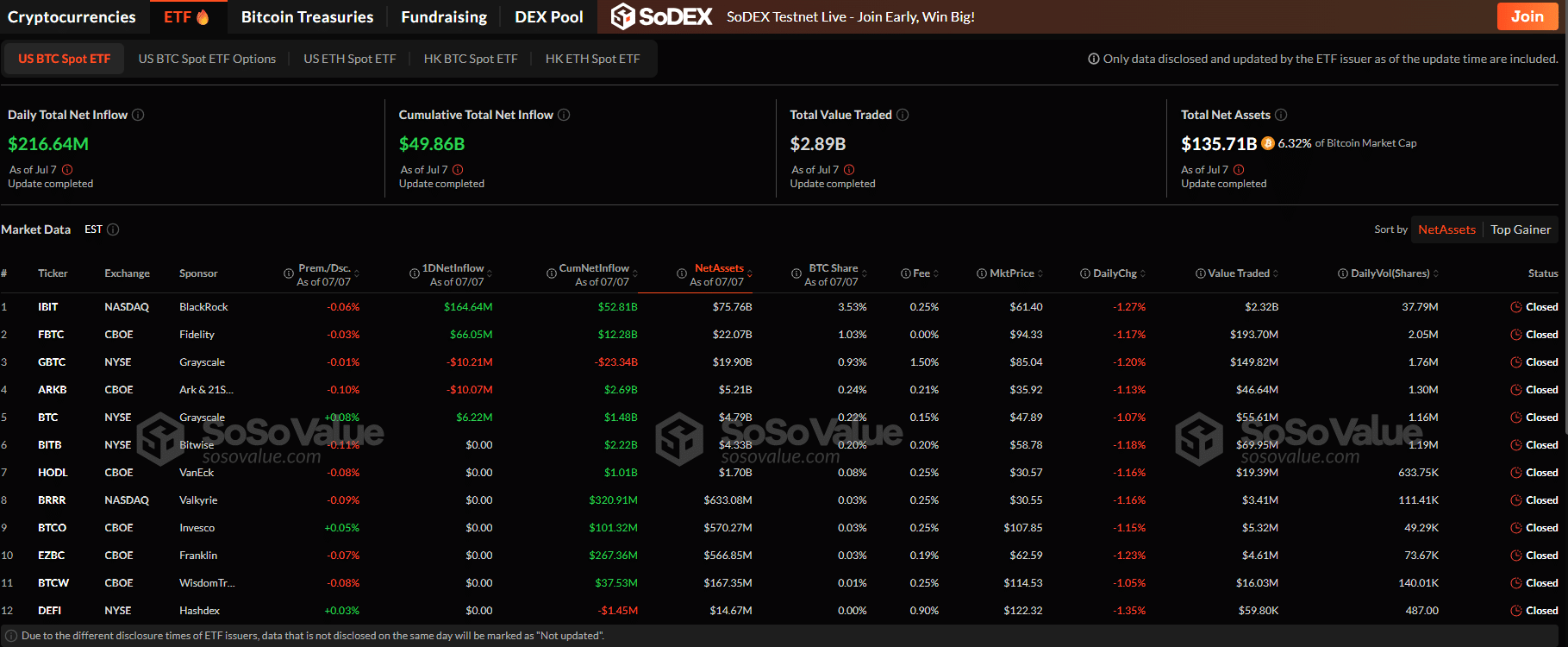

The stablecoin market is currently valued at around $280 billion, which represents around 7% of the total crypto market capitalization.

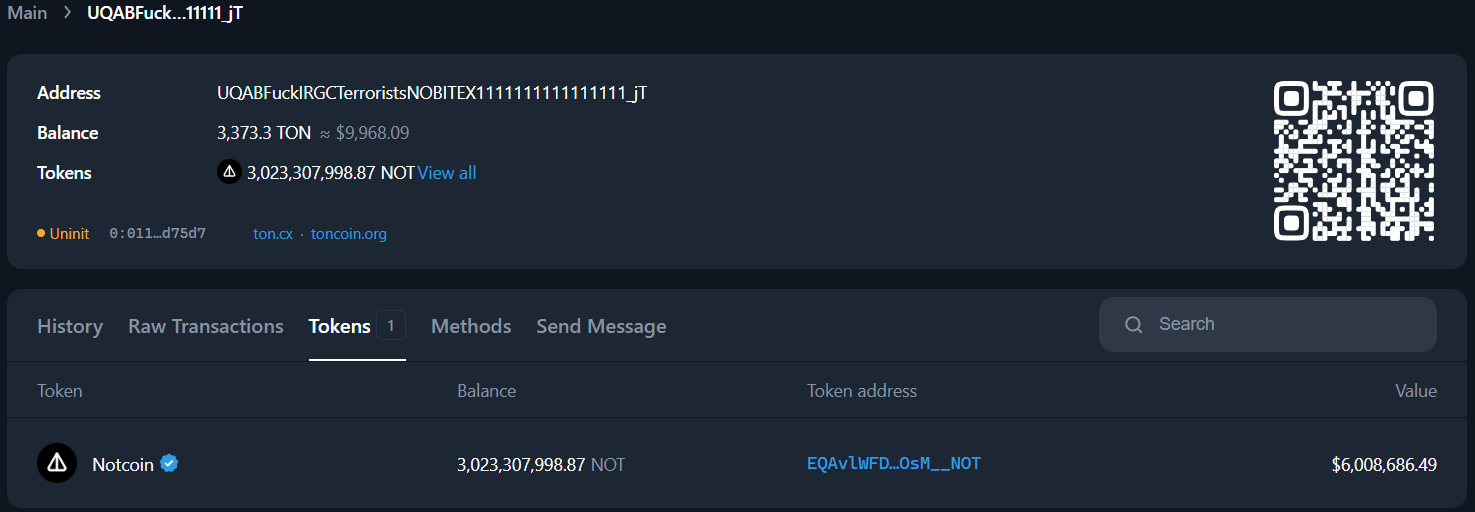

Tether still commands the lion’s share of that market with 60% and a record $167 billion USDT in circulation.

Circle remains second with 24% market share and $67.5 billion USDC in circulation, and Ethens USDe has flipped Maker’s USDS for third place with a 4% market share.

There have been a lot of new entrants to the crowded stable market recently, including Ripple (RLUSD) and World Liberty Finance (USD1), but these are minnows compared to the market leaders.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

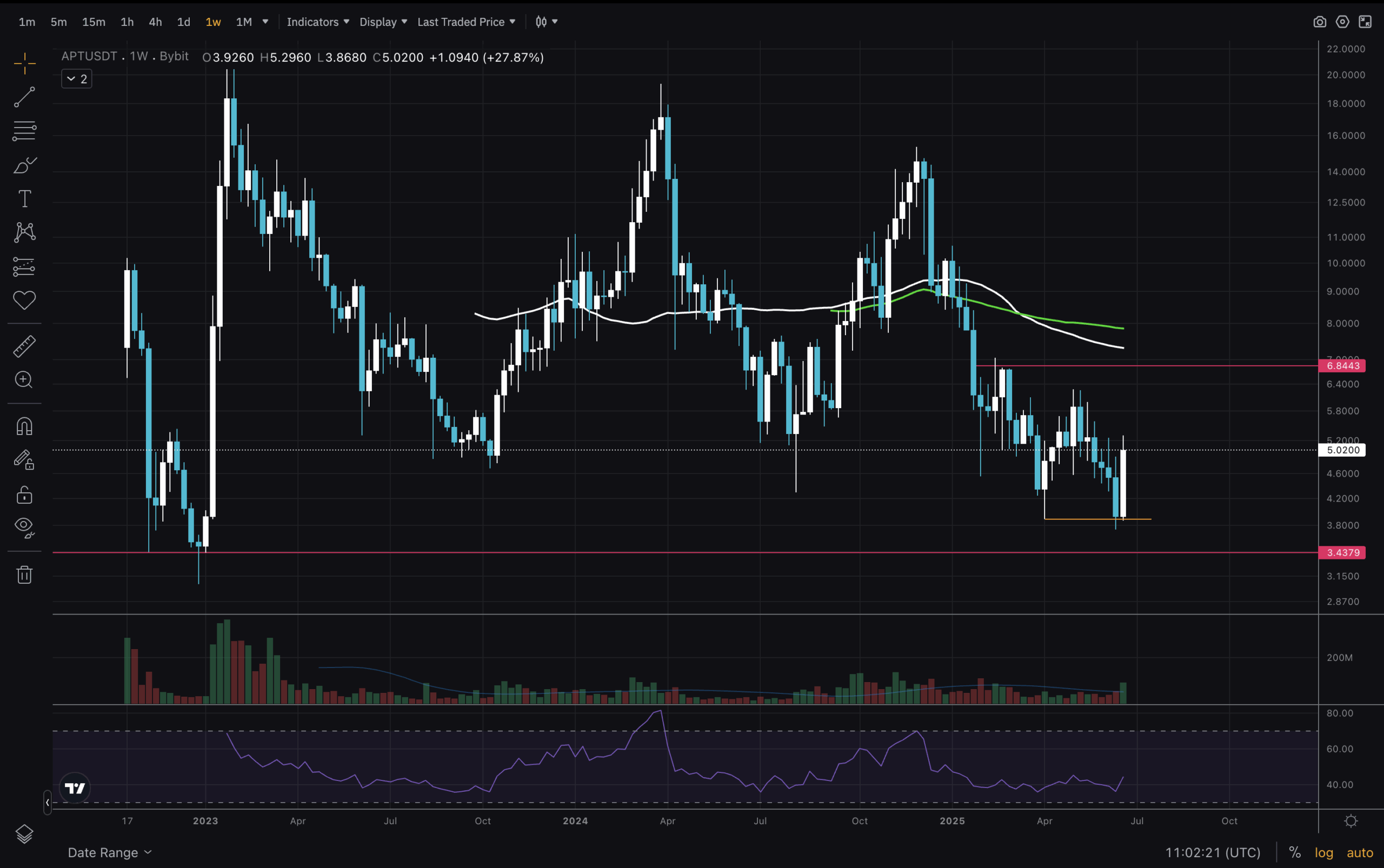

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!