Israel plans stricter stablecoin oversight and pushes ahead with a digital shekel roadmap to secure payments infrastructure while adapting to fast-growing private crypto use.

Summary

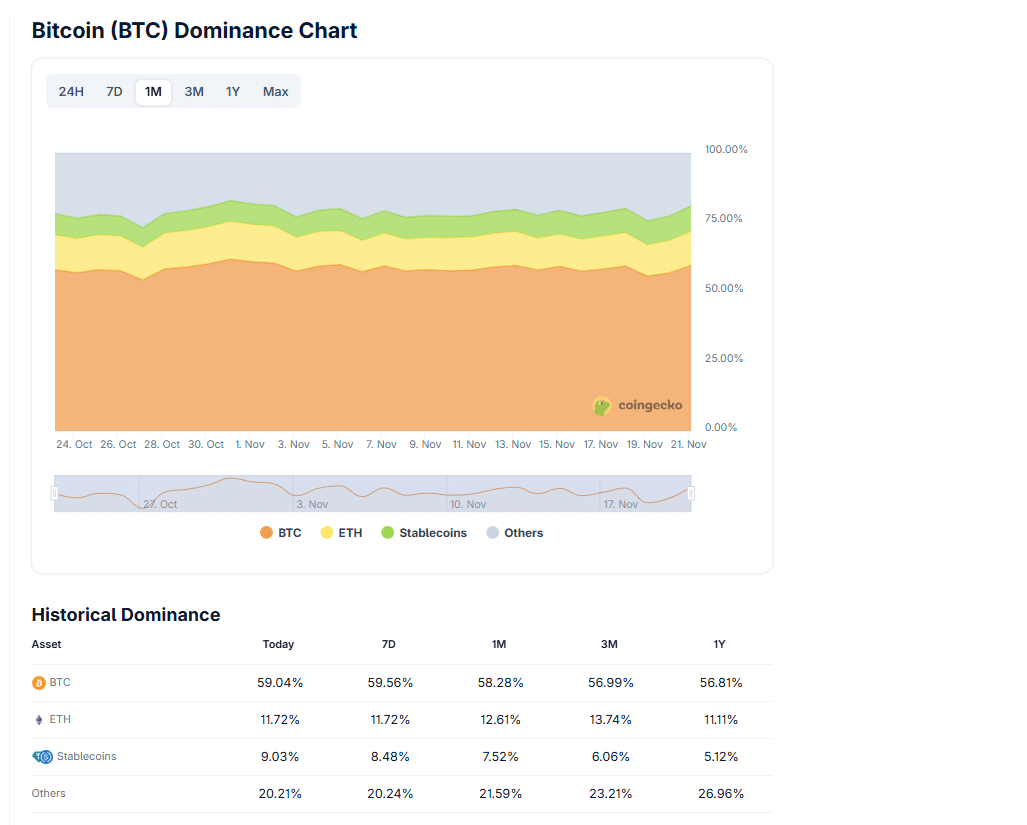

- Bank of Israel flags $300B+ stablecoin market and $2T monthly volumes, warning that reliance on Tether and Circle creates systemic risks.

- Officials want 1:1, highly liquid reserves and stronger regulation as stablecoins become embedded in trading, remittances, and everyday payments.

- The digital shekel project targets broad public use, with a 2026 roadmap and recommendations by end-2024 to keep the state central in payments innovation.

Israel is advancing toward tighter regulation of stablecoins as the Bank of Israel incorporates them into the country’s future payments infrastructure, according to statements made at a recent financial conference.

The Bank of Israel is reassessing the role of private digital currencies in daily financial transactions as stablecoin adoption expands beyond cryptocurrency trading circles, officials said.

Israel continues to push forward with stablecoin legislation

Bank of Israel Governor Amir Yaron outlined plans for increased regulatory requirements during the Payments in the Evolving Era conference in Tel Aviv, stating that oversight will intensify as stablecoin usage continues to grow.

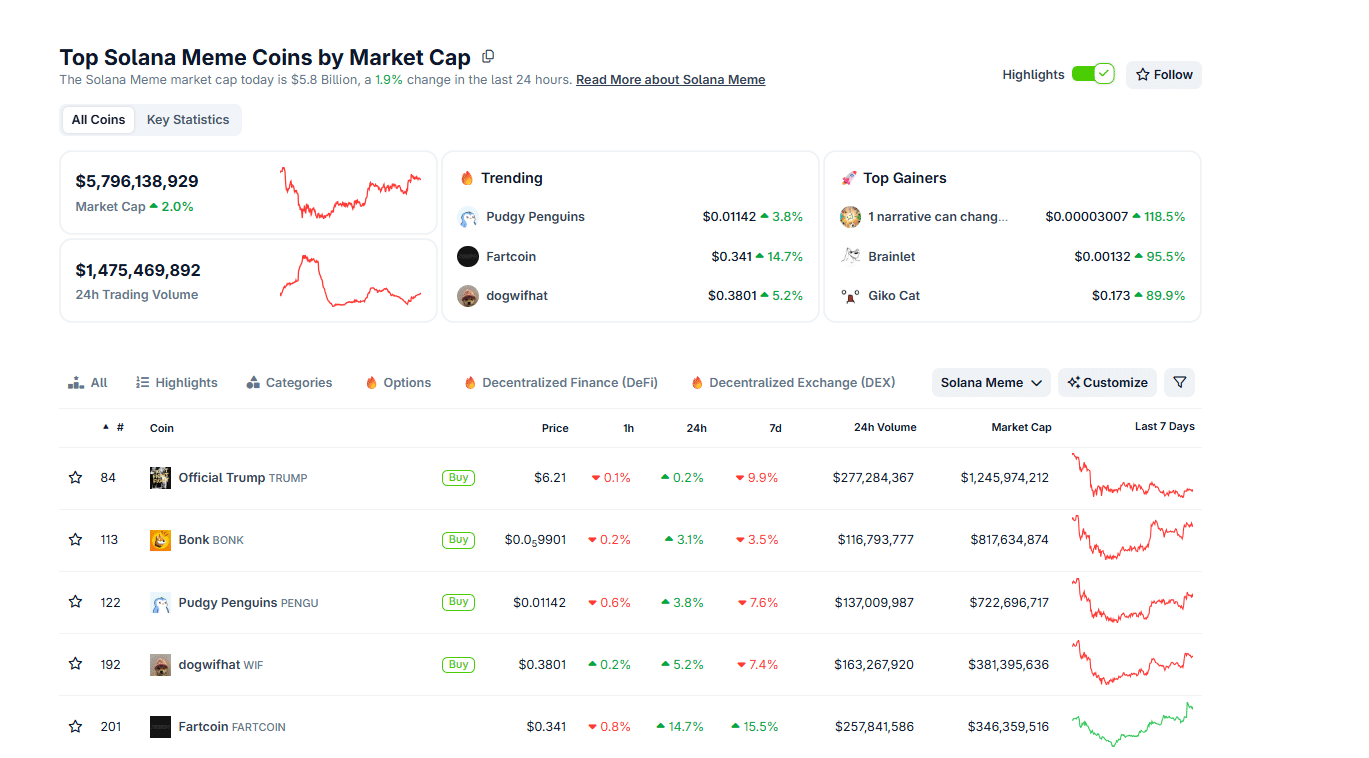

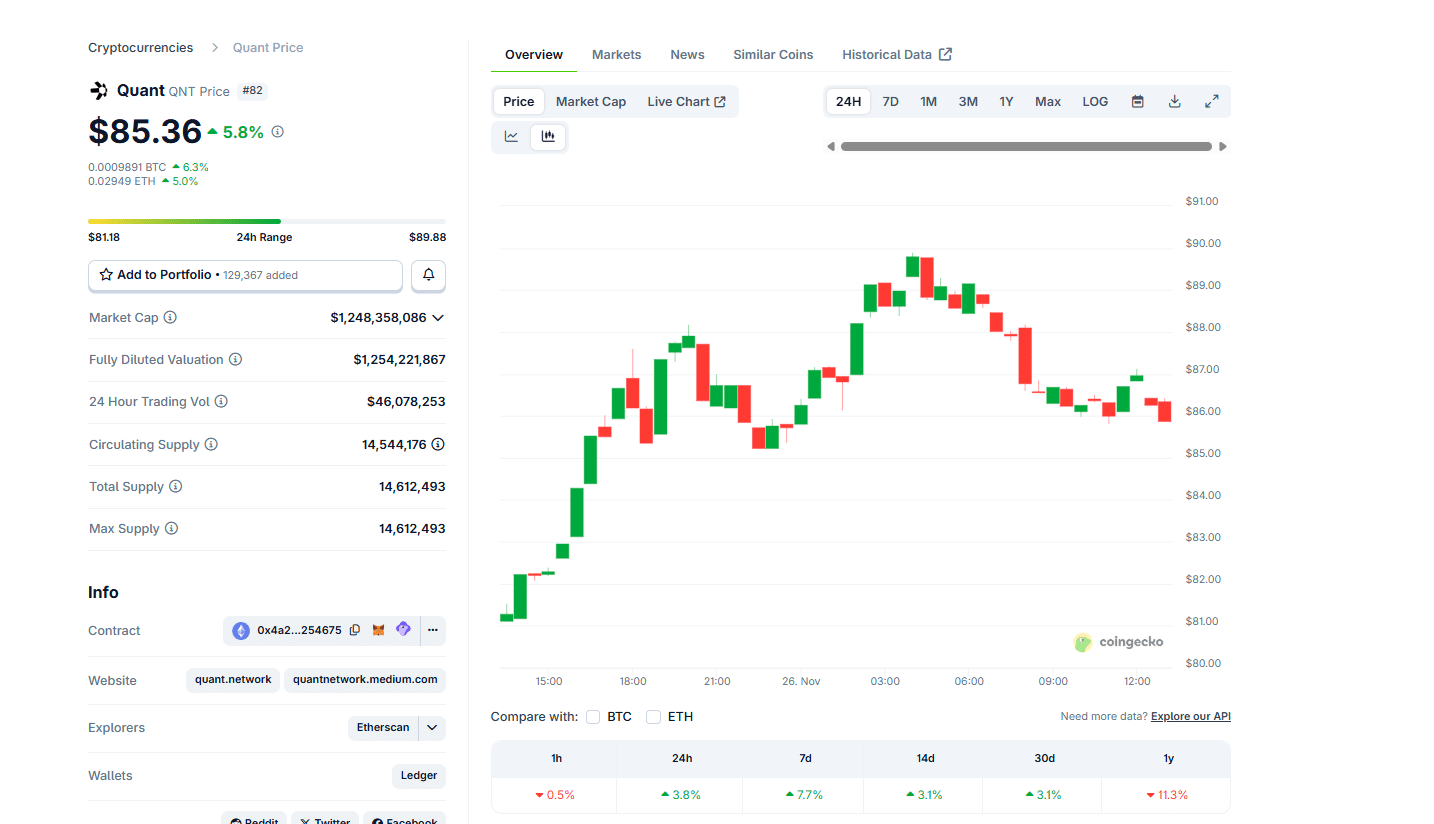

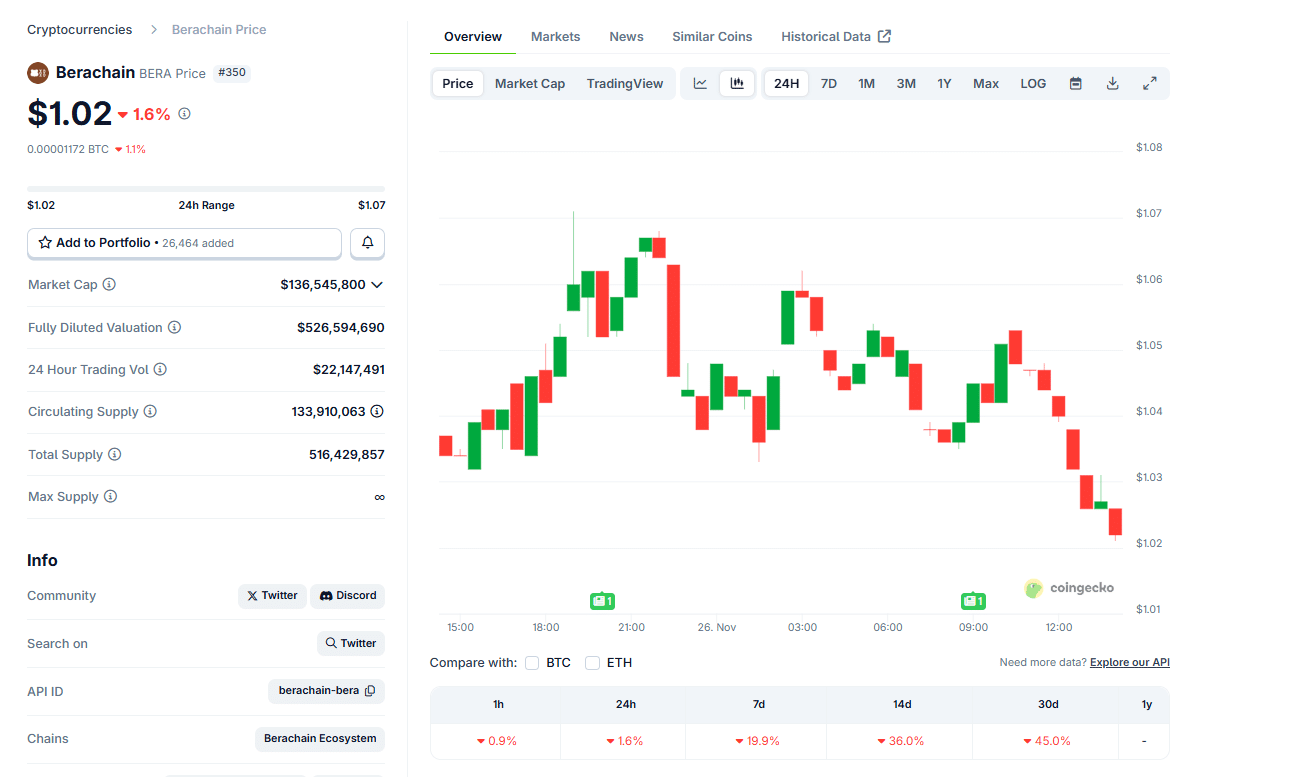

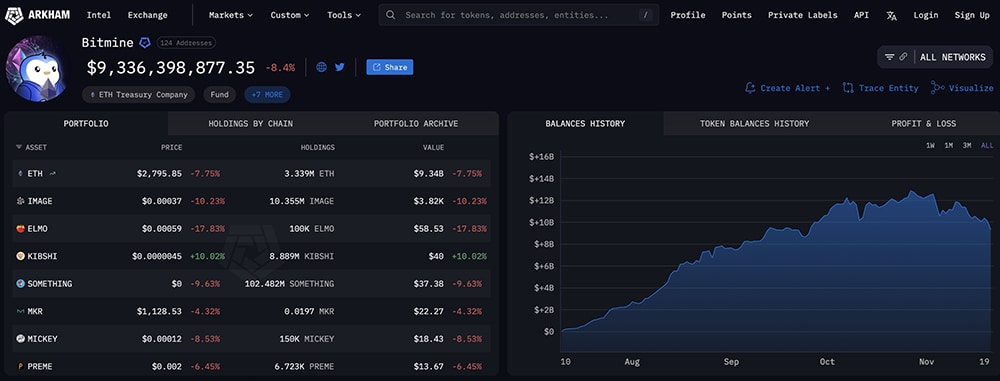

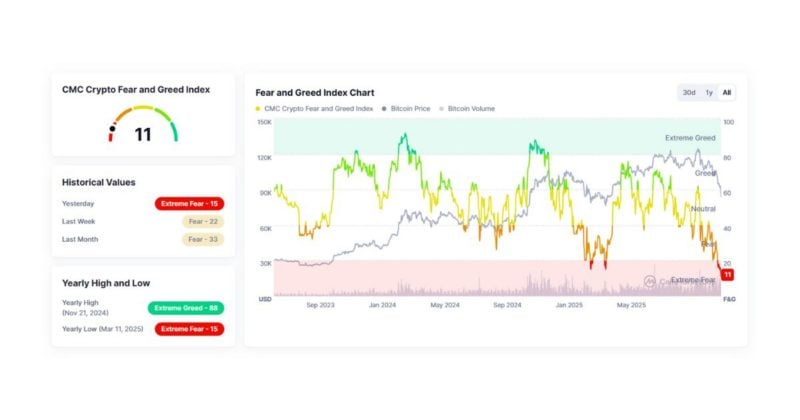

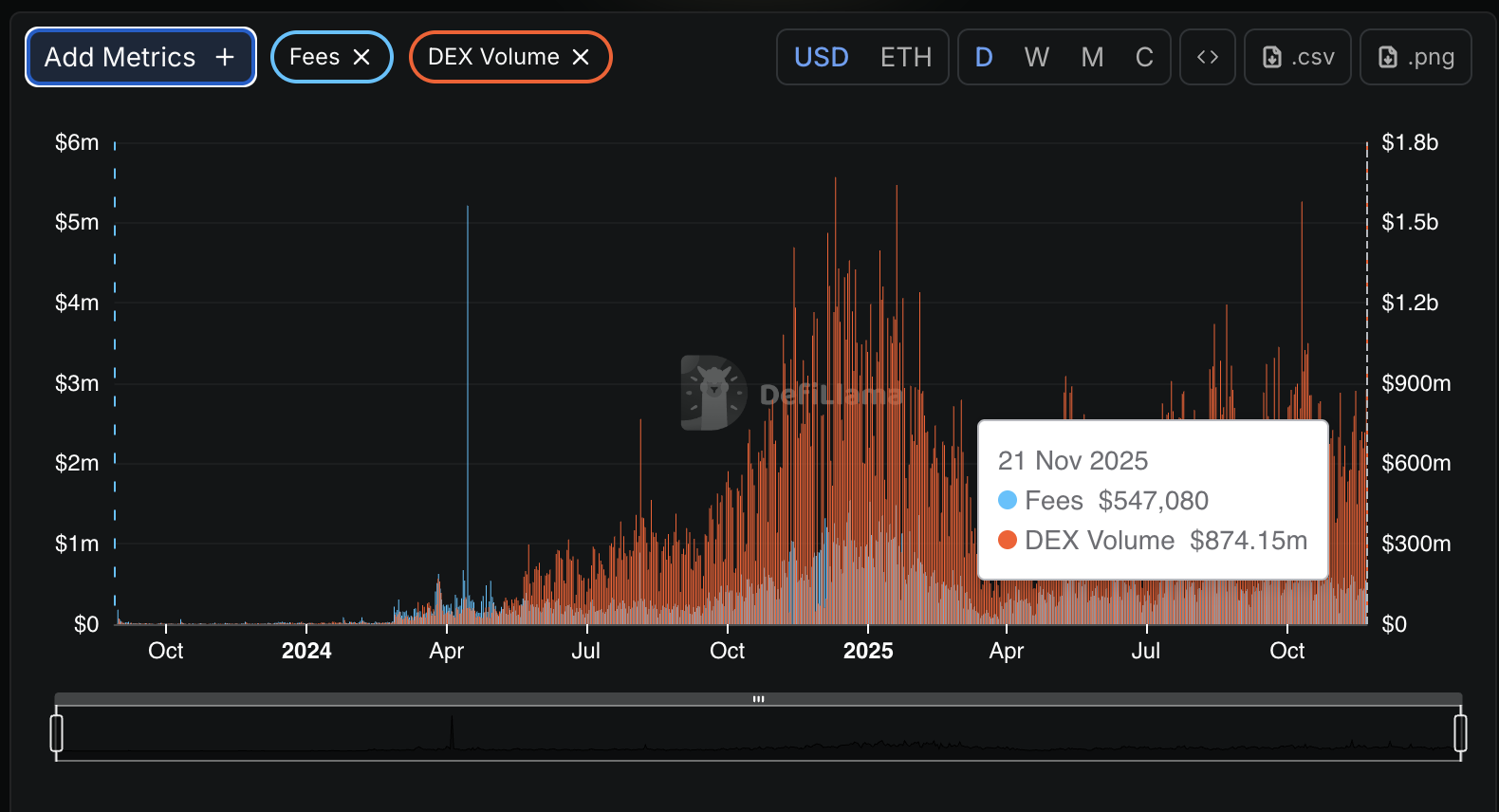

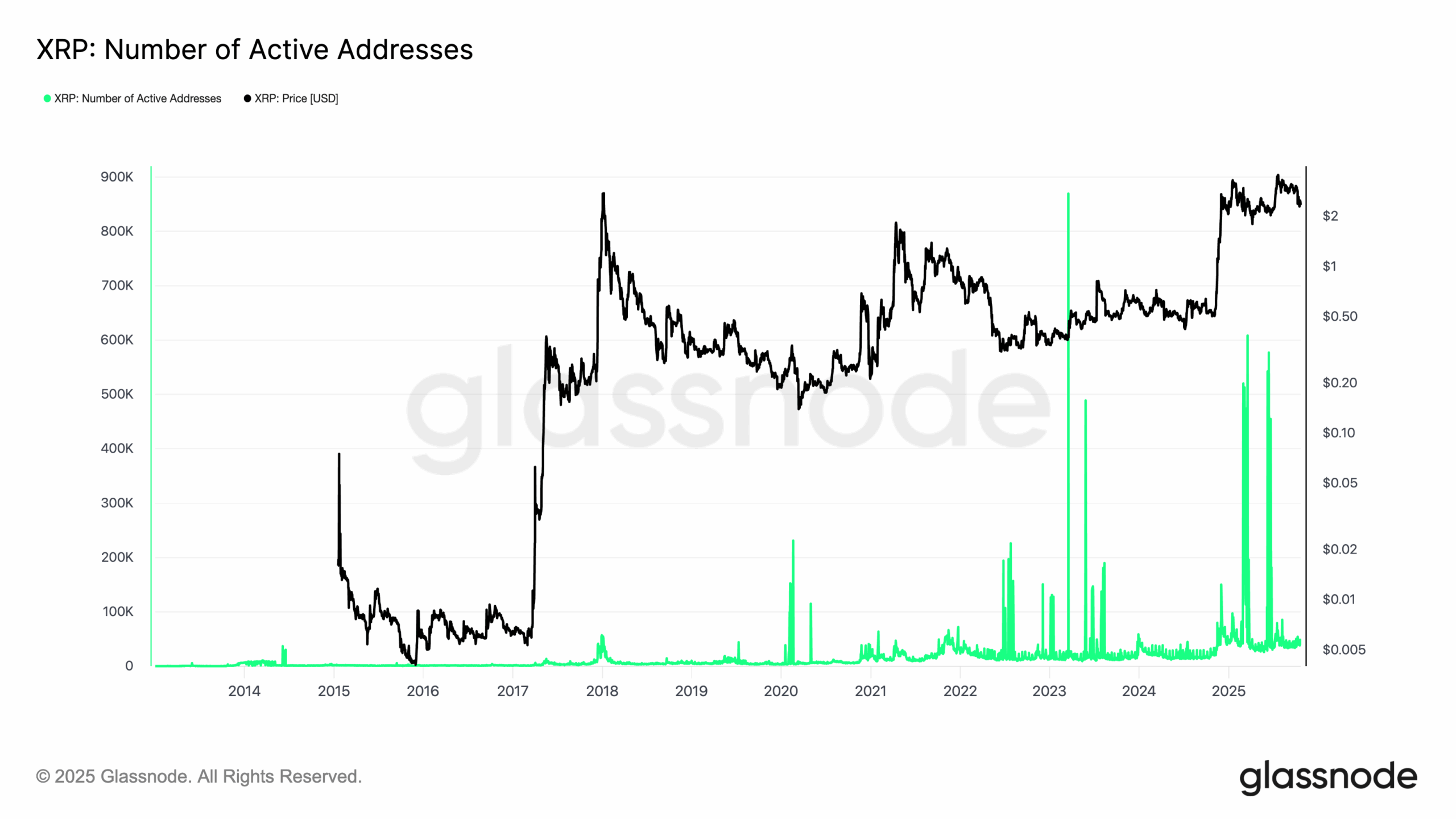

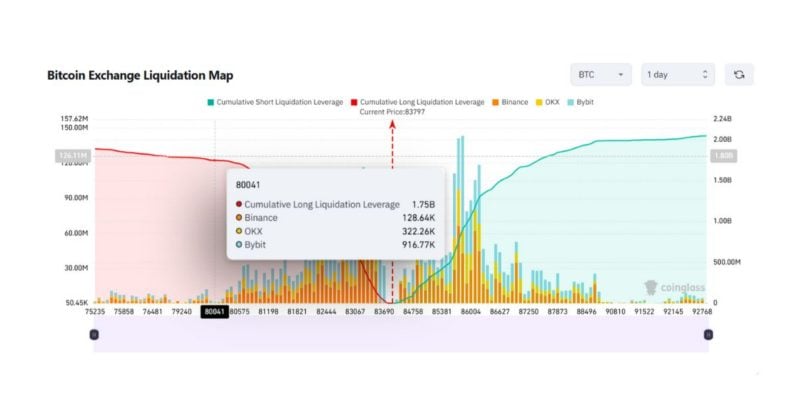

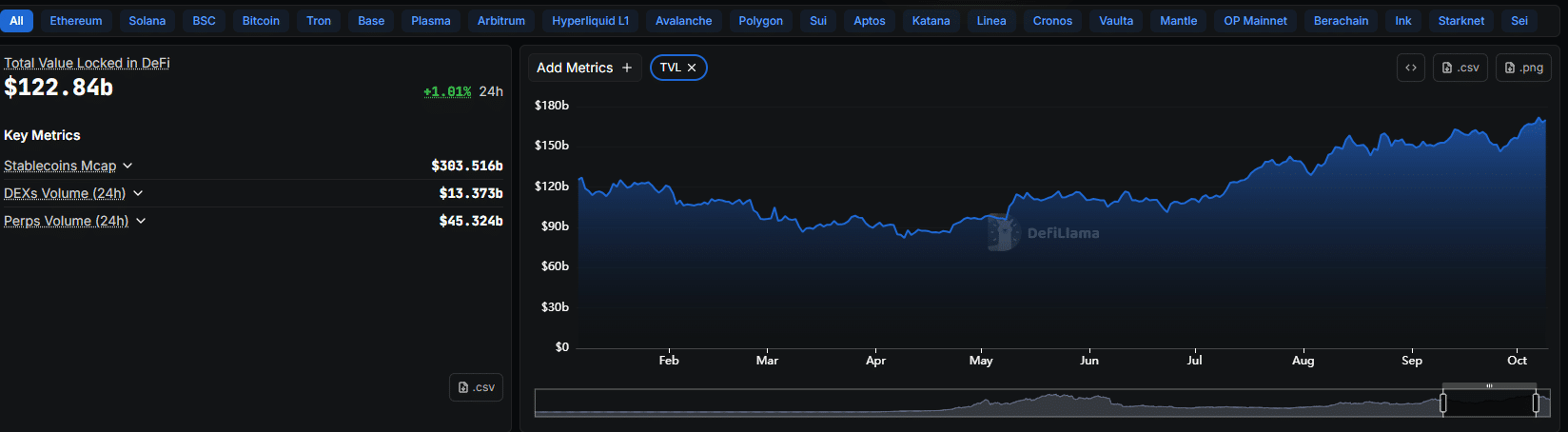

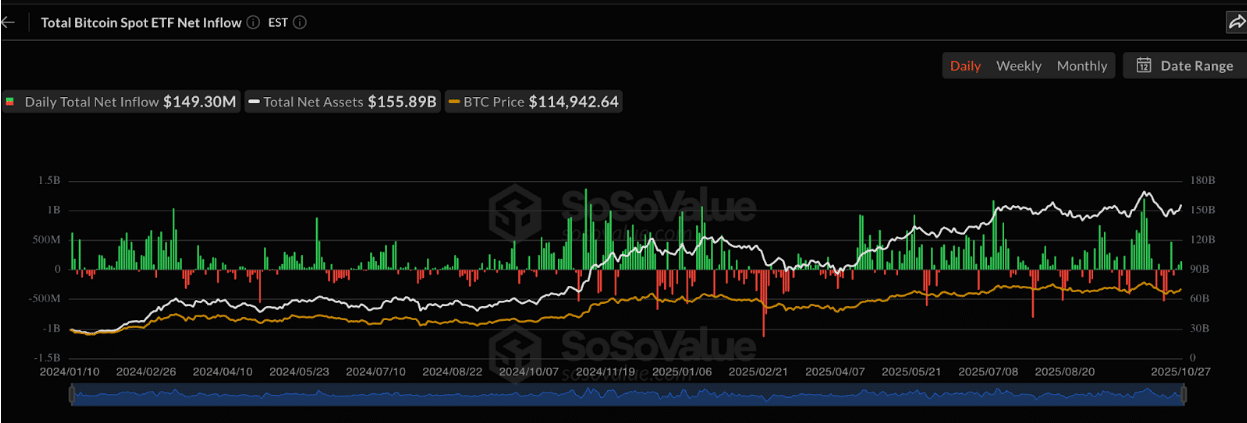

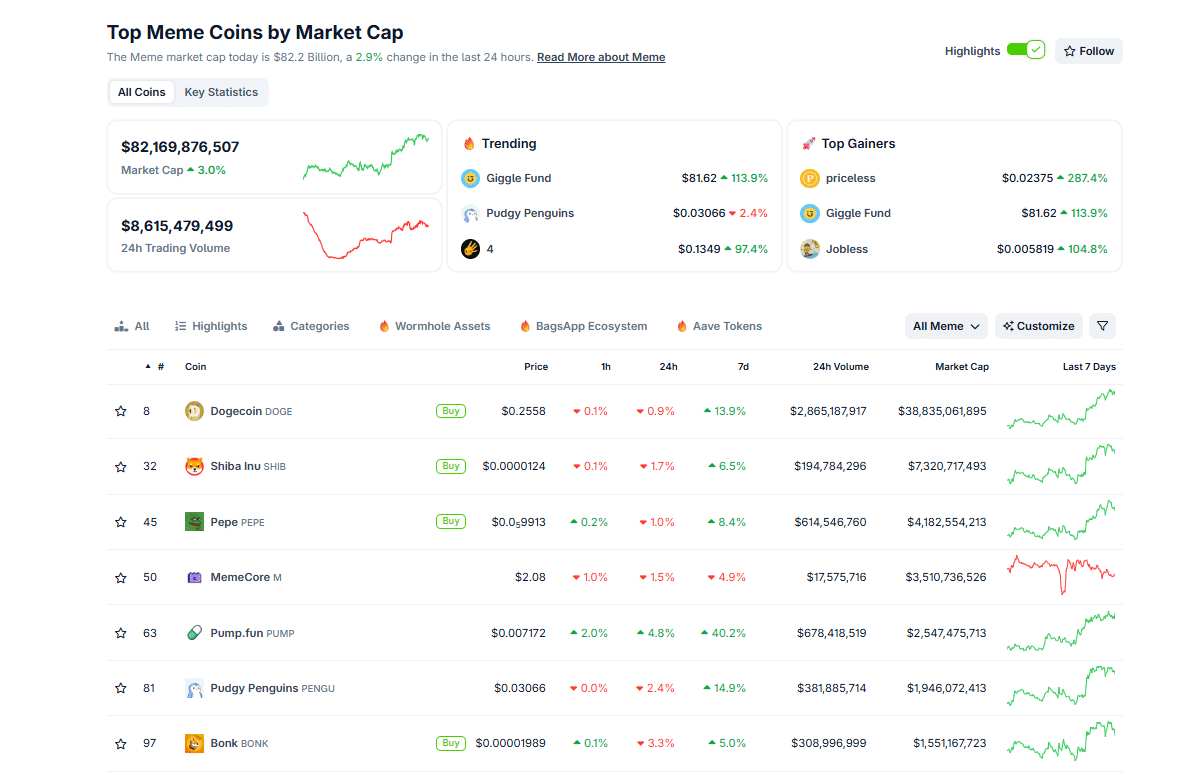

The Bank of Israel reported that global stablecoin usage has reached significant scale, with the sector surpassing $300 billion in market capitalization and monthly transaction volumes exceeding $2 trillion. According to CoinDesk, officials noted these figures place stablecoins at levels comparable to mid-sized international commercial banks’ balance sheets.

The growth has been driven by stablecoins’ use in trading, cross-border transfers, and demand for digital instruments that avoid the price volatility associated with other cryptocurrencies, according to conference presentations.

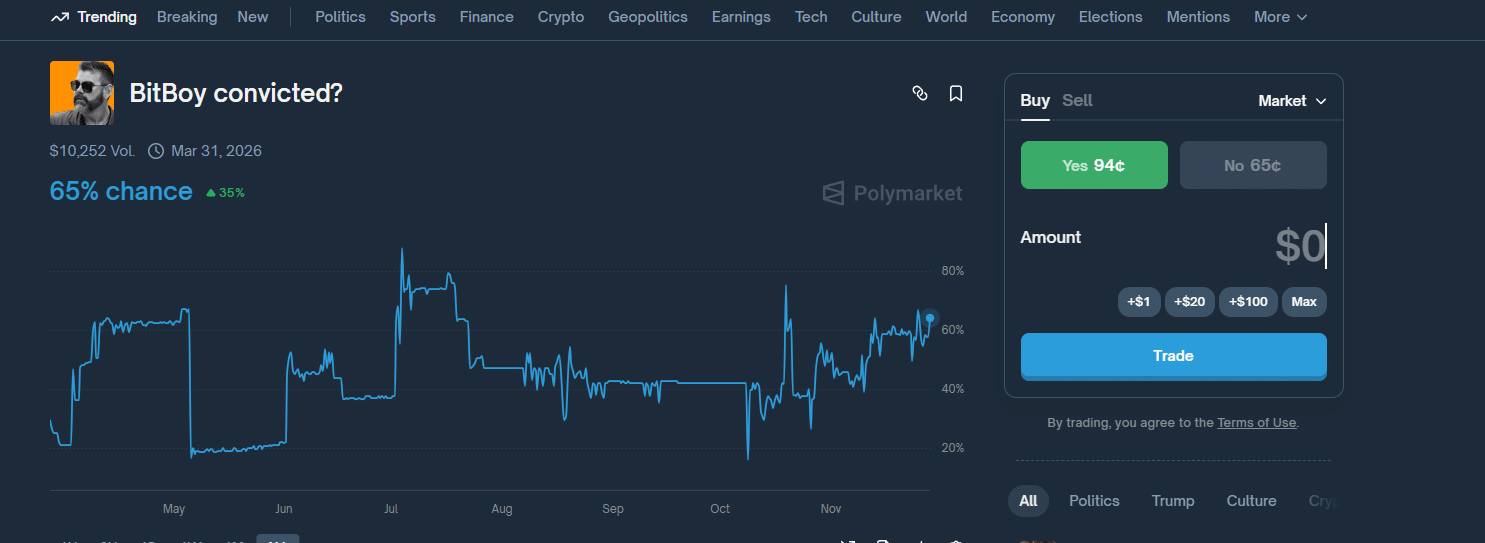

Approximately 99% of stablecoin market activity is concentrated in two issuers, Tether and Circle, according to data presented at the conference. Israeli policymakers stated this concentration creates systemic vulnerability, warning that disruptions at the issuer level could affect global payment channels.

Officials emphasized the need for strict reserve practices, including fully backed 1:1 reserves and liquid assets capable of handling sudden redemption demands, according to statements made at the event.

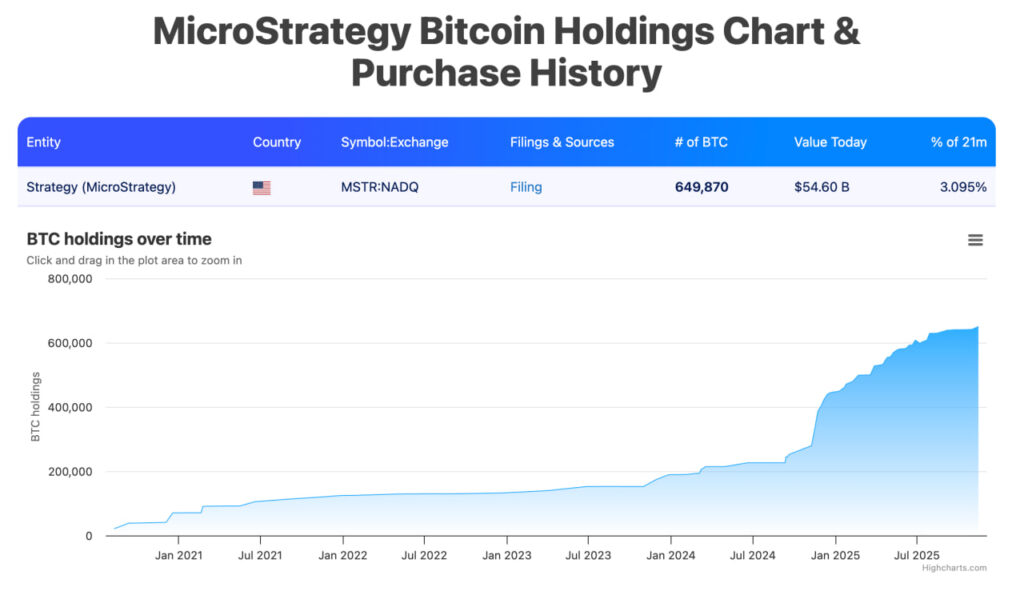

The Bank of Israel also advanced its central bank digital currency initiative. Yoav Soffer, who leads the digital shekel project, described the planned currency as central bank money designed for widespread use and released a 2026 roadmap outlining development stages. Official recommendations are expected by the end of 2024, according to the announcement.

The accelerated timeline mirrors recent moves by the European Central Bank, according to industry analysts. The faster schedule reflects central banks’ responses to competition from private digital currencies and rapid changes in the payments sector, observers said.

Market participants have linked the timing to a broader global trend of central banks modernizing digital money strategies. The digital shekel project represents a strategic effort to maintain control over national payments infrastructure while supporting innovation within regulated frameworks, according to industry commentary.