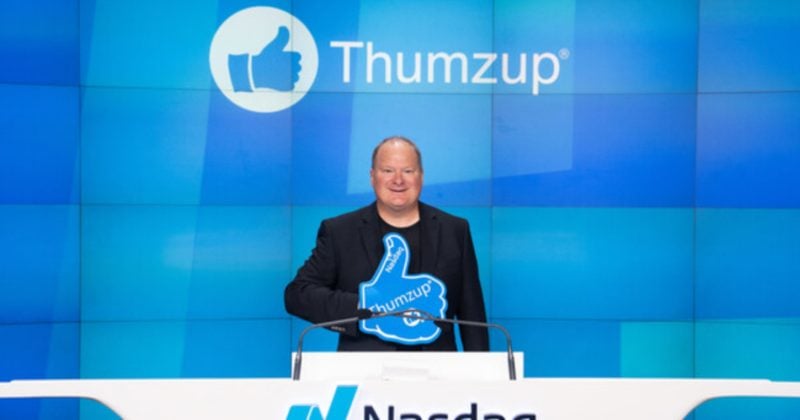

Bullish is going bigger than expected. The crypto exchange, backed by Peter Thiel and the owner of CoinDesk, has increased the size of its IPO to $990 million. The company is now offering 30 million shares priced between $32 and $33, pushing its projected valuation close to $4.8 billion. Just last week, the goal was $4.2 billion. The Bullish IPO is one of the largest public offerings in crypto since Circle’s debut earlier this year.

BlackRock and ARK Want In

The bigger raise isn’t happening in a vacuum. Major investors like BlackRock and ARK Invest are reportedly taking part, showing that there is real institutional interest in Bullish’s debut. JPMorgan, Citigroup, and Jefferies are running point on the deal, and the company plans to list on the NYSE under the ticker BLSH.

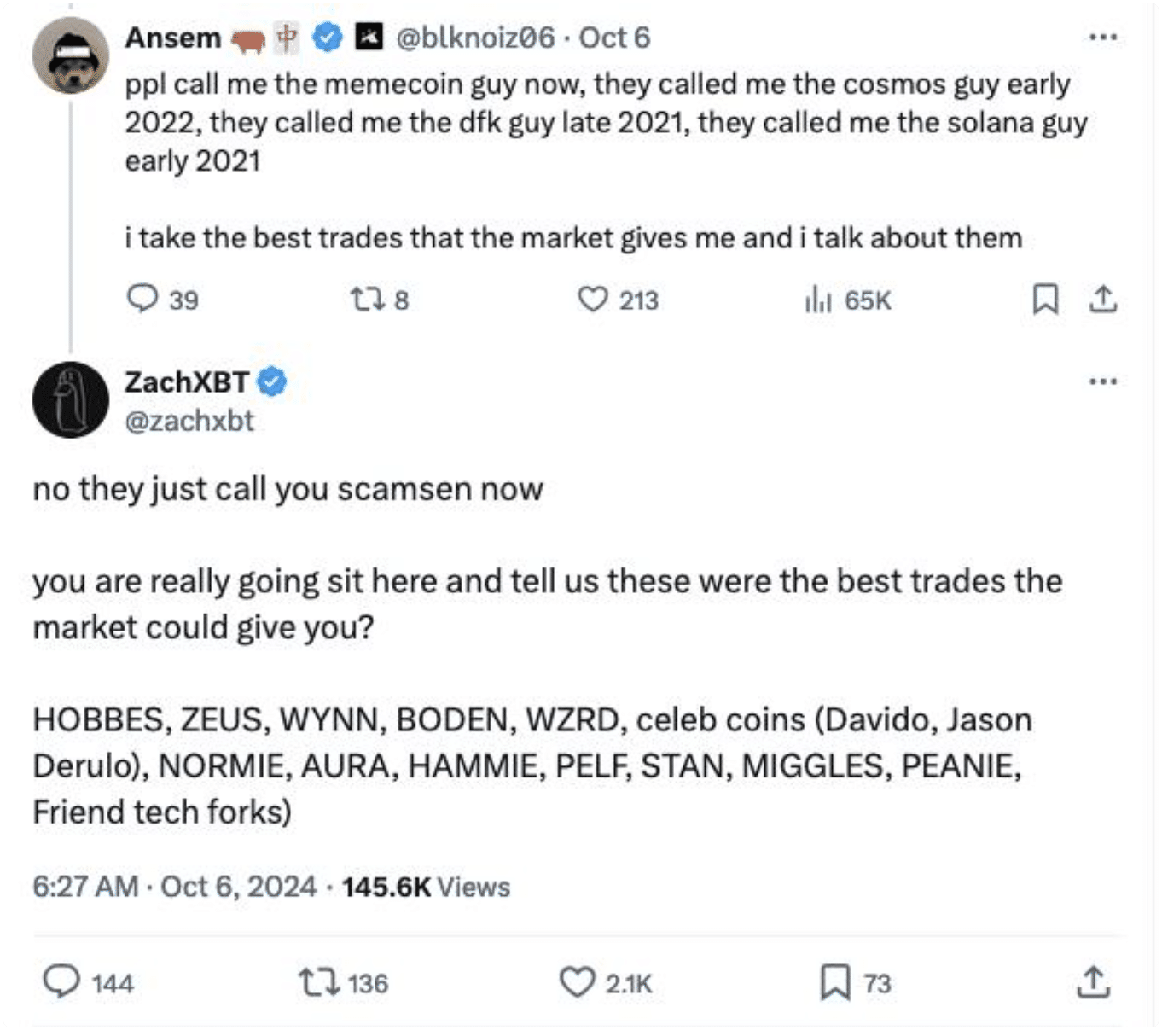

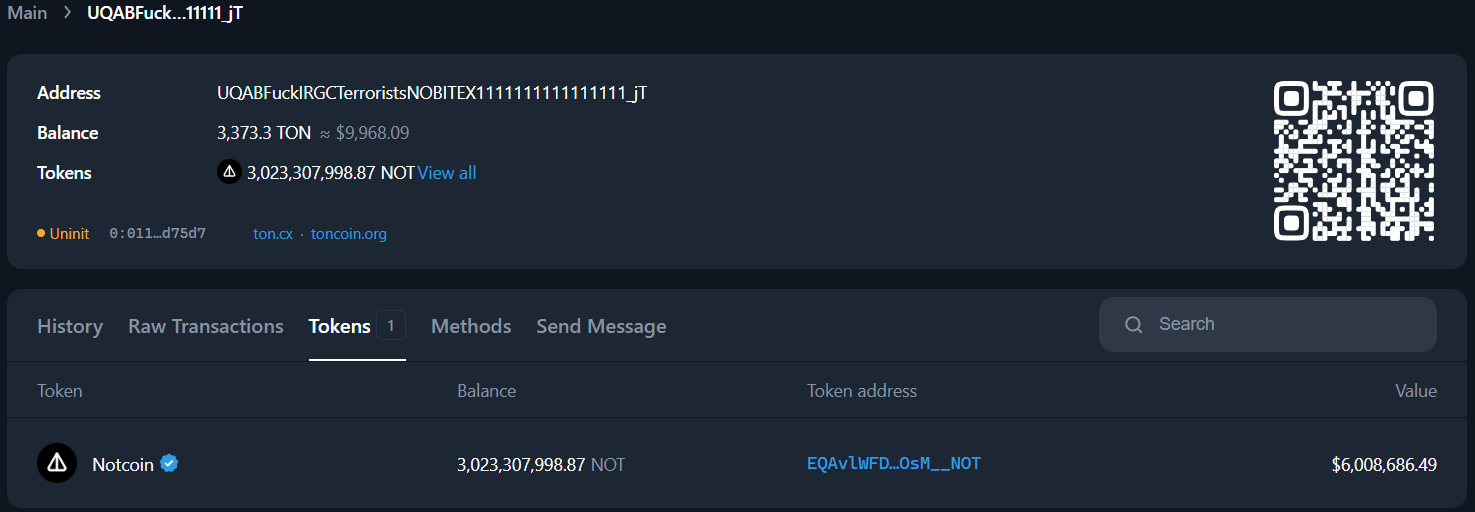

NEW IPO DROP: Bullish ( $BLSH ) just filed to go public on the NYSE

Price range: $28–$31

Expected date: 8/13/2025

Valuation: ~$4.3BBacked by Peter Thiel. Owns CoinDesk. $167M in revenue. A media + crypto play with institutional firepower behind it.

Robinhood’s applying… pic.twitter.com/UrobxA0Gd0

— EmanTheTrader (@miller_eman) August 4, 2025

The Second Time Might Be the Charm

This isn’t Bullish’s first attempt at going public. Back in 2021, it tried to go the SPAC route, aiming for a $9 billion valuation. That effort stalled after running into regulatory issues. This time, Bullish seems to be keeping its expectations in check and focusing on delivering a traditional IPO that aligns better with today’s market conditions.

DISCOVER: 20+ Next Crypto to Explode in 2025

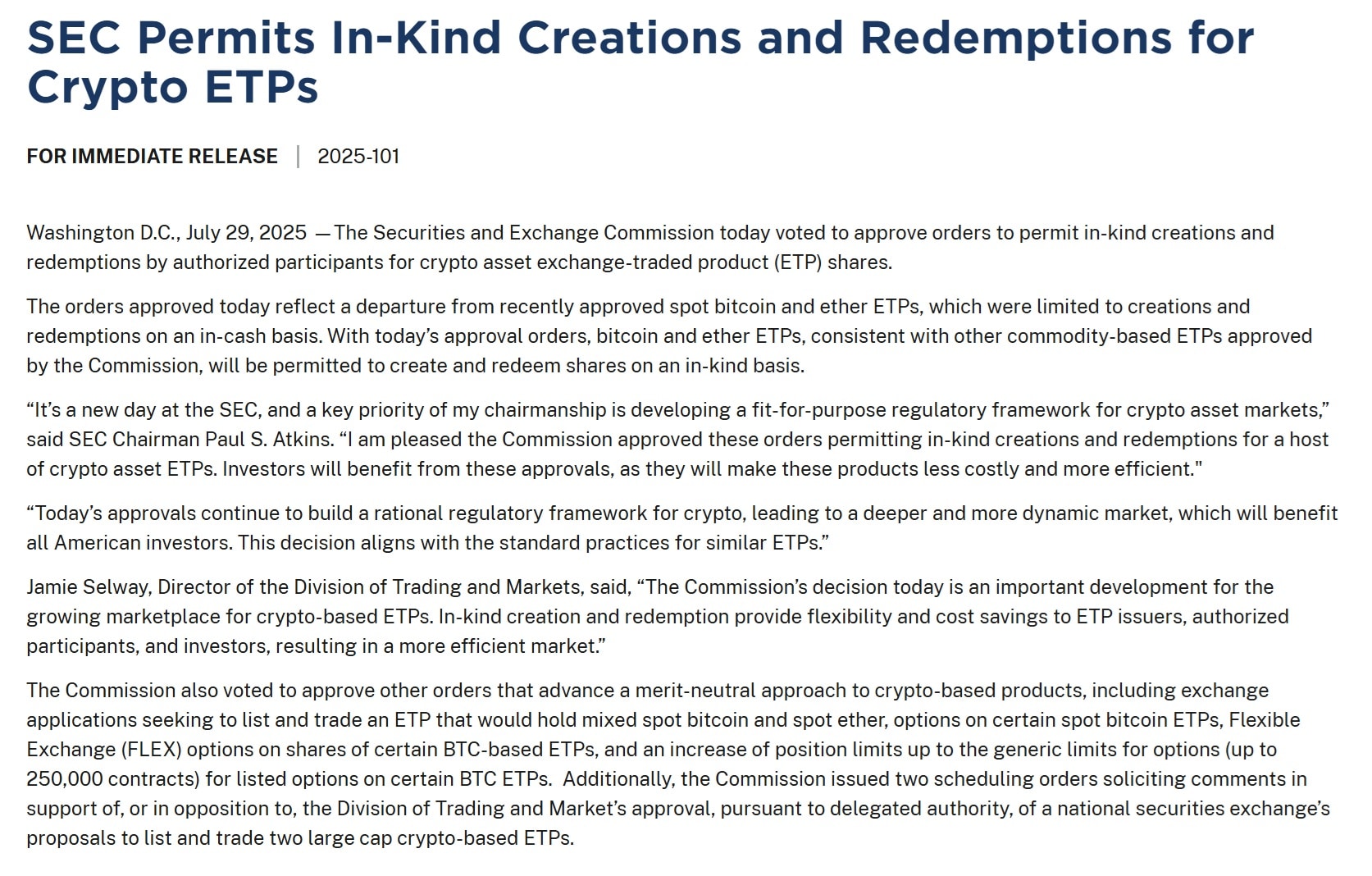

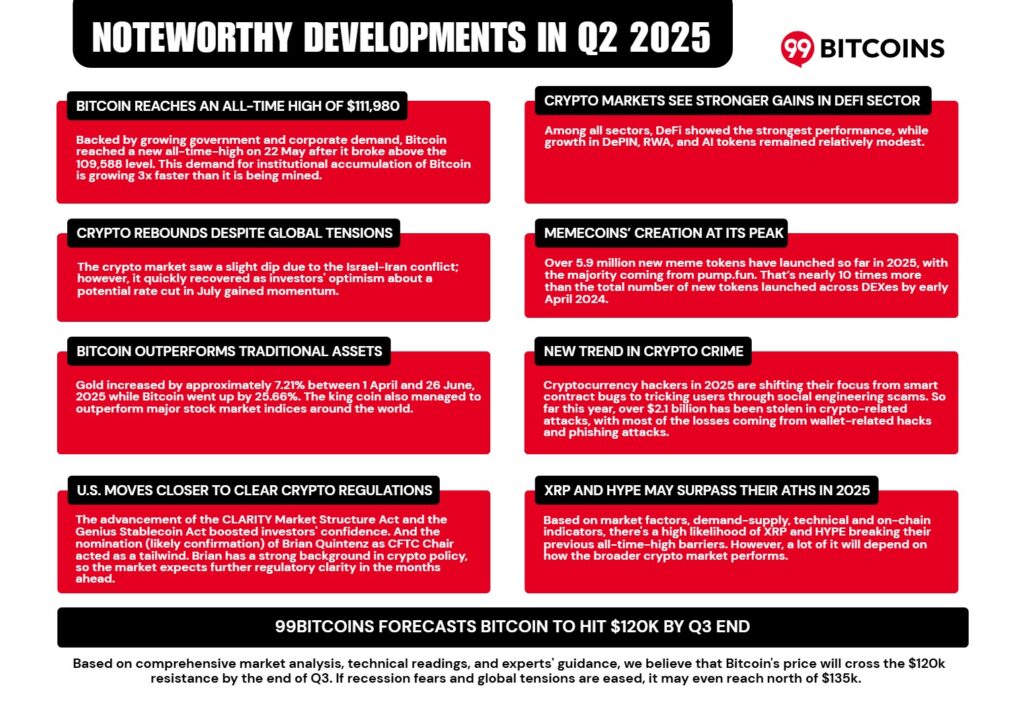

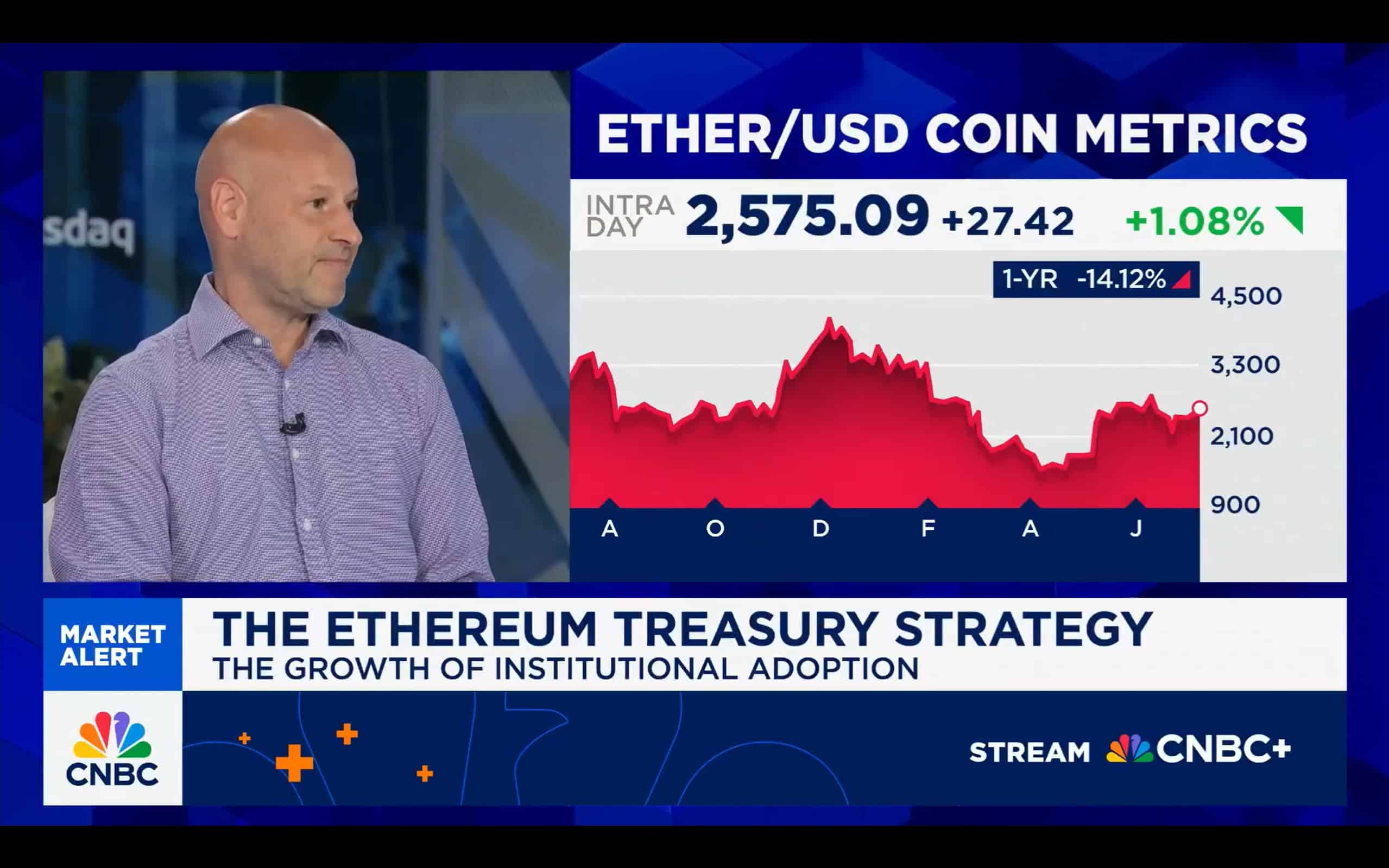

A Friendlier Climate for Crypto Firms

The timing of the IPO works in Bullish’s favor. Crypto regulation in the U.S. is finally starting to settle, especially after the GENIUS Act gave more definition to how digital asset companies can operate. Earlier this year, Circle successfully went public, setting a precedent for what a clean, compliant crypto IPO can look like. Bullish appears to be following that playbook.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Numbers That Give Investors Something to Work With

Bullish isn’t just selling hype. The company is projecting net income of up to $109 million for the second quarter of 2025. That’s on top of a solid year of trading activity in 2024, which helped the exchange generate real revenue. Unlike many crypto firms that rely on future promise, Bullish has something to point to right now.

Could This Reshape the Crypto IPO Scene?

This upsized IPO could open the door for more crypto companies to test the public markets. Gemini and BitGo are already rumored to be in the pipeline. If Bullish pulls this off cleanly, it could become the example others follow. It’s not just about raising money—it’s about proving that a crypto-native business can hold its own on Wall Street.

The Stakes Going Into the First Trading Day

All that’s left is to see how investors respond once the shares start trading. The company has the momentum, the backers, and a market that seems a bit more open to crypto than it was a couple of years ago. Whether it can maintain that excitement beyond the first few days is another question entirely.

Bullish is trying to do what few crypto companies have pulled off—go public with solid financials, institutional support, and timing that doesn’t feel wildly off. It may not be the most hyped name in the industry, but this move could quietly shape what comes next.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Bullish upsized its IPO to $990 million, pushing its valuation to nearly $5 billion

- Big names like BlackRock and ARK are reportedly backing the deal, adding institutional weight

- This is Bullish’s second attempt at going public, after a failed SPAC plan in 2021

- Improved U.S. crypto regulation and Circle’s IPO have created a more favorable environment

- Bullish projects strong earnings, making it one of the few crypto firms showing real profits

The post Bullish Crypto Exchange Upsizes IPO to Nearly $5 Billion Valuation appeared first on 99Bitcoins.