Bengaluru-headquartered digital assets prime brokerage firm, FalconX, has entered into a partnership with Standard Chartered. This strategic alliance is FalconX’s first collaboration with a global traditional bank, noted a Reuters report on 14 May 2025. Does this signal a growing institutional demand for digital assets through traditional finance channels?

Big News for Crypto!

FalconX

Standard Chartered to power institutional crypto investments!

A major step toward mass adoption.

Stay tuned — the institutions are coming!pic.twitter.com/UAG0nfeifG

— AltCoiners.live (@alt_coiners) May 14, 2025

“Our collaboration with FalconX underscores our commitment to advancing the digital asset ecosystem,” said Luke Boland, Head of Fintech, ASEAN, South Asia and GCNA at Standard Chartered.

The partners will expand beyond traditional banking, and include products and services for asset managers, hedge funds, token issuers, and payment platforms.

Addressing the growing institutional demand for digital assets, Boland said, “As institutional demand for digital assets continues to grow, we’re proud to provide the banking infrastructure that enables firms like FalconX to deliver world-class trading and financing solutions to institutional clients.”

Meanwhile, Matt Long, General Manager, APAC and Middle East at FalconX, commented, “We are pleased to partner with Standard Chartered, one of the most forward-thinking global banks in digital asset adoption. At FalconX, we support trading and financing for some of the world’s largest institutions in digital asset markets, and this relationship strengthens our ability to deliver robust banking and FX solutions to clients who rely on us to operate in crypto markets,” he added.

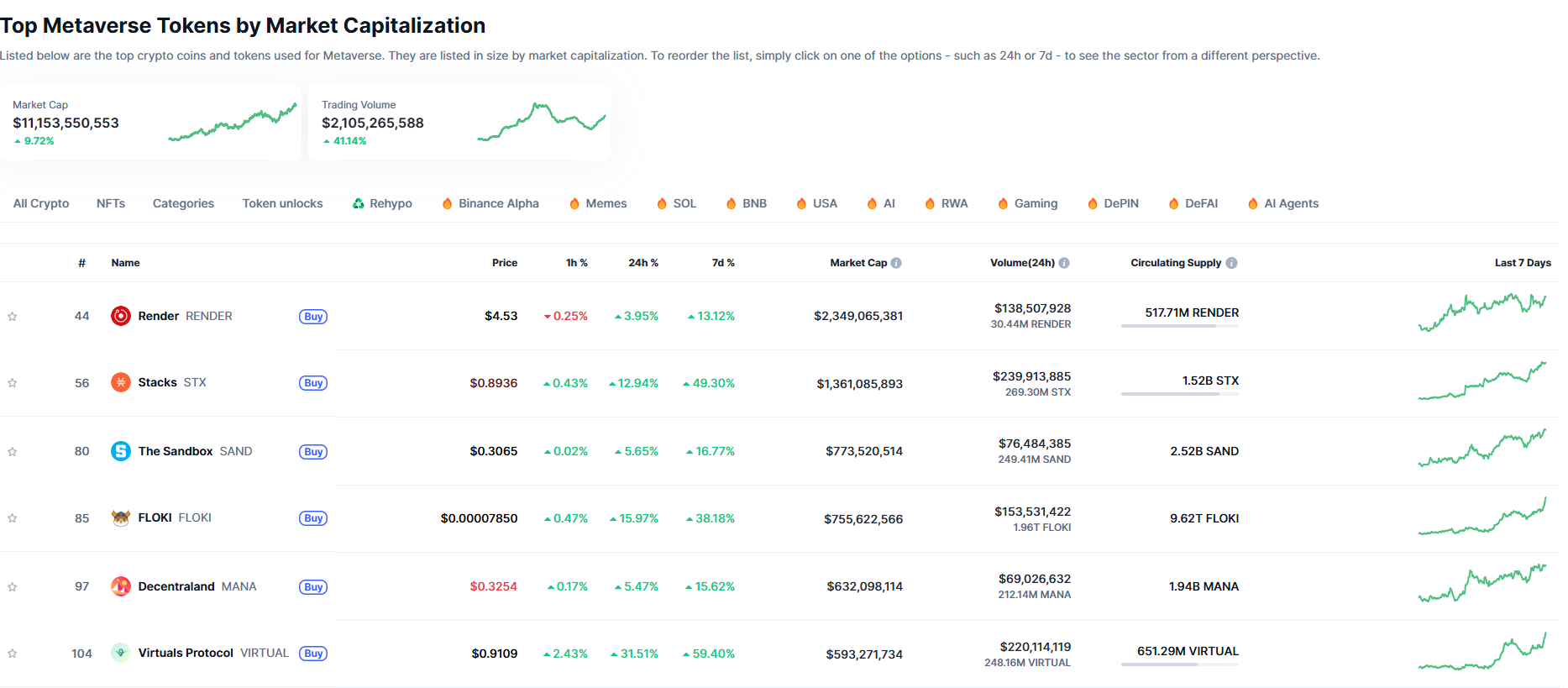

EXPLORE: 10 Coins with High Returns: Crypto Forecast 2025

Partnerships Established By Standard Chartered

The bank launched a spot trading desk for Bitcoin (BTC) and Ethereum (ETH) in June last year.

In August 2024, Crypto.com revealed its partnership with Standard Chartered, where the bank is designated to provide Crypto.com with tailored banking and payment solutions.

Standard Chartered backed Zodia Custody announced a strategic partnership with Maple Finance, a prominent crypto lending platform. The British multinational bank’s crypto subsidiary is also in the process of acquiring part of a digital-asset business backed by billionaire hedge fund manager Alan Howard.

Most recently, Standard Chartered, announced the launch of a new entity in Luxembourg to provide crypto custody services on 9 January 2025.

Explore: Bitcoin vs. Tesla: Standard Chartered Picks BTC as TSLA Crashes

Targeting Institutional Clients: Circle, BitGo, Coinbase, Paxos Go For US Banking Licenses

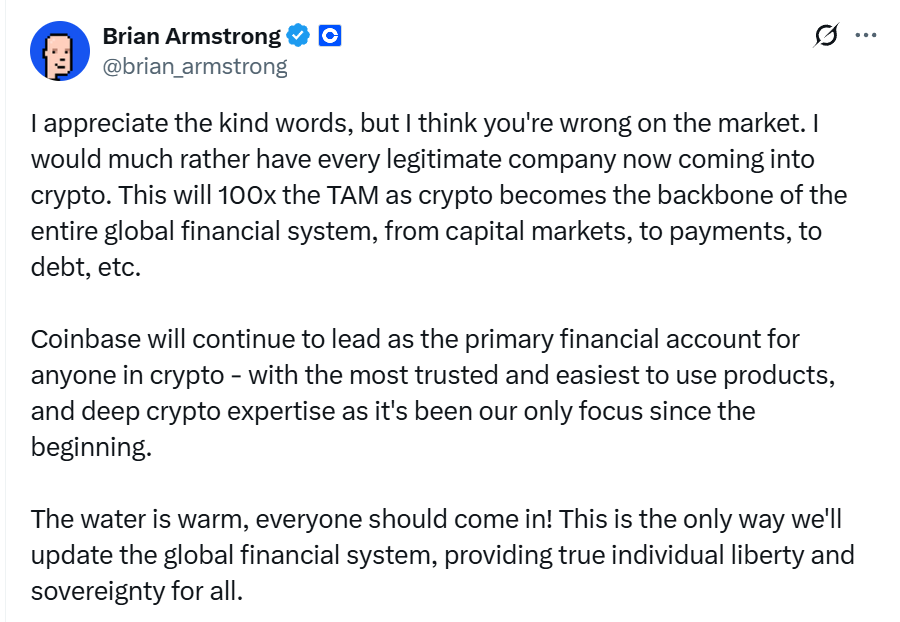

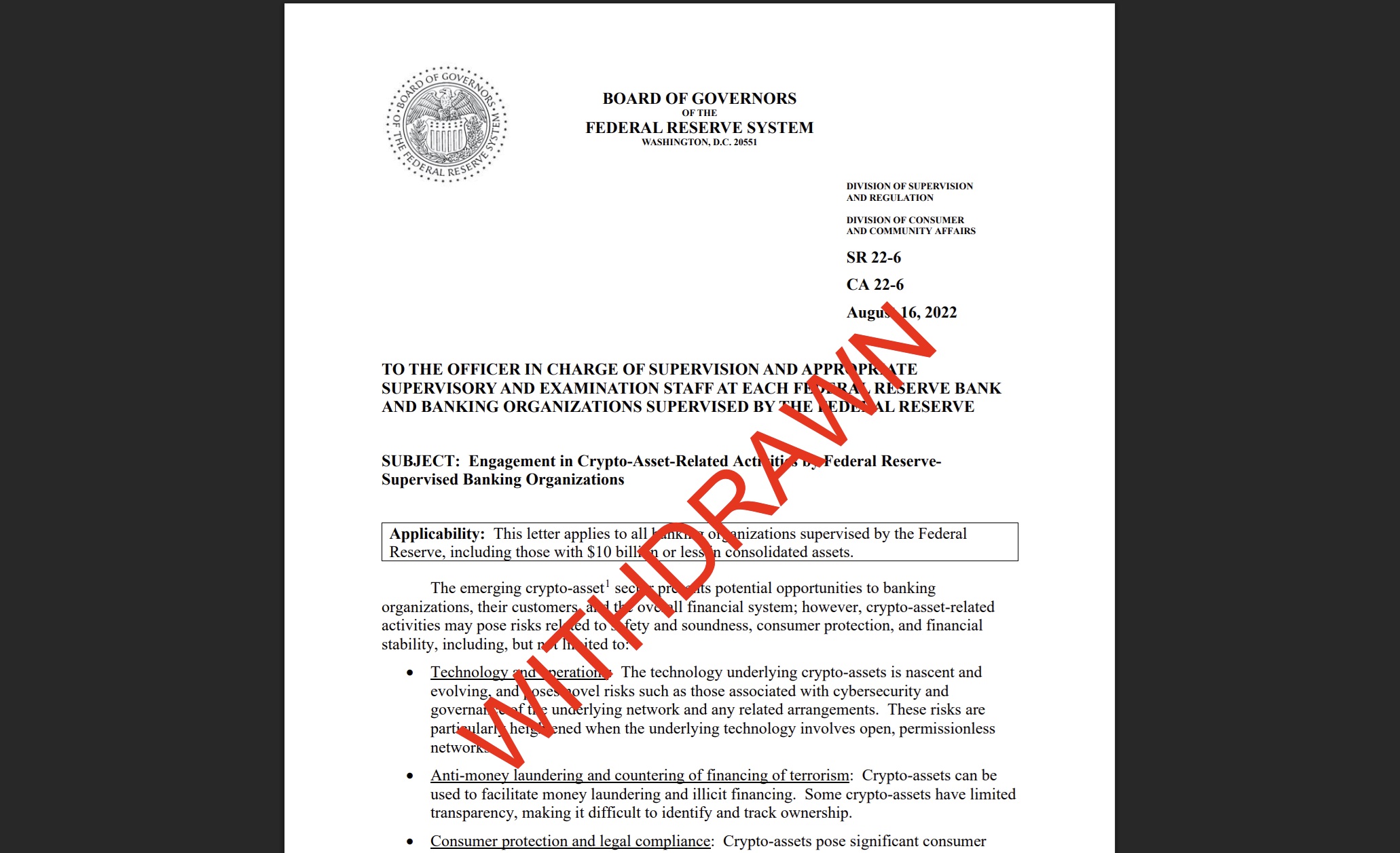

After the US President Donald Trump eased crypto regulations and restrictions, major crypto companies like Circle, BitGo, Coinbase and Paxos are filing their applications for US banking licenses.

According to the Wall Street Journal report, these crypto companies are ready to capitalise on the current US government’s pro-crypto stance.

The companies are currently pursuing various types of banking licenses. It mostly depends on their specific business models. Some are seeking national trust or industrial bank charters, which would allow them to operate with capabilities similar to traditional banking institutions. Others are focusing on more specialized licenses that would primarily enable stablecoin issuance and custody services.

“This represents a natural evolution for the crypto industry,” explains cryptocurrency analyst Sarah Johnson. “As these platforms mature and seek to serve a broader customer base, banking licenses provide the regulatory framework and customer protections needed to operate at scale within the existing financial ecosystem.”

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Key Takeaways

-

The partnership is expected to expand beyond banking into additional products and services tailored to the evolving needs of FalconX’s and Standard Chartered’s institutional clients.

-

In the first phase of the partnership, Standard Chartered will provide a comprehensive suite of banking services to FalconX globally.

The post FalconX and Standard Chartered Partner to Advance Digital Asset Ecosystem for Institutional Clients appeared first on 99Bitcoins.