Tokyo-listed investment firm Metaplanet has officially surpassed El Salvador in bitcoin holdings after its biggest-ever single purchase of the scarce digital asset.

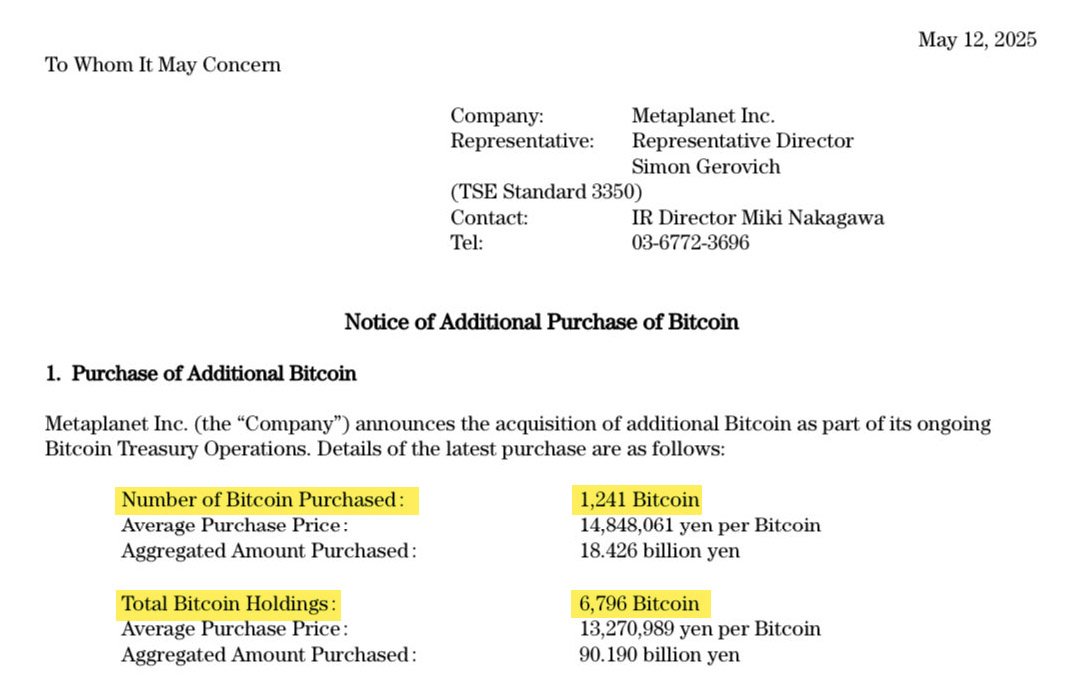

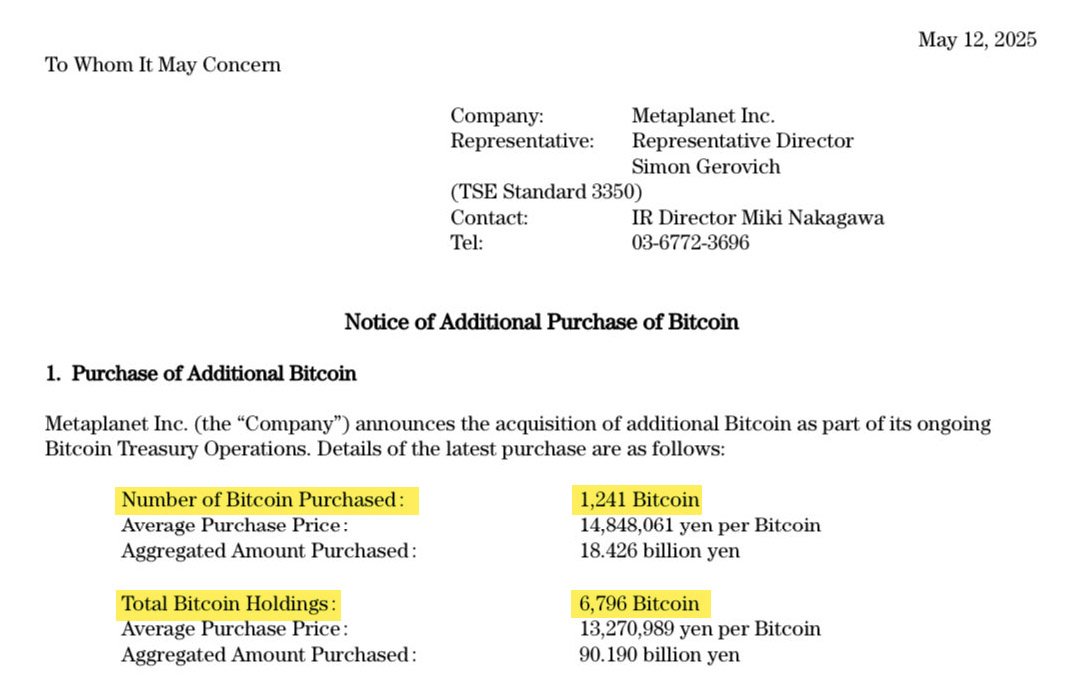

On May 12, 2025, the company announced it had bought 1,241 Bitcoin (BTC) for approximately $123.8 million, or ¥18.4 billion. The average price per coin was about $102,111, marking the firm’s largest purchase to date.

This latest buy brings Metaplanet’s total bitcoin reserves to 6,796 BTC, worth over $700 million.

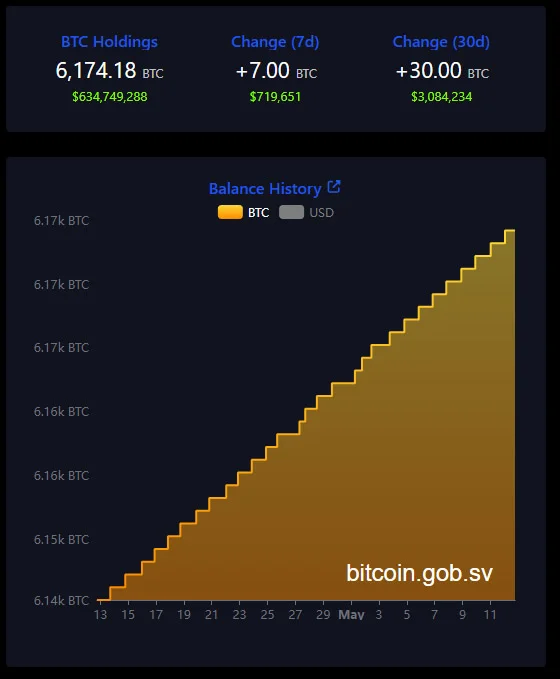

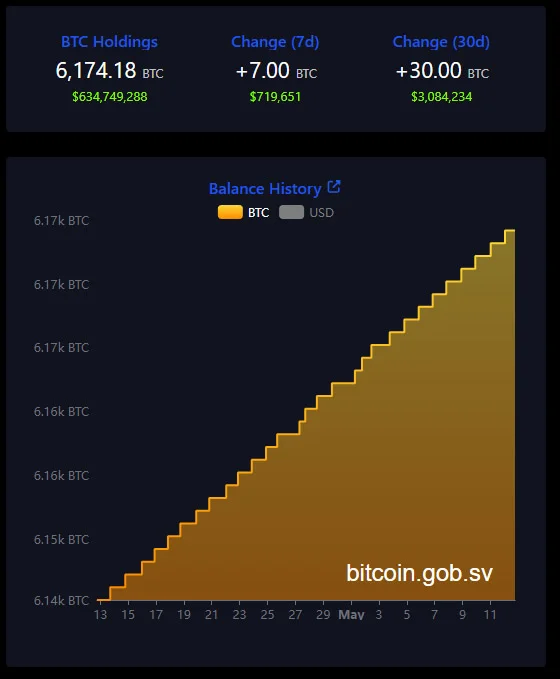

That puts Metaplanet ahead of El Salvador, the Central American nation that made headlines in 2021 for adopting bitcoin as legal tender. According to its National Bitcoin Office, El Salvador currently holds 6,174 BTC, worth roughly $642 million.

“Metaplanet now holds more bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re just getting started,” said CEO Simon Gerovich on X after the company’s announcement.

The Japanese investment company started its bitcoin treasury strategy in April 2024 and has become the largest corporate holder of bitcoin in Asia and 11th globally. It aims to hold 10,000 BTC by the end of 2025.

To fund these purchases, the firm has turned to bond issuances, including zero-percent bonds. In early May, Metaplanet issued $25 million worth of 0% bonds under its EVO FUND program to finance bitcoin buys without diluting shares or taking on traditional debt.

And Metaplanet’s strategy seems to be working. Its BTC Yield — a proprietary metric that measures bitcoin accumulation per share — is 38% for Q2 2025 so far. In previous quarters, the firm reported 95.6% in Q1 and a whopping 309.8% in Q4 2024.

The stock price has also gone up 1,800% since May 2024 and 51% in 2025 alone, currently trading above 550 JPY.

Metaplanet is often called “Japan’s MicroStrategy”, a reference to the U.S.-based company Strategy (formerly MicroStrategy) led by Bitcoin advocate Michael Saylor. Strategy is the world’s largest corporate bitcoin holder with over 568,840 BTC in its coffers, worth more than $58 billion.

Like Strategy, Metaplanet is using creative financing tools such as convertible bonds and non-dilutive bond issuance to build a big bitcoin treasury. These financial instruments give the company the ability to fund further bitcoin purchases without diluting shareholders’ value.

Metaplanet is buying bitcoin very rapidly. This has become a trend in the corporate world, where private companies are challenging nation-states in the digital asset space.

Unlike governments which face regulatory and political hurdles, corporations like Metaplanet can move quickly and decisively. Since 2020 over 80 publicly traded companies have collectively bought more than 632,000 BTC worth over $65 billion.

This is a fundamental shift in how companies manage their treasuries — moving away from cash or bonds and towards the digital scarcity that bitcoin presents.

This creates a new form of financial power where corporations can hold a significant portion of a finite asset, unlike fiat currencies which governments can print to infinity.