Ondo Finance and LayerZero have launched a bridge enabling cross-chain transfers of tokenized stocks and exchange-traded funds across Ethereum and BNB Chain.

Summary

- Ondo Finance and LayerZero launched a bridge for cross-chain transfers of tokenized stocks and ETFs.

- The bridge supports over 100 assets across Ethereum and BNB Chain at launch.

- Ondo plans to expand the bridge to additional EVM networks.

Ondo Finance has introduced a new cross-chain tool aimed at expanding how tokenized securities move across blockchain networks.

The launch was announced on Dec. 17 in a statement from Ondo confirming a collaboration with interoperability provider LayerZero.

Cross-chain transfers for tokenized stocks and ETFs

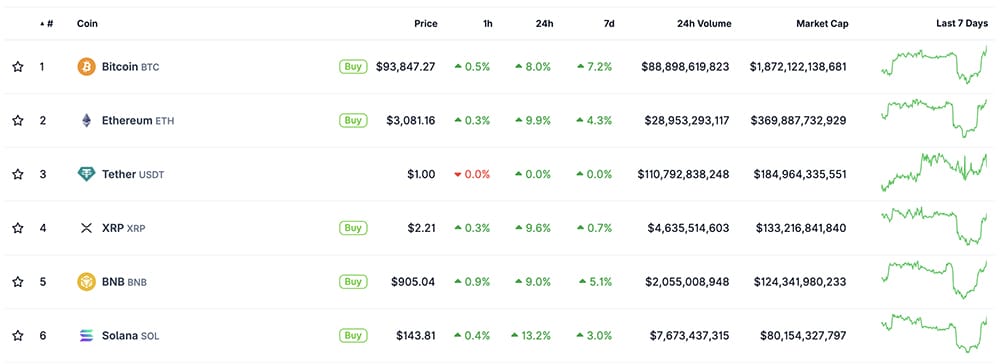

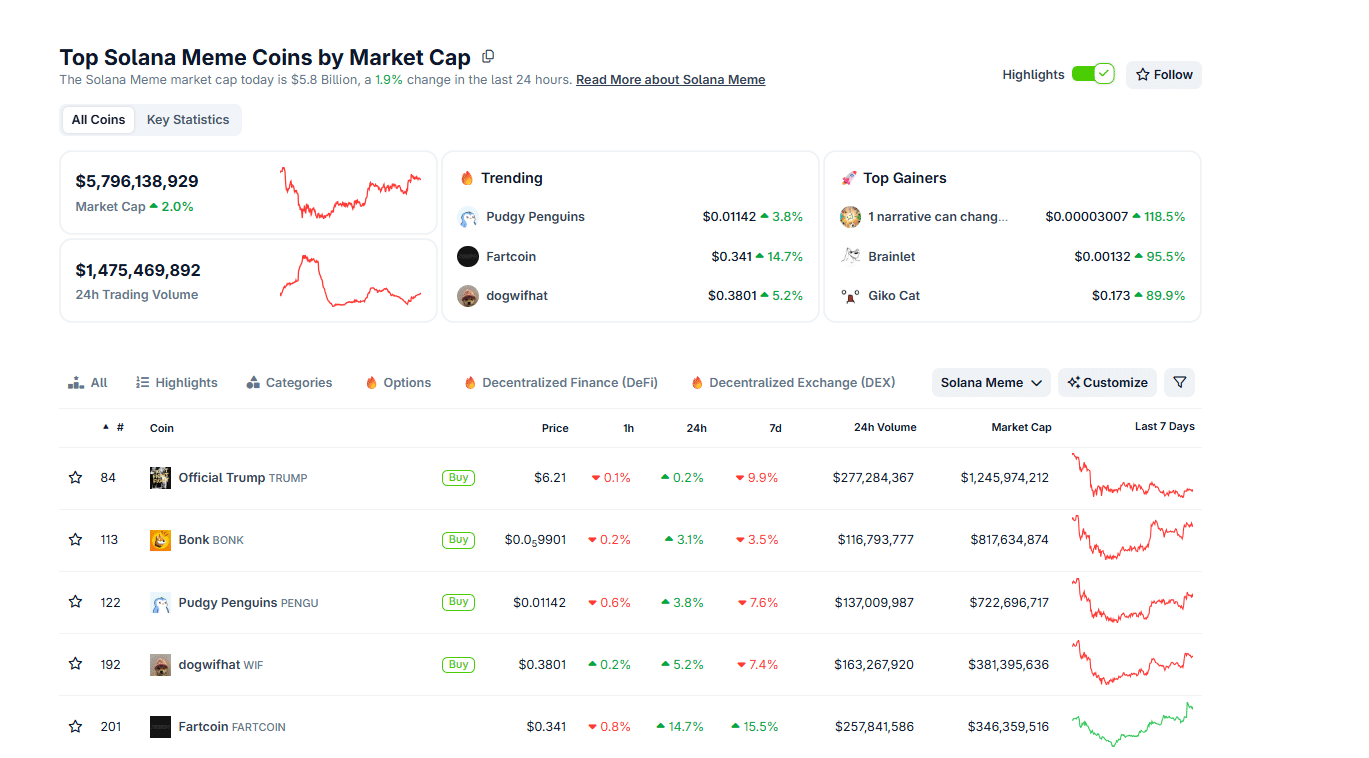

The new Ondo Bridge allows users to transfer more than 100 tokenized stocks and exchange-traded funds between Ethereum and BNB Chain. Additional EVM-compatible networks are expected to be added over time.

The bridge connects Ondo Global Markets assets across chains with one-to-one parity, meaning tokens remain fully backed as they move between networks. Ondo said the system replaces its earlier setup, which relied on separate bridge contracts for each asset and chain.

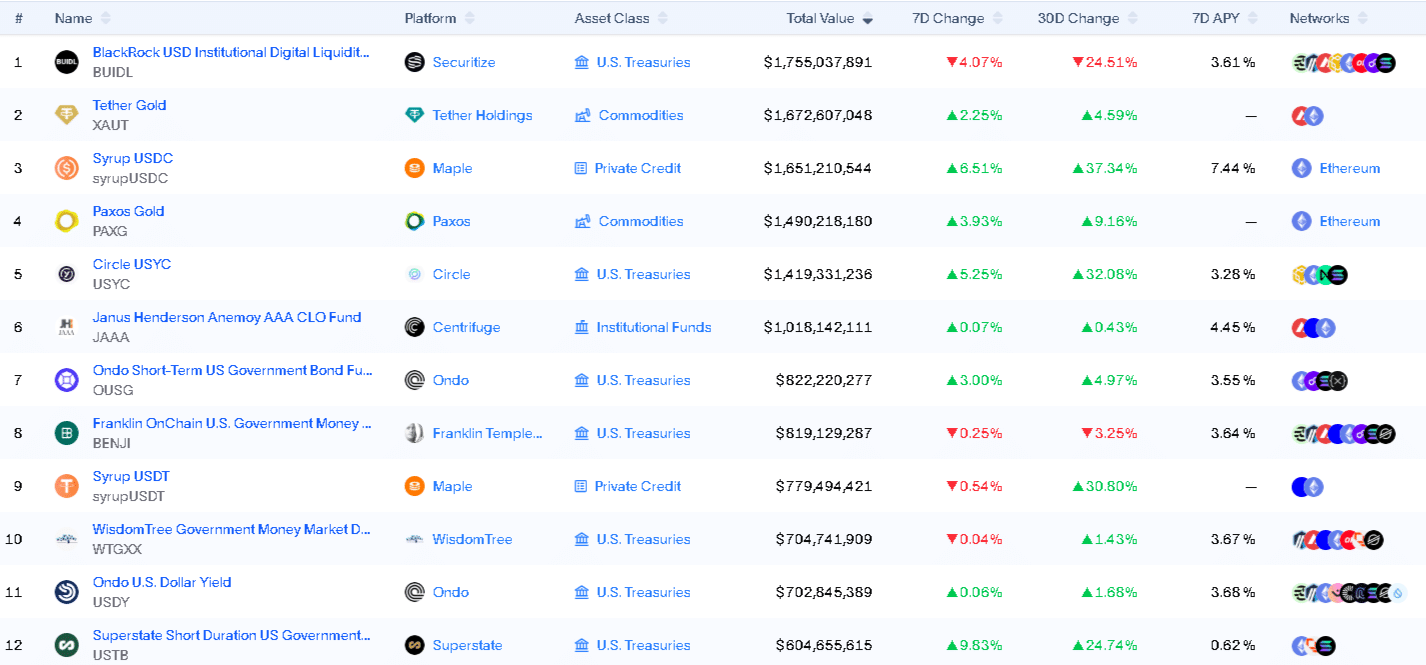

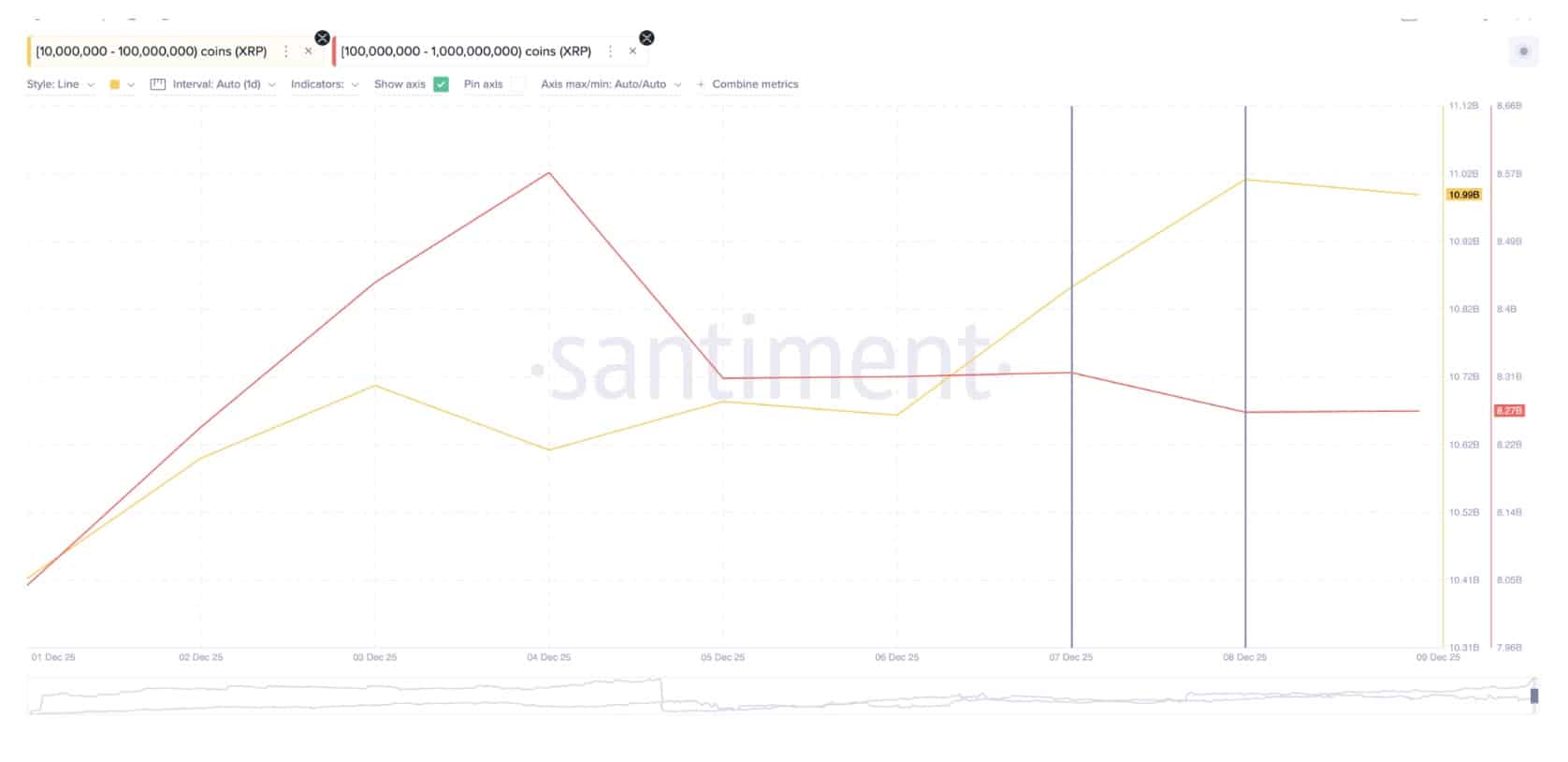

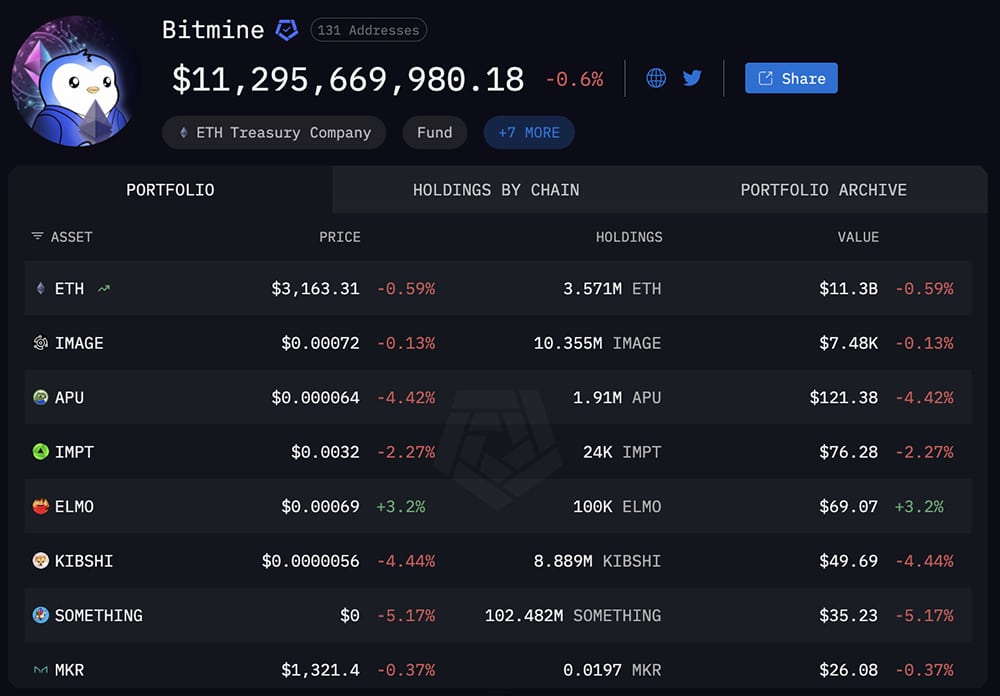

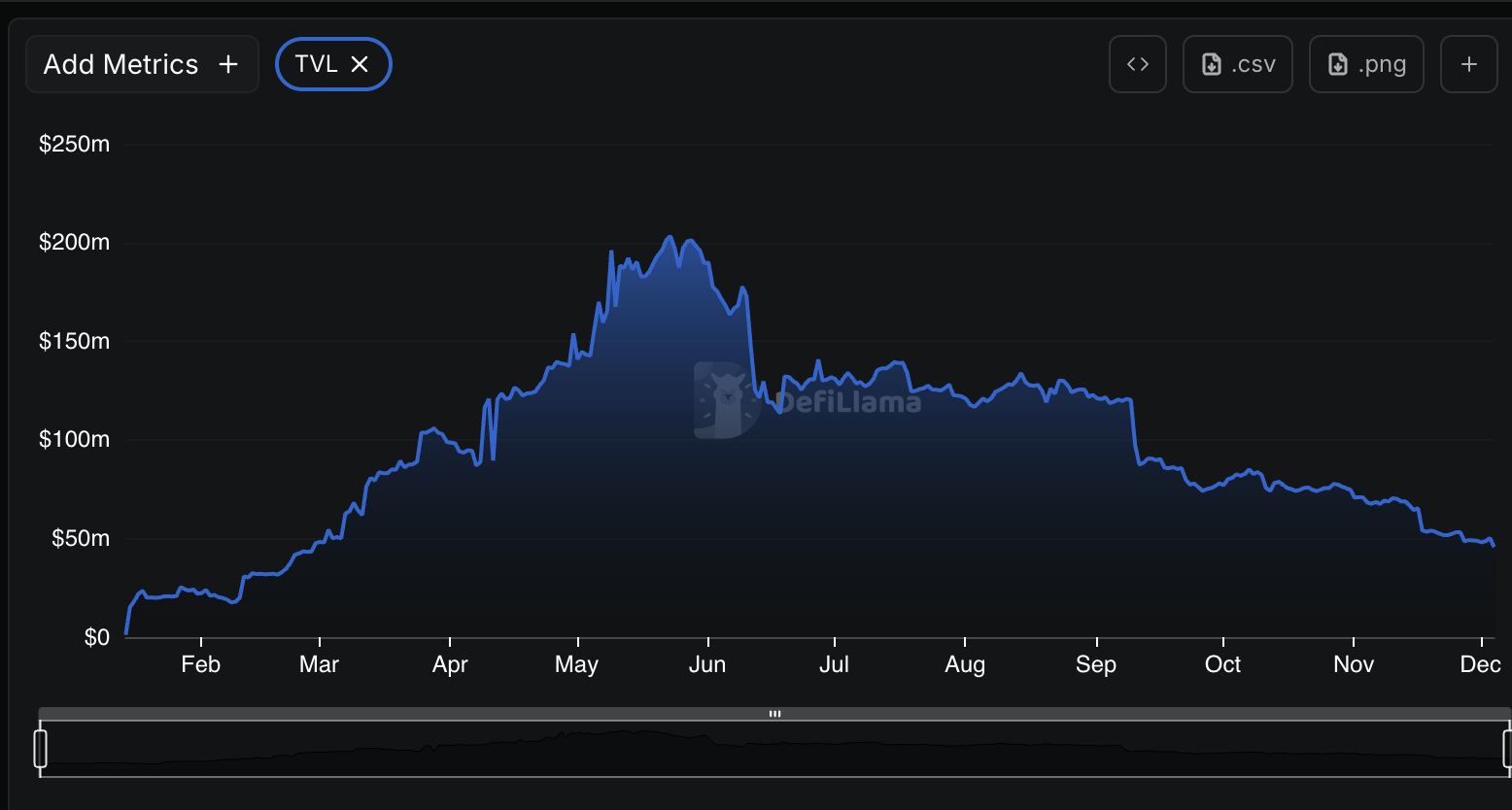

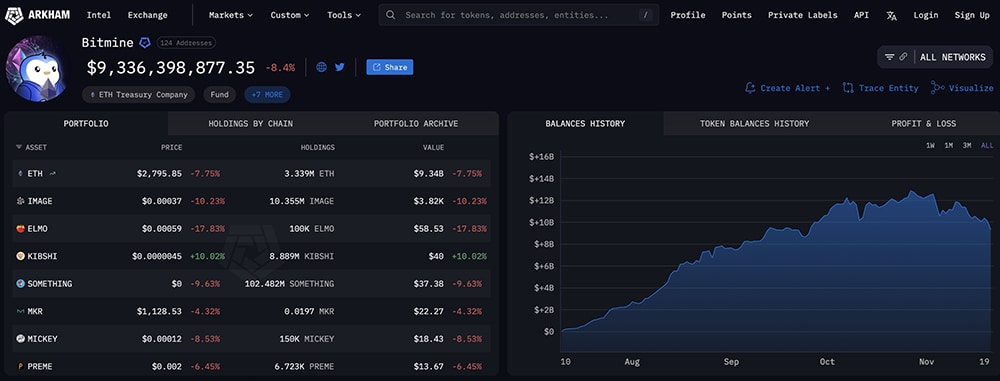

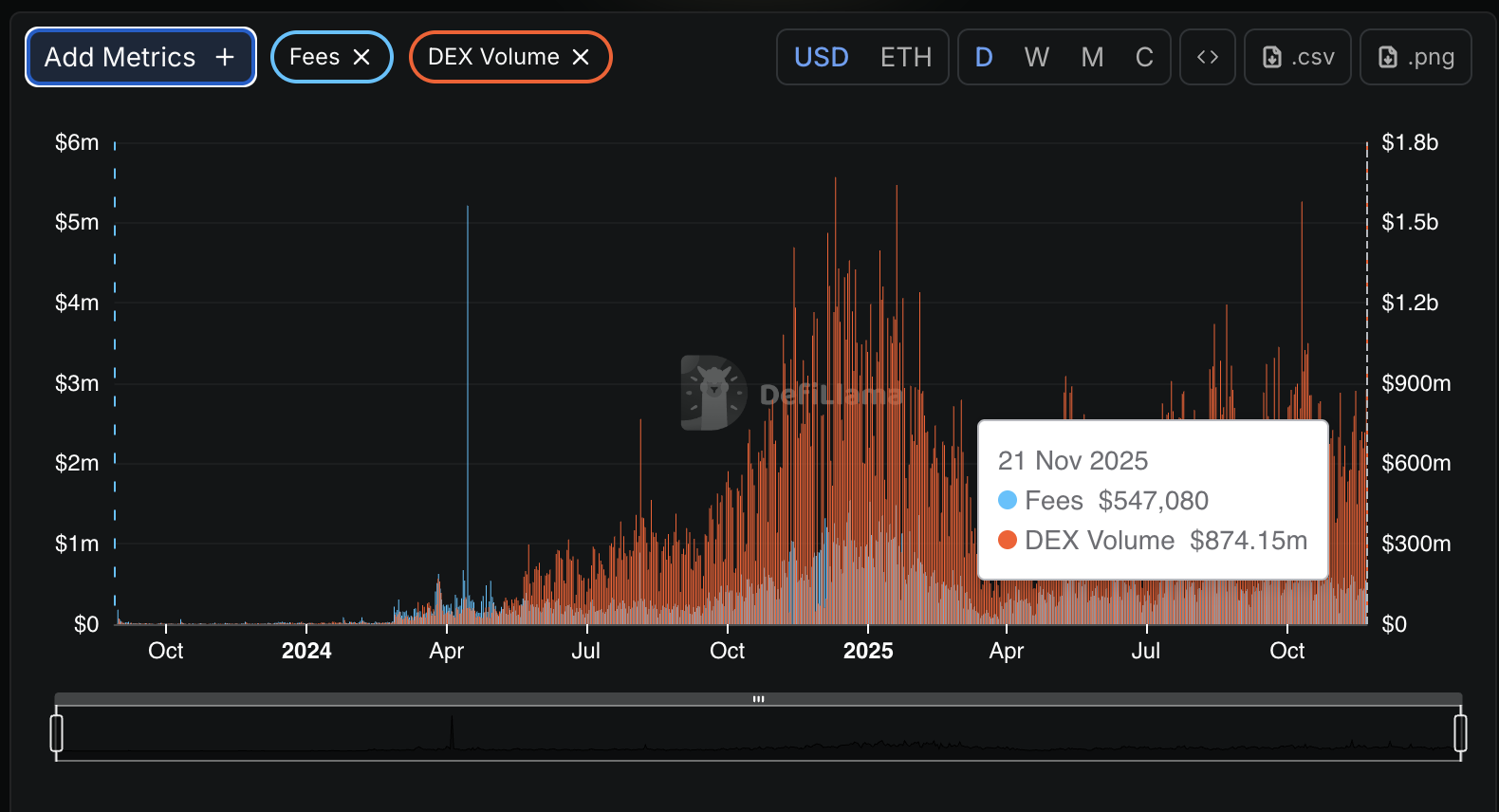

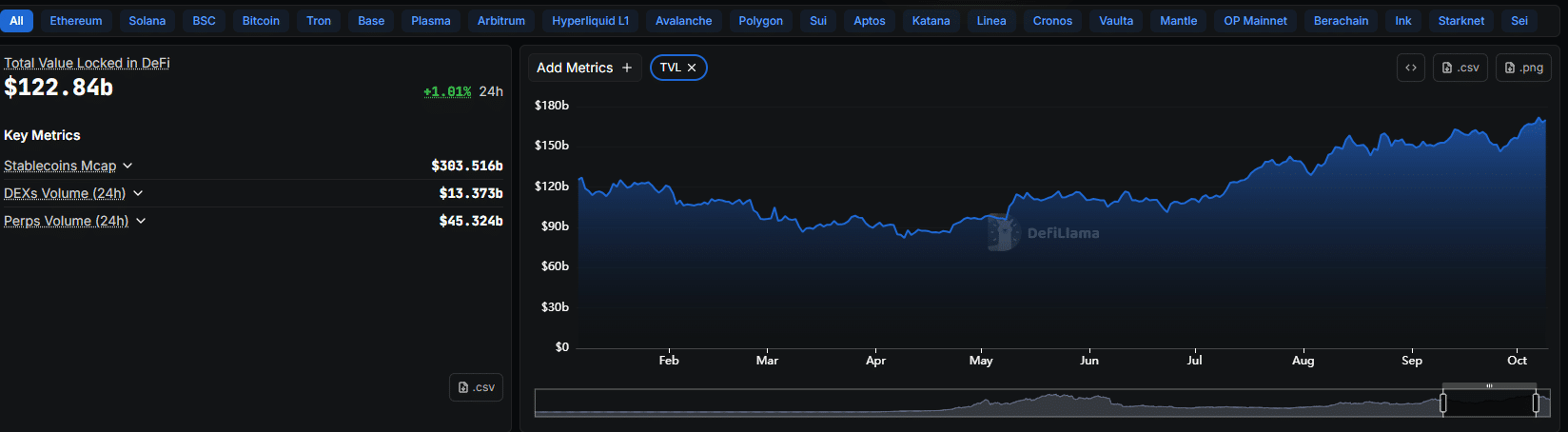

Ondo Global Markets launched on Ethereum in September and expanded to BNB Chain in October. Since then, the platform has grown to more than $350 million in total value locked and over $2 billion in cumulative trading volume, according to the company.

Built on LayerZero infrastructure

The bridge uses LayerZero’s messaging framework, allowing Ondo to manage cross-chain transfers through a single architecture rather than asset-specific bridges. Ondo said this setup makes it easier to deploy its tokenized securities to new chains, with integrations measured in weeks rather than months.

Because the bridge relies on LayerZero, applications already connected to that network can add Ondo assets with limited additional work. LayerZero said more than 2,600 apps currently support its standard across Ethereum and BNB Chain. Stargate has already added Ondo assets following the launch.

Ondo described the bridge as the largest live bridge dedicated to tokenized securities, based on the number of supported assets available at launch. The company has continued to expand its tokenized finance offerings in recent months, including a private tokenized money market fund announced with State Street and Galaxy Digital on Dec. 10.

Earlier this month, the U.S. Securities and Exchange Commission closed its investigation into Ondo Finance, removing a regulatory overhang as the company pushes further into compliant on-chain securities.