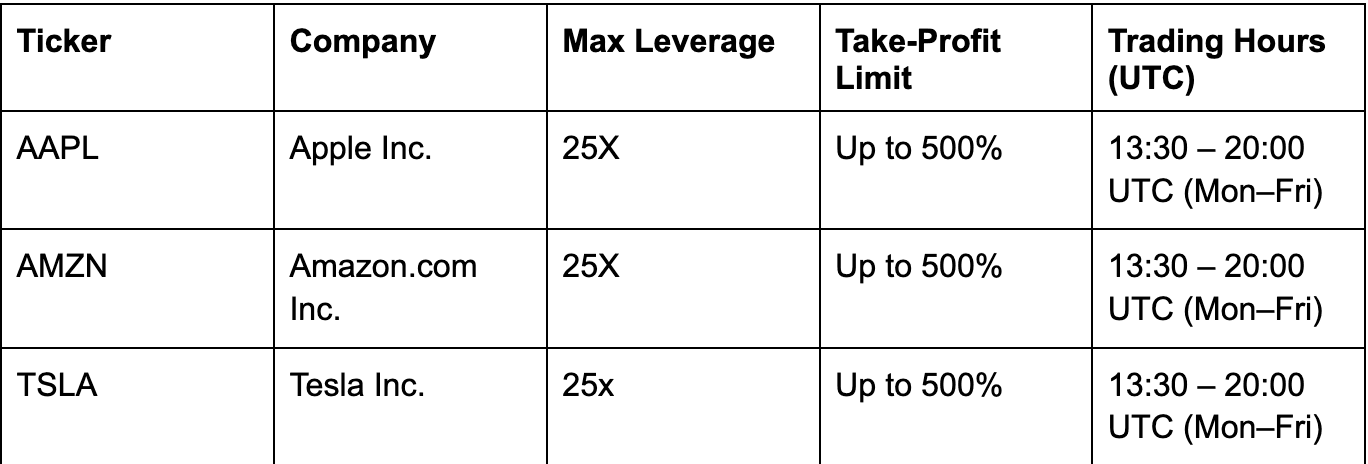

PancakeSwap will enable traders to bet on the price of Apple, Amazon, and Tesla, with up to 25x leverage.

Summary

- PancakeSwap launches stock perpetual contracts with up to 20x leverage

- Apple, Amazon, and Tesla will be available on the platform

- Trades will work on the chain, directly from users’ crypto wallets

Crypto platforms are increasingly offering stock trading. On Wednesday, August 6, PancakeSwap (CAKE) will start offering stock perpetuals on several stocks. Namely, traders will be able to bet on the price of Apple, Amazon, and Tesla.

PancakeSwap perpetuals are non-expiring derivatives that allow users to speculate on price movements without owning the underlying stocks. These contracts support up to 25x leverage, and all trades will be executed directly from users’ crypto wallets. However, trading will be limited to stock market hours.

Traders can go long or short on these stocks, potentially earning outsized returns. However, derivatives carry significant risk. A move in the wrong direction can lead to total capital loss. Short positions, in particular, carry the risk of losses exceeding the initial investment.

Tokenized stocks help open up access to markets

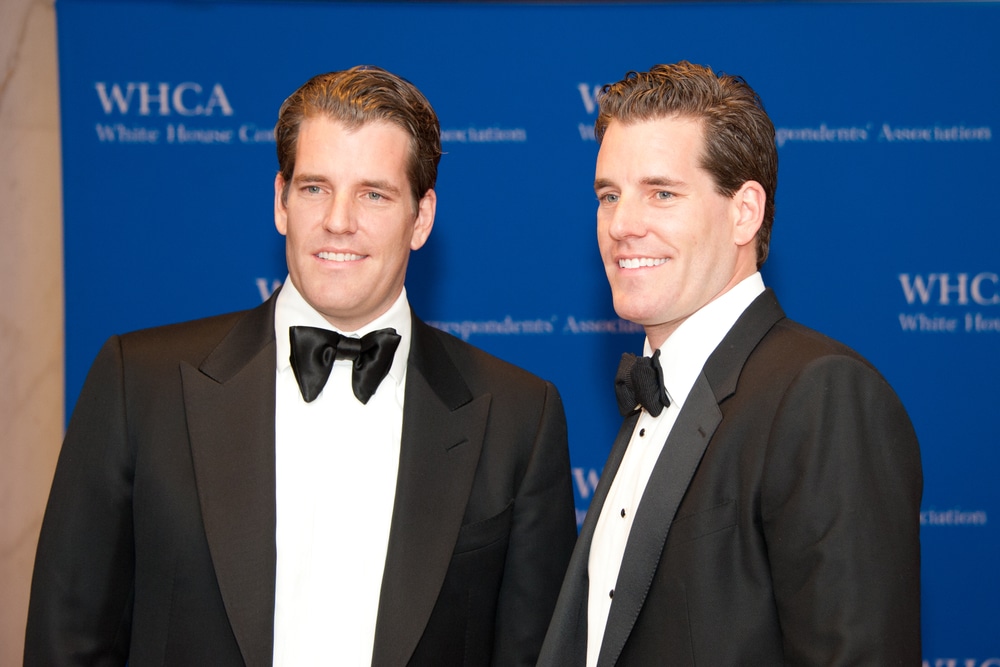

PancakeSwap is not the first crypto platform to offer stock perpetual contracts. For instance, Strike launched stock perpetuals on Cardano in May, while xStocks offers similar contracts. Moreover, in July, Gemini expanded its tokenized stock offering with 14 new stocks in the EU.

Tokenized stocks and perpetual contracts offer several advantages over traditional markets. They expand access, allowing users outside the U.S. to participate in the stock market.

Additionally, tokenized stocks highlight a growing convergence between decentralized finance and traditional finance. Traders can participate without opening brokerage accounts or completing complex KYC procedures.