A long-awaited decision in Washington is now set to reshape leadership at the U.S. derivatives regulator.

Summary

- The U.S. Senate has confirmed Michael Selig as the 15th CFTC chairman.

- Selig brings prior experience from both the CFTC and the SEC’s Crypto Task Force.

- His leadership comes as Congress debates expanding the CFTC’s role in crypto markets.

A leadership change at a key U.S. market regulator is now set.

Michael Selig was confirmed by the U.S. Senate on Dec. 18 and will soon be sworn in as the 15th chairman of the Commodity Futures Trading Commission, ending nearly a year of interim leadership at the agency.

A familiar figure returns as CFTC chairman

Selig is no stranger to the regulator he will now lead. He began his career at the CFTC in 2014 as a law clerk to then-Commissioner Christopher Giancarlo, who later became chairman. After leaving the agency, Selig spent several years in private practice, advising trading firms, exchanges, and digital asset companies on compliance with U.S. securities and commodities laws.

He returned to government earlier this year as chief counsel to the Securities and Exchange Commission’s Crypto Task Force, where he served as a senior advisor to Chairman Paul Atkins. That role placed him at the center of inter-agency discussions on how digital asset markets should be supervised.

Selig will take over from Caroline Pham, who has served as acting chair for much of 2025 and, for several months, was the CFTC’s only Senate-confirmed commissioner.

Enforcement priorities and crypto policy ahead

During his confirmation hearing, Selig made clear that he favors a lighter regulatory touch where possible. He argued that enforcement actions focused on minor technical issues can drain resources and push legitimate businesses offshore, without improving market integrity.

At the same time, he said the CFTC must remain active against fraud, manipulation, and abuse. In his words, the agency should still act as “a cop on the beat,” with enforcement aimed at conduct that causes real harm.

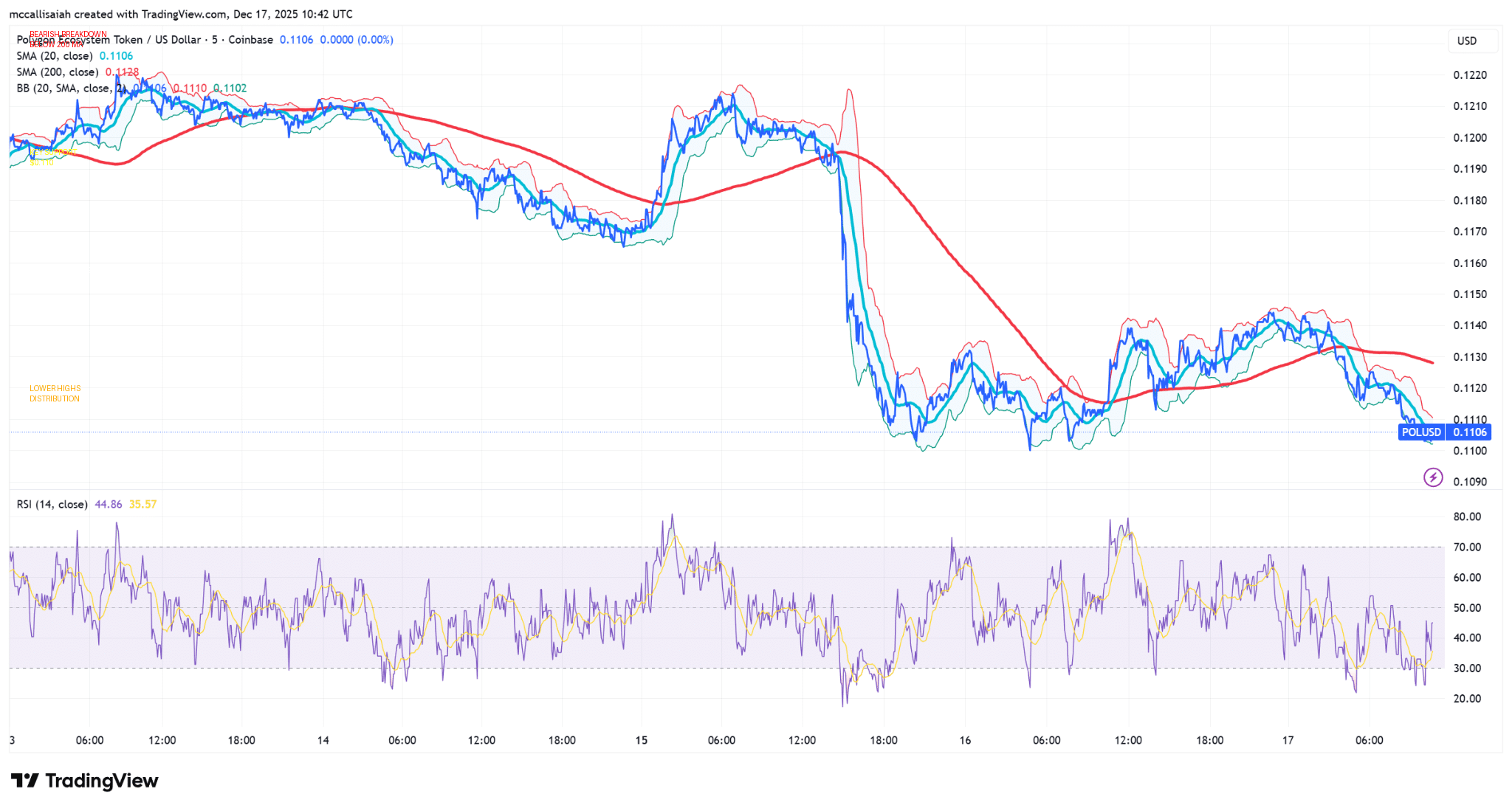

That approach closely tracks the direction set under Pham. Over the past year, the CFTC narrowed its enforcement focus, reduced emphasis on paperwork violations, and shifted resources toward complex fraud and retail harm. The agency also updated its investigation rules to give firms more transparency and time during enforcement proceedings.

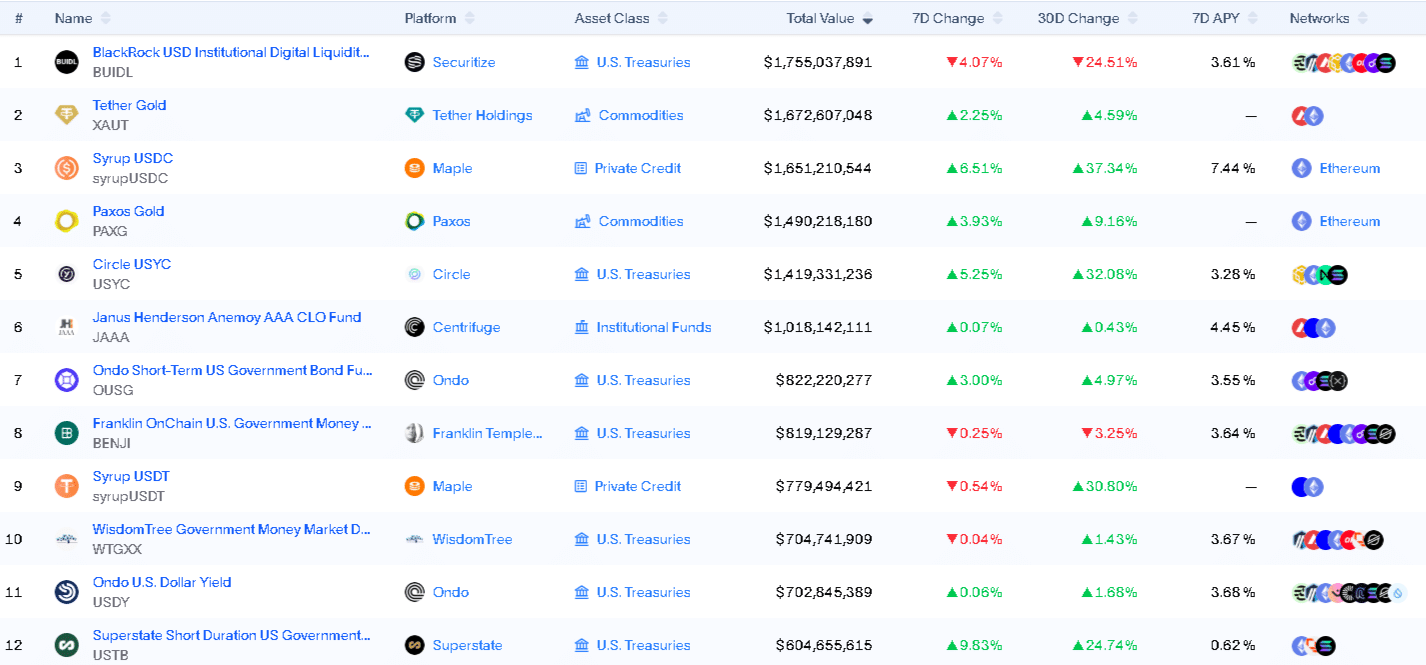

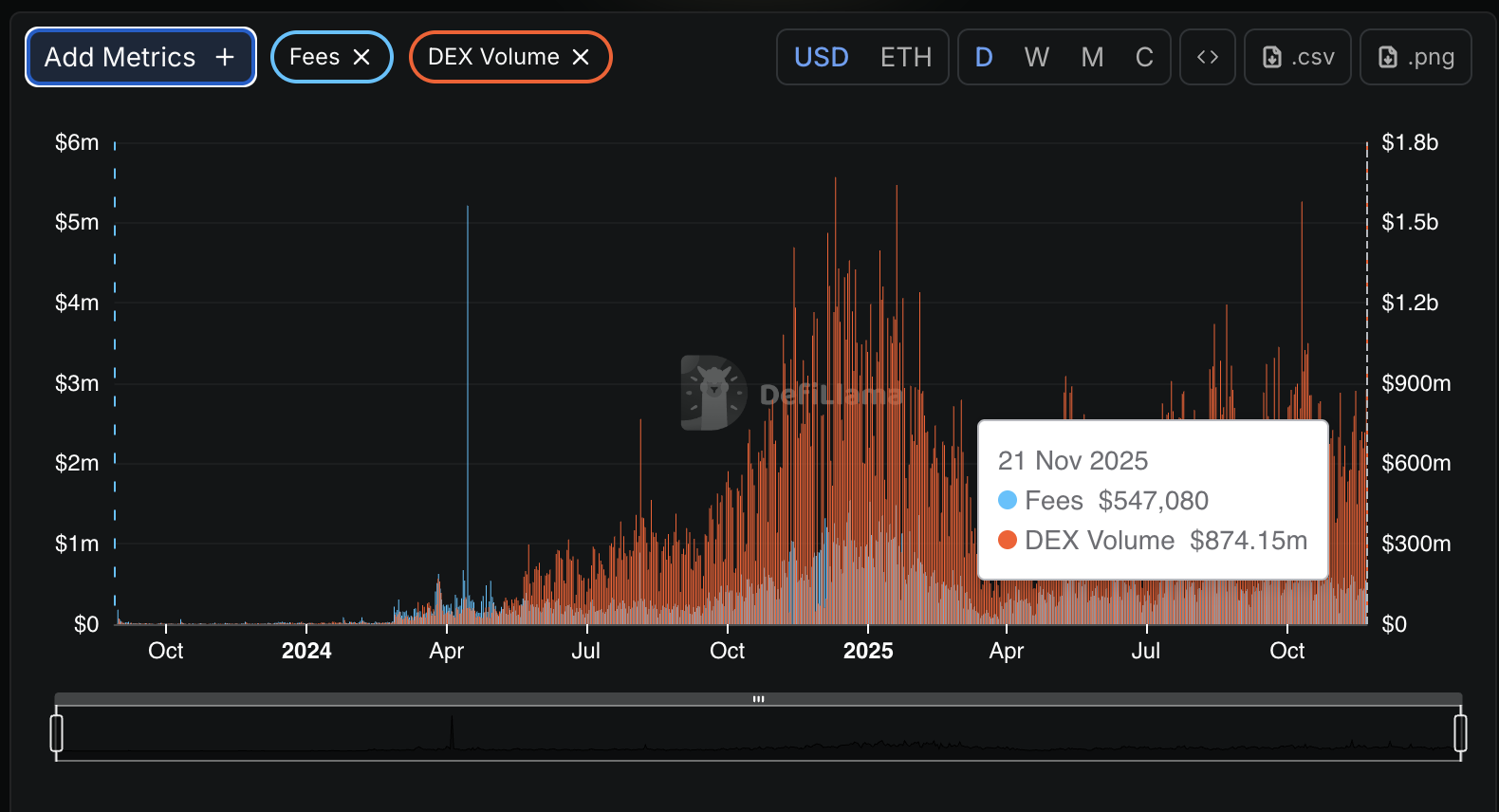

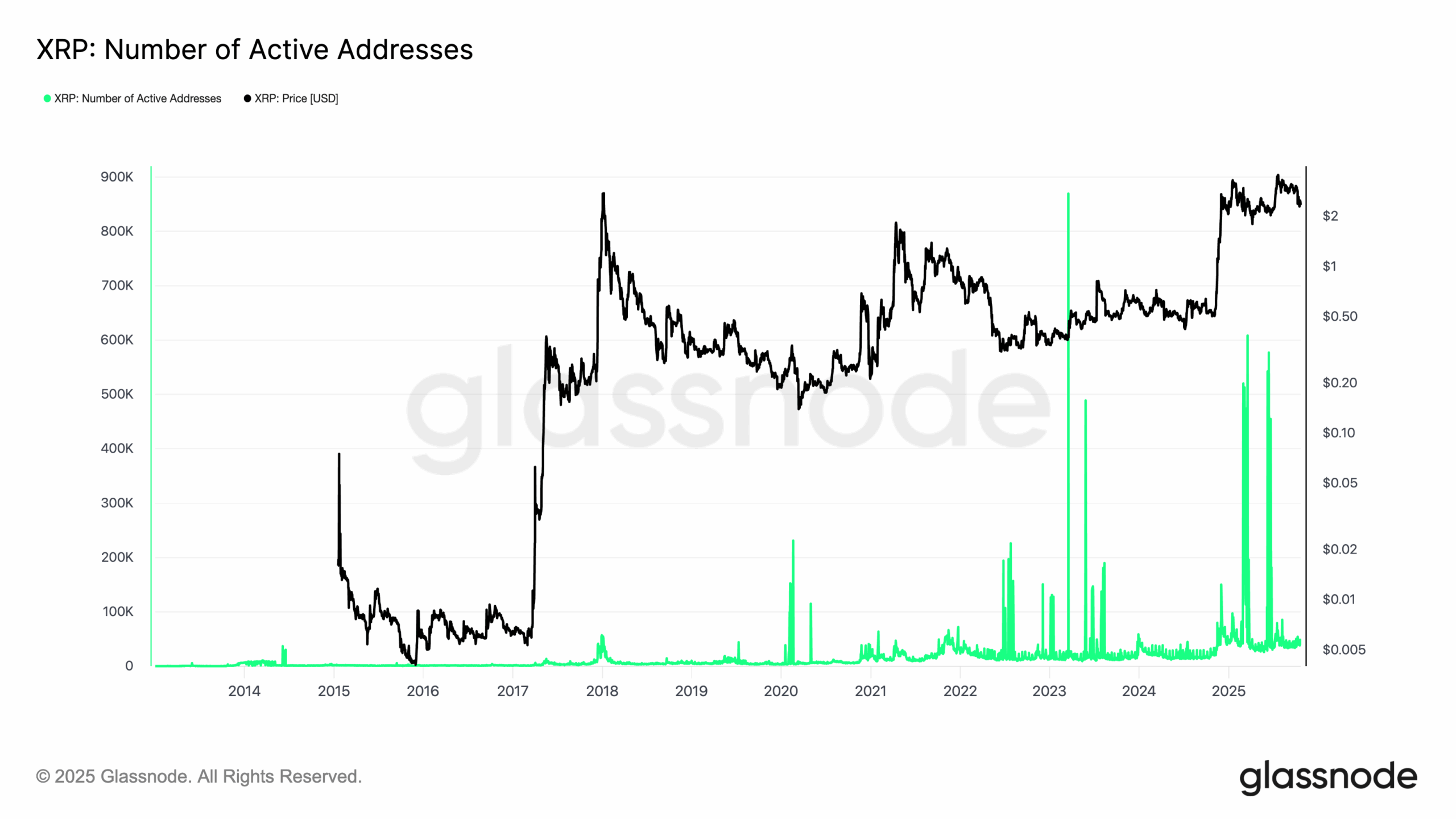

On crypto, Selig is expected to continue the CFTC’s recent push to bring more activity onshore. The agency has already moved ahead with pilot programs covering tokenized collateral and listed spot crypto products on regulated exchanges. Selig has previously supported clearer market structure rules and closer coordination with the SEC, Treasury, and banking regulators.

His confirmation comes as Congress debates legislation that could give the CFTC primary oversight of spot crypto commodity markets. If passed, those laws would expand the agency’s role at a moment when digital asset oversight is still taking shape.

For now, Selig steps into the job with a full agenda and little runway. How quickly policy turns into action will be closely watched by both traditional markets and crypto firms alike.