SharpLink Gaming, once known as a sports betting affiliate technology provider, has rebranded itself to become the world’s largest corporate holder of Ether.

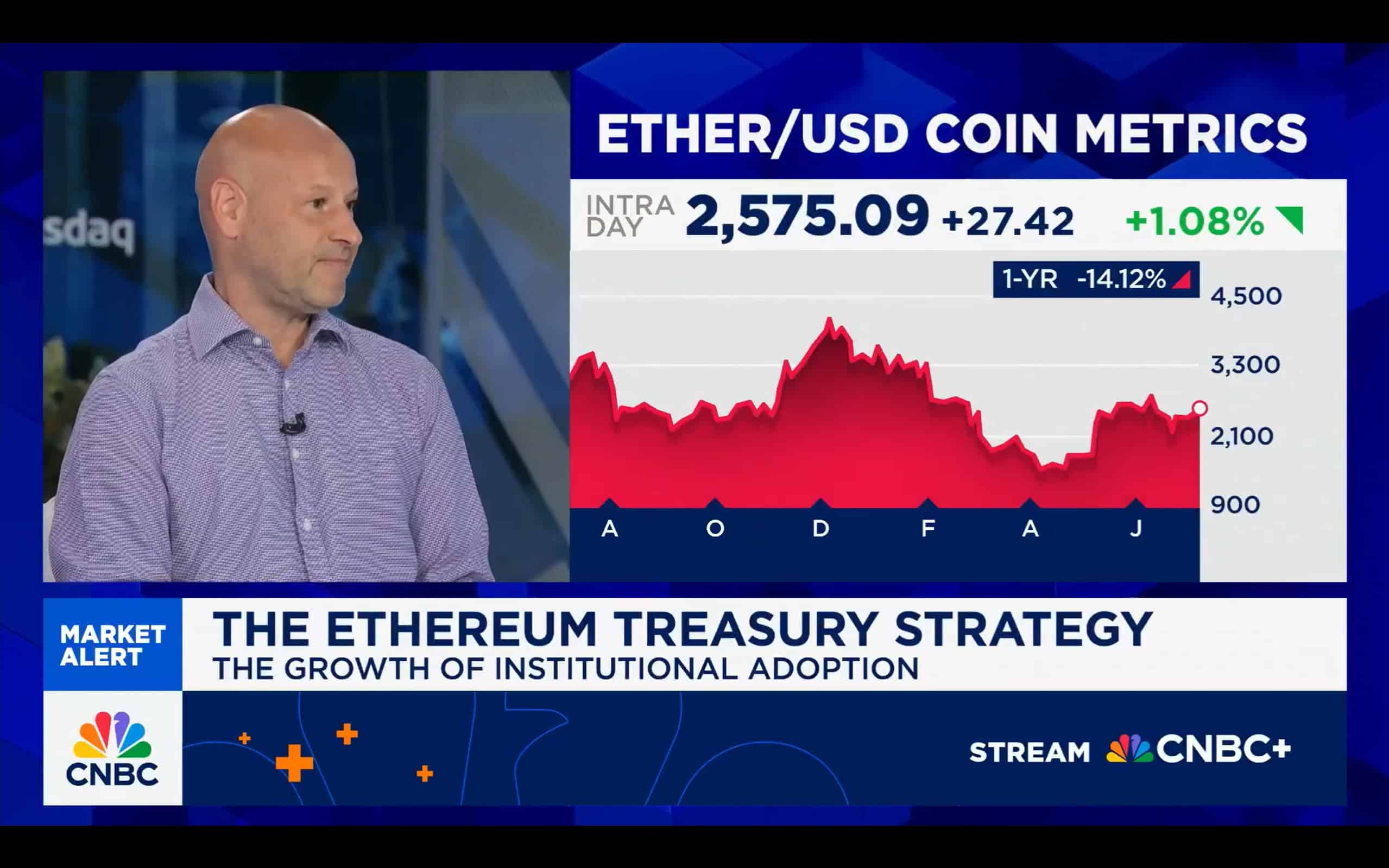

SharpLink today is perhaps the most recognizable publicly traded Ethereum (ETH) treasury vehicle. In one of his first ever interviews since becoming Sharplink’s co-CEO, Joseph Chalom discusses the rationale behind this strategic overhaul, why Ethereum was chosen over other assets, and how the company plans to activate its ETH beyond simple buy-and-hold.

The pivot was led by a $425 million private placement led by ConsenSys, founded by Ethereum co-creator Joseph Lubin, who also chairs SharpLink’s board of direcotrs. With a position valued at around $1.65 billion, the company has already staked a significant portion of its holdings and is actively exploring other ways to generate yield, including restaking and selective participation in DeFi protocols.

As Ethereum cements its role in tokenization, stablecoins, and the broader financial stack, SharpLink is positioning itself not just as a passive holder but as a corporate operator within the Ethereum economy.

In the Q&A that follows, Chalom details how SharpLink intends to leverage its deep ties to the Ethereum ecosystem, maintain investor confidence, and build long-term value beyond speculative appreciation.

crypto.news: SharpLink very recently pivoted from a sports betting affiliate tech firm to an Ethereum-focused strategy and has now become the world’s largest corporate holder of ETH. My first question wants to focus on the timing. Why now? What has changed in your investment thesis or market outlook in the past few months that led you to adopt Ethereum as your primary treasury reserve asset?

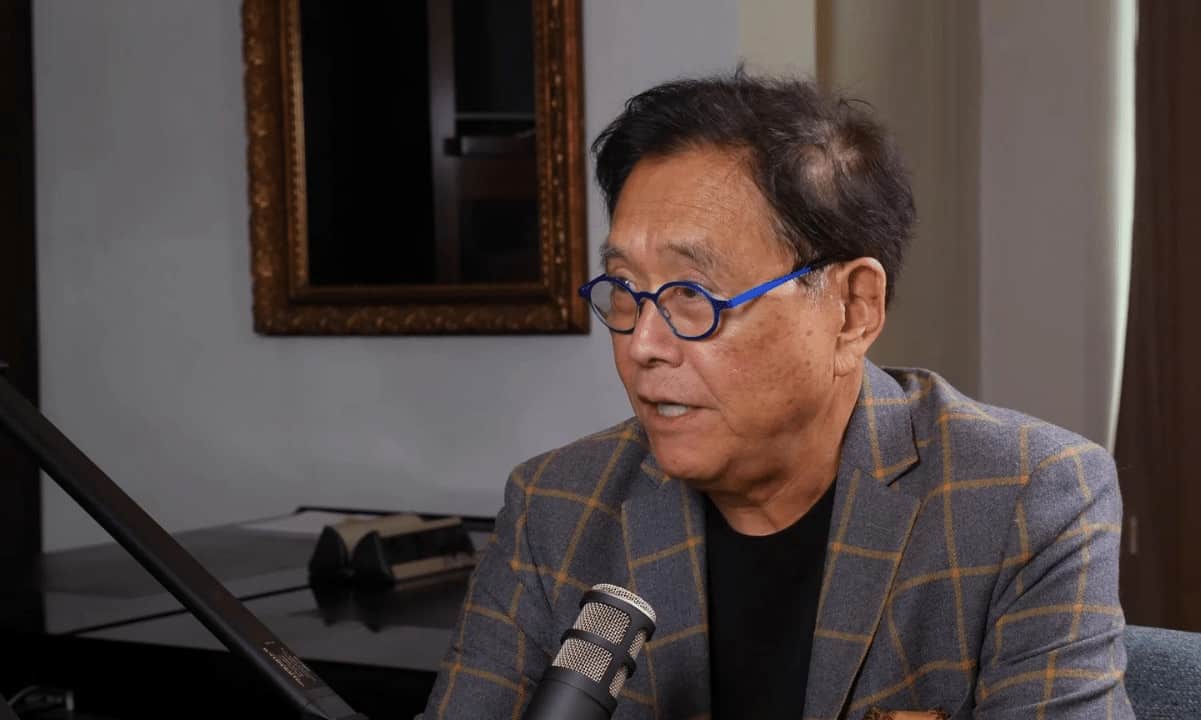

Joseph Chalom: We believe in Ethereum as a transformational technology and a long term opportunity. We have to credit Michael Saylor and Strategy for the inspiration to adopt an ETH treasury strategy for SharpLink. After doing research into the idea around the turn of the year, Joseph Lubin, SharpLink’s Chairman, Co-Founder of Ethereum and Founder and CEO of Consensys, came to the determination that this is an optimal way to maximize returns on Ethereum while driving shareholder value..

Our investment thesis is Ethereum will be the neutral, decentralized platform that will secure stablecoins, a range of tokenized real world assets, and other economic activity for the next generation – you can think of it as the trustware for global finance.

CN: Your July 2025 update noted that roughly $257 million of newly raised capital remains to be deployed into ETH purchases. Going forward, will SharpLink continue aggressively accumulating Ether? Do you have a target total ETH holding or timeline for deployment of those funds? Moreover, beyond the current staking yields and unrealized gains, are you exploring additional ways to monetize this substantial ETH treasury (for example, offering staking services, leveraging ETH in DeFi, or other revenue streams), or is the strategy primarily a long-term appreciation play?

JC: SharpLink’s mission aims to drive shareholder value by becoming the most trusted corporate holder of ETH and activating it for yield. It is our intention to leverage our institutional experience, resources and strategic relationship with Consensys to accelerate institutional adoption of Ethereum, putting it at the center of global finance.

Our platform will focus on earning distinction as one of the largest ETH treasuries of any public company; seeking to acquire ETH at the lowest blended cost to increase our ETH Concentration; execute strategies to capture long term price appreciation, staking yield and accretive returns from our active, disciplined treasury management. We will benefit from our core strategic relationship with the most experienced Ethereum development company on the planet – Consensys.

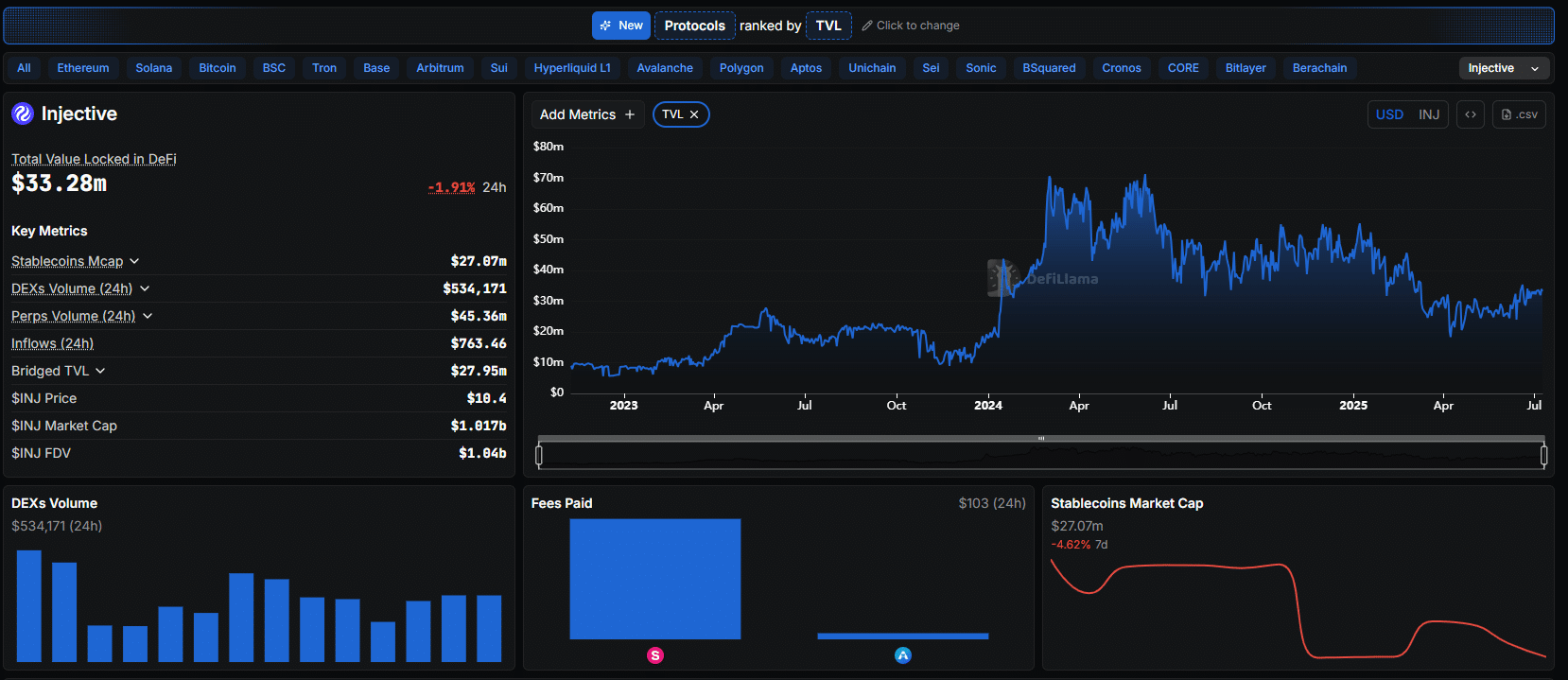

Staking is the baseline mechanism for us to generate productive yield on all of our ETH holdings. There are further opportunities to deploy ETH across the DeFi stack in ways that manage our risk while supporting sustainable growth in the Ethereum ecosystem, which we will continue to explore and evaluate. Selective DeFi participation is the natural next step beyond staking.

We do this through a public equity – SBET – which is a highly-liquid Nasdaq-listed treasury company with strong, average daily trading volume.

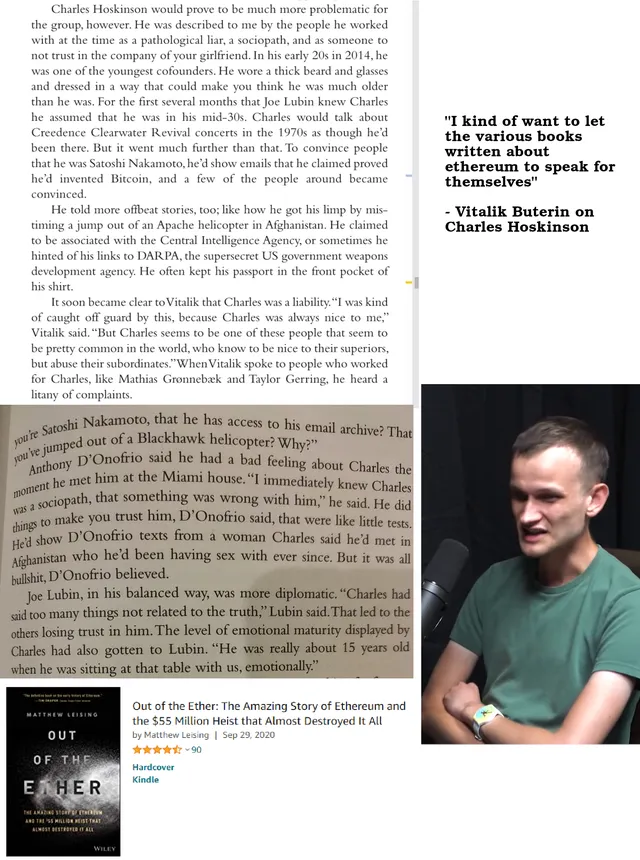

CN: Ethereum co-founder Joseph Lubin is now SharpLink’s Chairman of the Board, and his company ConsenSys led a $425 million private placement to kick-start your Ethereum treasury strategy. How is Lubin’s involvement and ConsenSys’s support influencing SharpLink’s direction on a practical level? Can you share examples of how this partnership is helping, for instance, in developing Ethereum-based products, advising on blockchain integration, or opening doors within the crypto industry?

JC: Consensys’ investment in SharpLink enables a powerful partnership that has strengthened both organizations and created new opportunities. SharpLink is benefitting from our Chairman’s – Joe Lubin – leadership as well as from guidance of other key executives who have years of experience at Consensys. While separate and distinct companies, SharpLink and Consensys enjoy a robust strategic collaboration.

Consensys’ expertise is being brought to bear on SharpLink’s plans to pursue DeFi opportunities on Ethereum.

CN: Your strategy so far has been to stake nearly 100% of your ETH holdings to earn on-chain yield. Do you foresee going beyond plain staking into other Ethereum-based financial strategies? Lubin mentioned SharpLink is “acquiring, staking and restaking ETH as responsible stewards” of the network. Could this imply exploring new protocols (for example, re-staking via emerging Ethereum Layer-2s or DeFi lending) to boost returns?

As stated earlier, staking 100% of our ETH holdings is our baseline expectation for treasury management and yield generation. We are also actively exploring DeFi protocols across the entire Ethereum ecosystem, including restaking and lending, to identify opportunities to generate even greater sustainable value to our shareholders while managing risk and supporting Ethereum.

CN: Holding over three-quarters of a billion dollars in Ether comes with a big responsibility in terms of security. What measures are you taking to safeguard SharpLink’s ETH treasury? Retail crypto investors swear by the mantra “not your keys, not your coins” but in your corporate and Wall Street context, whose “keys” secure the company’s ETH, and how can investors be confident those funds are safe from theft or loss?

JC: Security is our top priority. SharpLink utilizes best industry practices to safeguard our treasury, supported by relationships with leading industry providers, such as Galaxy Digital, ParaFi, Anchorage and Coinbase.

CN: Does SharpLink have any plans to introduce its own cryptocurrency token or Ethereum-based digital asset as part of your ecosystem? For instance, could you launch a token to reward users, facilitate betting transactions, or represent loyalty points in a provably fair way? Or do you intend to stick with existing cryptocurrencies (like ETH) and traditional payment methods for your platform?

SharpLink has no plans to introduce our own token. The Nasdaq ticker is $SBET. The asset is $ETH.

CN: SharpLink’s core business has been in online marketing and technology for sportsbooks, e.g. your PAS.net affiliate network and the C4 BetSense platform that personalizes betting offers. How do these legacy operations intersect with your new Ethereum-centric approach? Will you be integrating blockchain into those existing services (such as using smart contracts to track affiliate referrals or reward users with crypto incentives)? Or do you view the crypto initiatives as a separate arm that will develop new products from the ground up?

We believe that the investment led by Consensys made possible our pioneering ETH treasury strategy and expect that it will strengthen our affiliate marketing business. We will always look to leverage blockchain technology where it’s a value-add for our investors and partners.

CN: Some investors are comparing SharpLink’s strategy to having a time machine to invest in Strategy, but with ETH instead of BTC”. Additionally, other public companies like BitDigital and Bitmine have recently pivoted to Ethereum treasuries as well. With more players adopting a similar crypto treasury model, what sets SharpLink apart? How do you plan to maintain a competitive edge or unique value proposition as the first mover in Ethereum among public companies? And importantly, how do you ensure SharpLink is valued by investors not just as a quasi-ETH ETF or a mini-Strategy (nothing wrong with that) but I would assume your vision is to evolve into a company that can utilize Ethereum to innovate your industry, rather than sitting on the asset.

JC: Fortunately there are fantastic leaders who share our outlook on the value of digital assets like BTC and ETH, and we are working in the same direction to make blockchain the bedrock of the financial system.

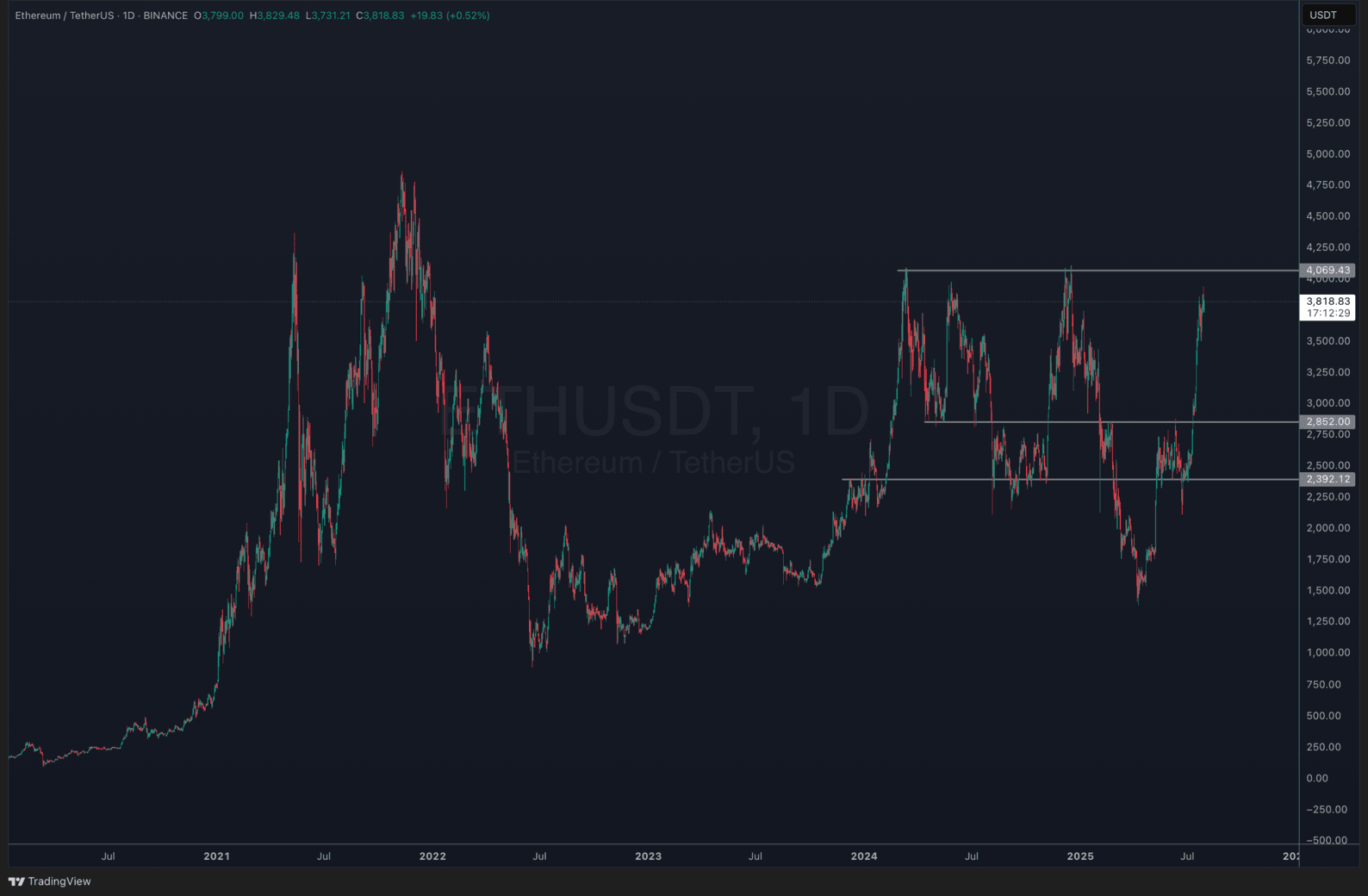

BTC as a store of value is a great initial use case to introduce digital assets to ordinary investors. Like BTC, ETH is also a non-dilutive digital asset, however ETH’s advantage over BTC is it is a productive asset in a productive platform with access staking and other yield generating activities. That gives us far greater flexibility to bring investors value than BTC treasury companies.

SharpLink’s differentiation from other ETH treasury companies is our unparalleled onchain expertise, which derives from the top with Joe Lubin’s leadership.

I’m excited to bring my own experience to SharpLink, with lessons learned from helping scale BlackRock’s Aladdin fintech business and leading the company’s digital assets strategy, including stablecoins, crypto exchange products like IBIT and ETHA, as well as the BUIDL tokenization initiative.