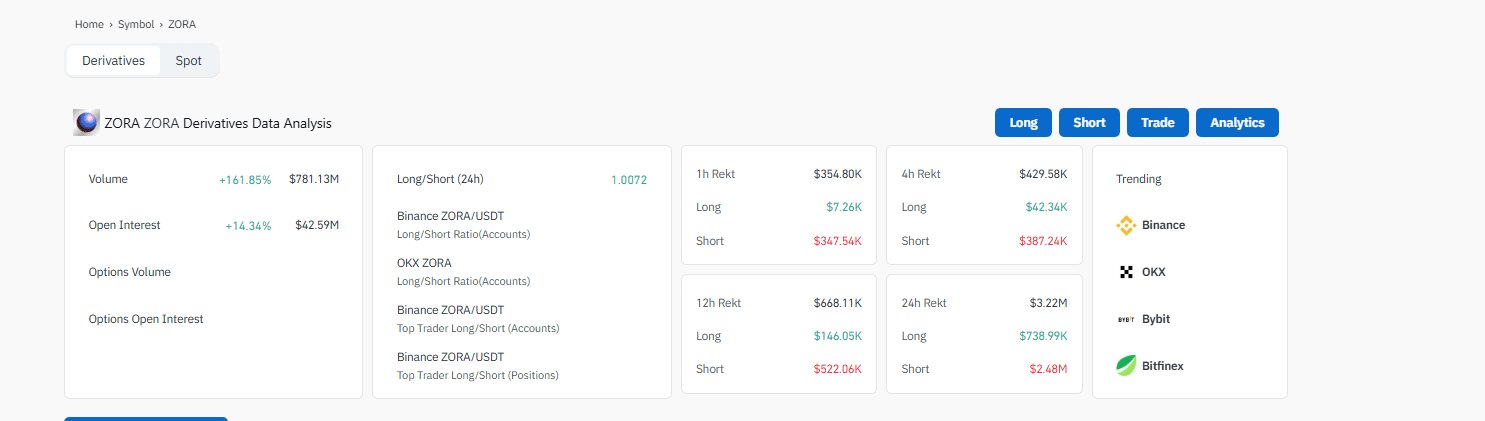

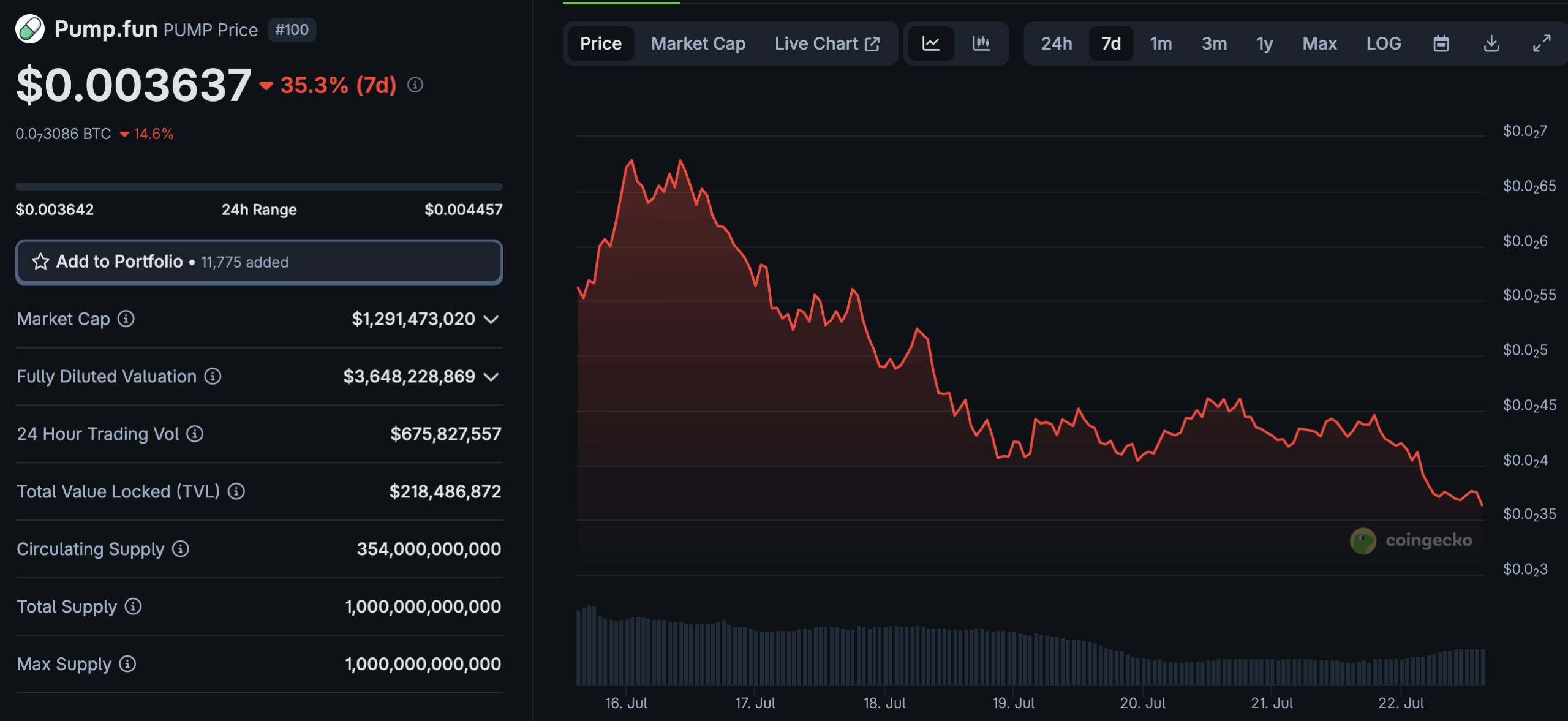

Now, what that means is that the total amount of circulating stablecoins of these eight denominations (e.g., USDT) was collectively worth approximately $245 billion US dollars, according to CoinMarketCap data as of the time of this writing.

Stablecoins Compared To US Dollar Base Supply

Stablecoins are already a significant part of the financial economy in 2025, and the world’s central banks and the IMF recognize that there’s a real presence in the blockchain sector.

For a useful baseline comparison, the total adjusted monetary base of US dollars in circulation plus reserve balances was $5.7 trillion at the same time.

With stablecoins, markets are discussing something that is, in some way, 4.29% of the size of all the real money from the US that the world is working with, based on the $245 billion figure.

Take a nickel and set it next to a dollar. Now, that’s how much top 8 USD stablecoins there are compared to dollars.

Blockchain’s Massive ‘Infrastructure Inversion’

It may certainly call for crypto market investors, as well as national economic scientists and advisors, to factor into their forward outlooks:

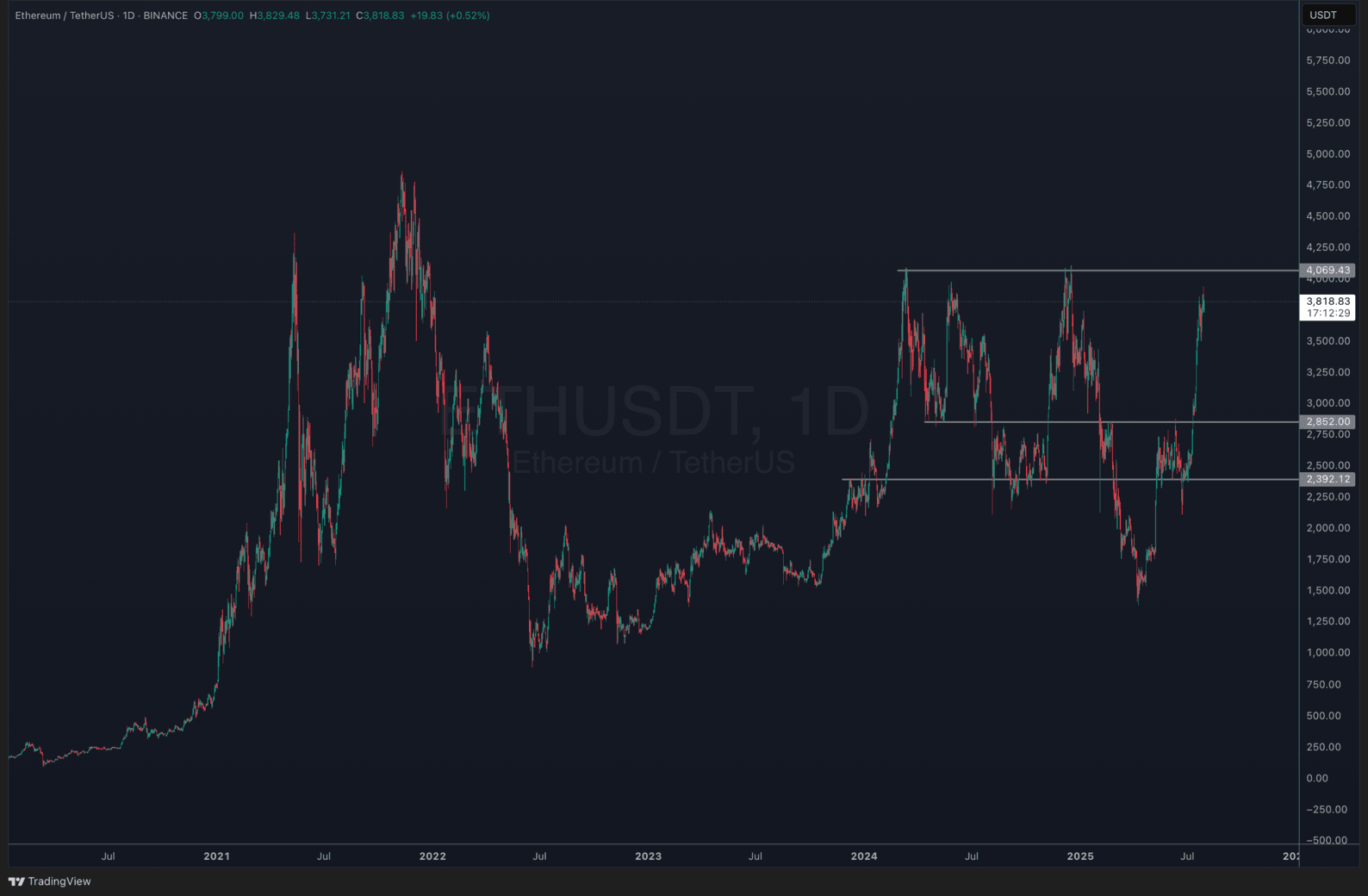

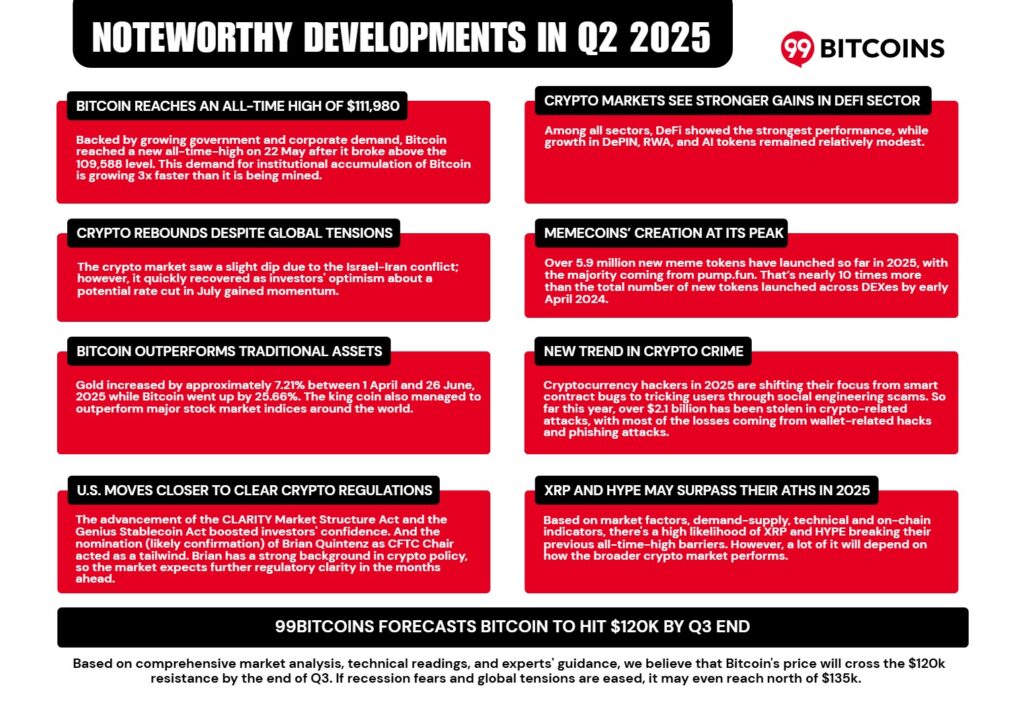

What kind of broad inflection point for the values and relations among these currencies could be ahead as a smaller base of dollars chases a larger and faster-growing market cap of cryptocurrencies?

How was all this even possible? And did it save the economy from a money contraction and debt revaluation spiral, or hyperinflation from too many dollars chasing a basket of scarce consumer goods instead of tokens from an infinitely liquid Internet press?

These questions presage an era of crypto prices defined in markets characterized by total global “infrastructure inversion” with traditional banking.

Bitcoin expert and unofficial spokesperson Andreas Antonopoulos posited this stage of the crypto market’s development several years ago on the Joe Rogan podcast.

That’s how big this thing has gotten from nothing at all in just eleven years, since 2014 when the first stablecoin, Tether, launched.

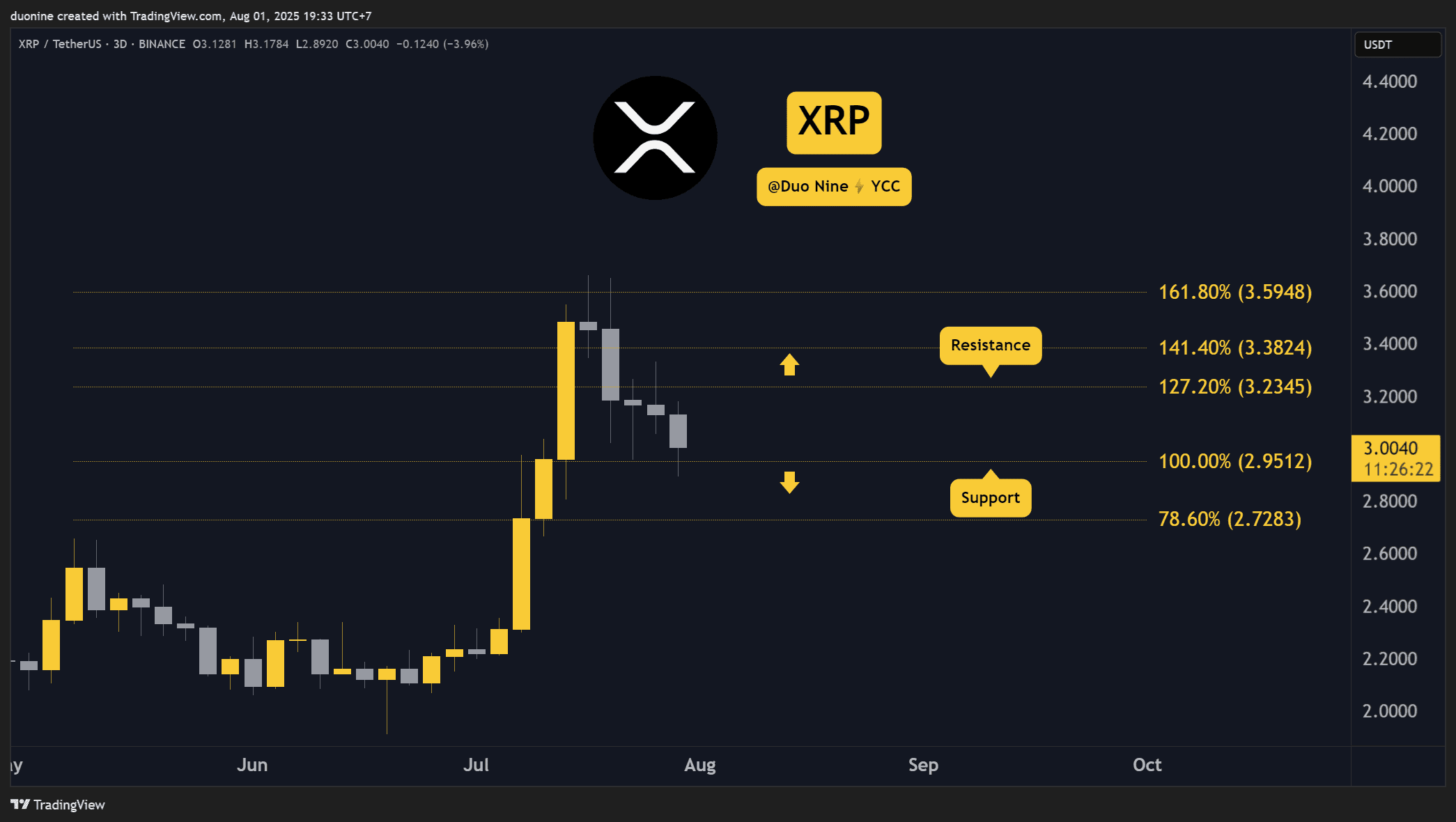

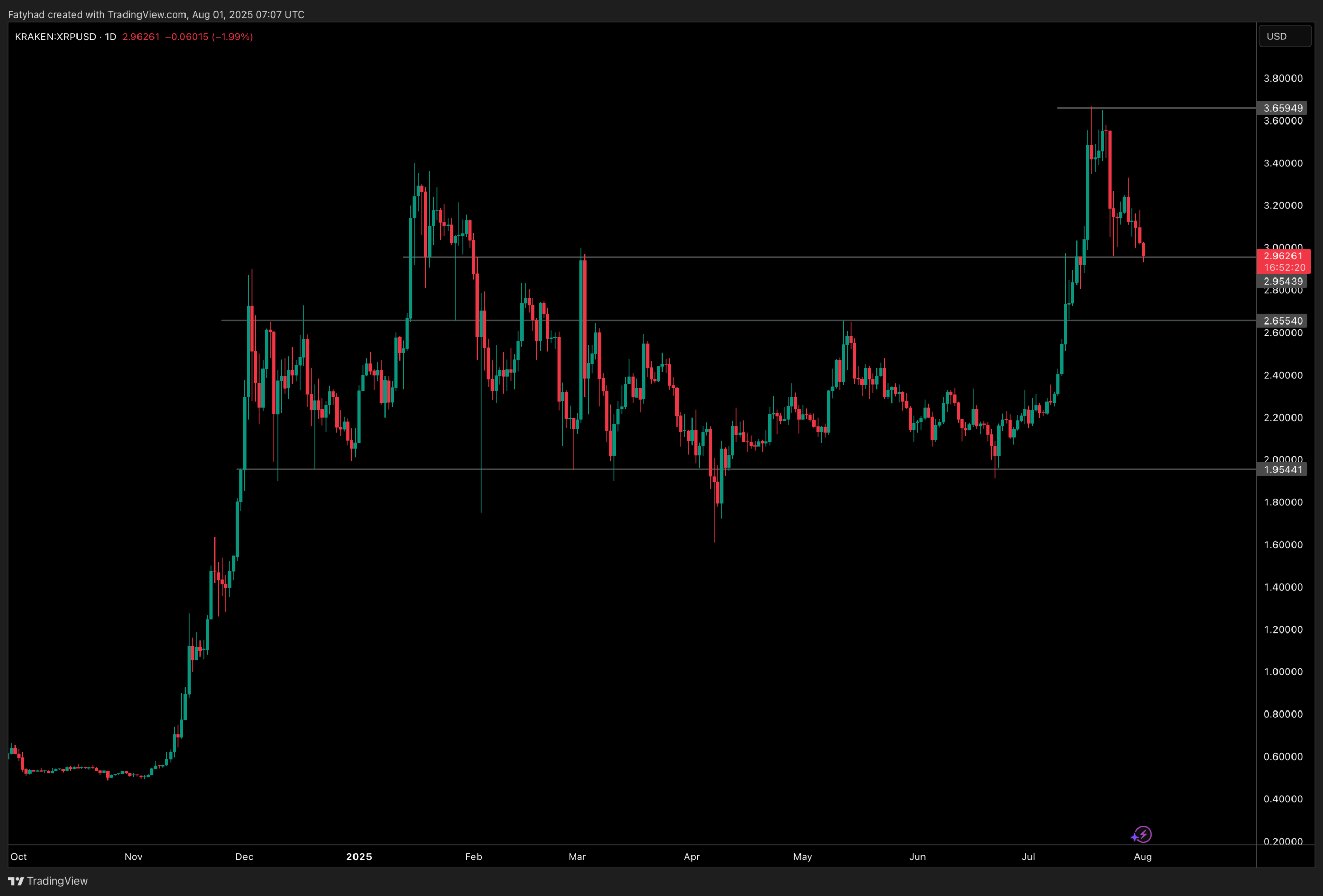

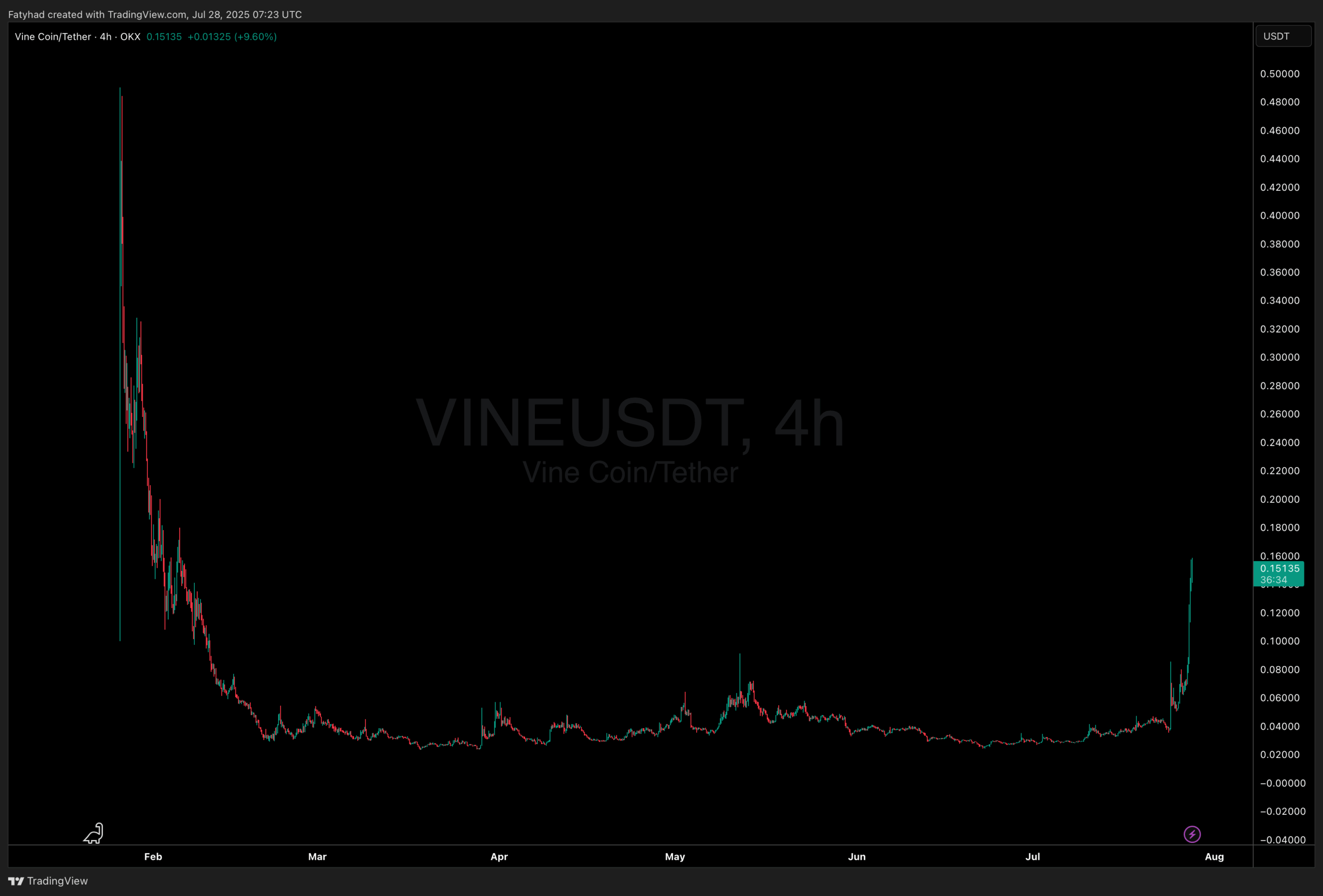

That’s a signal portent for the valuation of blockchain cryptocurrency markets with floating exchange rates or spot prices that follow the ebullient and volatile changes of a market.

Crypto Markets Fuel Stablecoin Demand

Cryptocurrency traders often prefer to use stablecoins because they maintain a stable value, equivalent to a dollar or another fiat currency. That allows them to cash out trades in markets that intensely do not hold their value to a dollar.

That way, they can sell their altcoins at the market price for a dollar equivalent that is tokenized and swaps on the platform they use as easily as cryptos like Bitcoin and Ethereum.

They can also sell those stablecoins for US dollars and cash out to the traditional dollar economy, sending their money to their Federal Reserve or local credit union bank account.

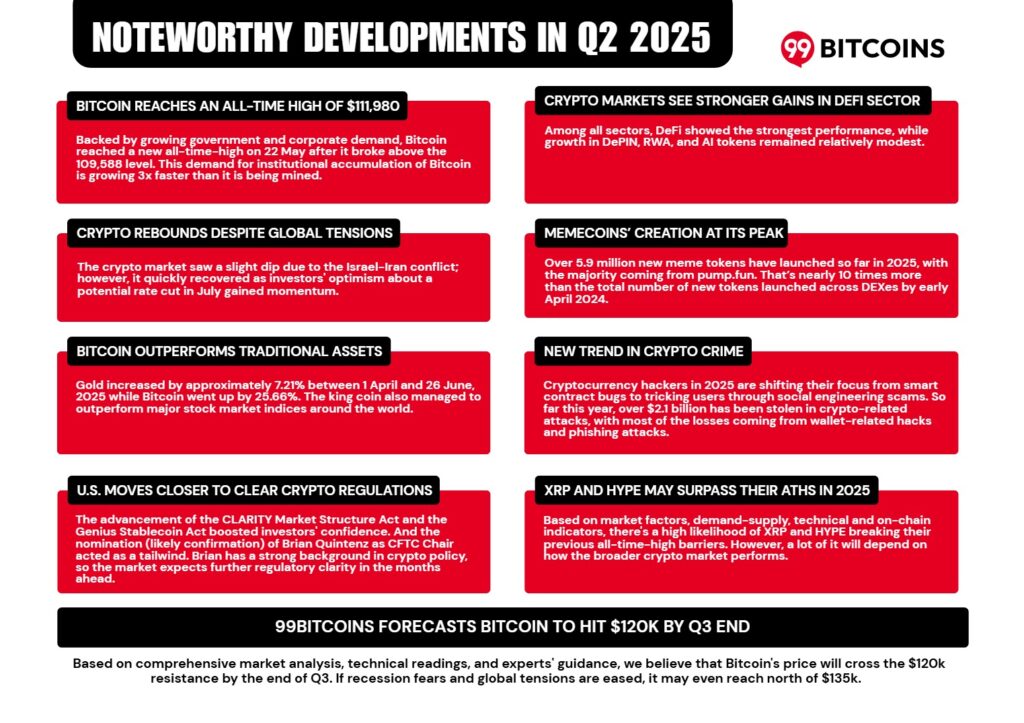

The sheer volume of stablecoins in existence as of Q3 2025 is a testament to the burgeoning growth of crypto markets and cryptocurrency valuations. It also signals there may be more demand for crypto than market price levels in 2025 suggest.

While cryptocurrencies are worth only a fraction of a cent, a dime, a nickel, and a penny to every US dollar in the July base amount recorded by the Federal Reserve, and stablecoins are a bit heavier than another nickel, most Americans still don’t own any cryptocurrency.

Most US businesses still don’t either.

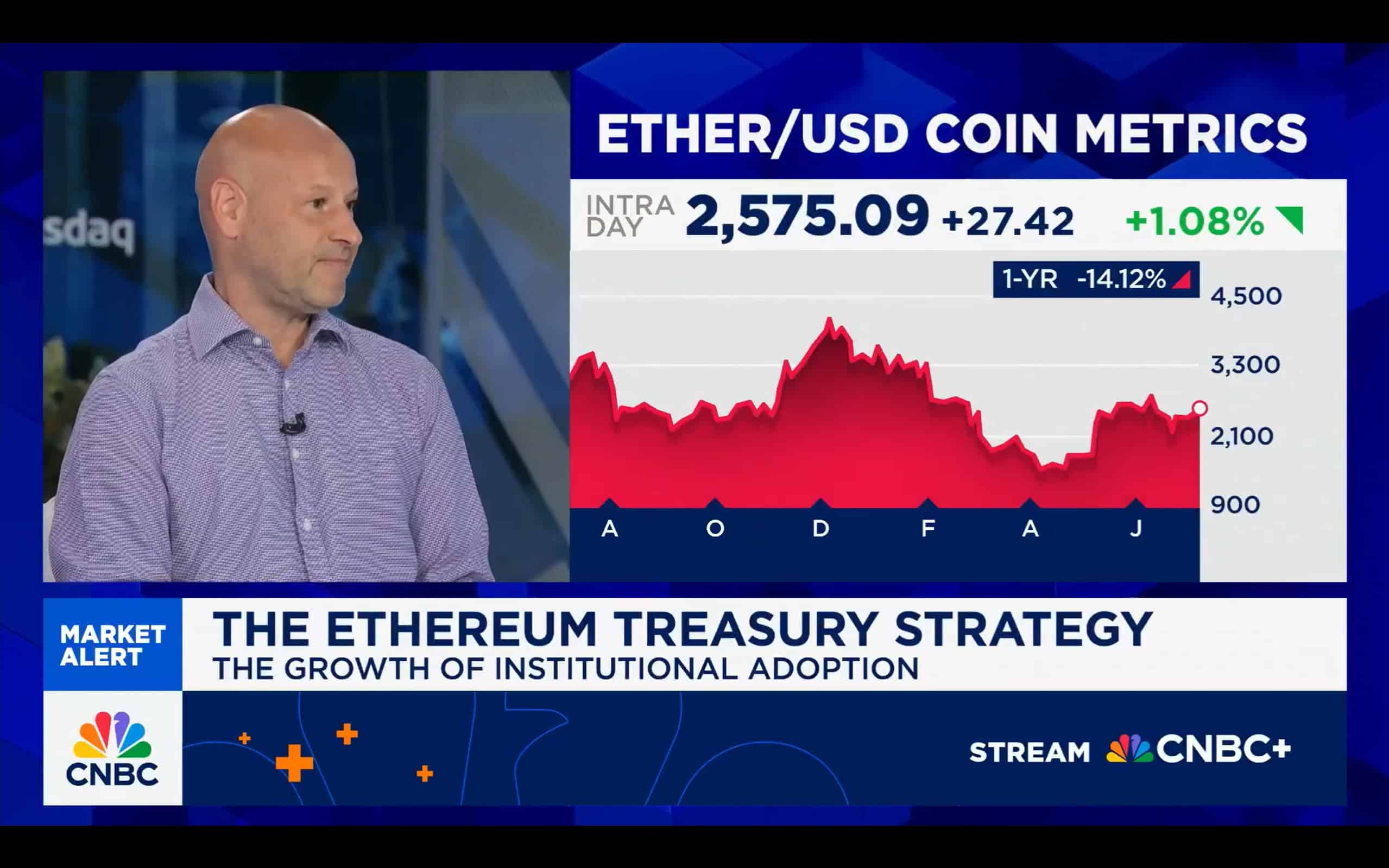

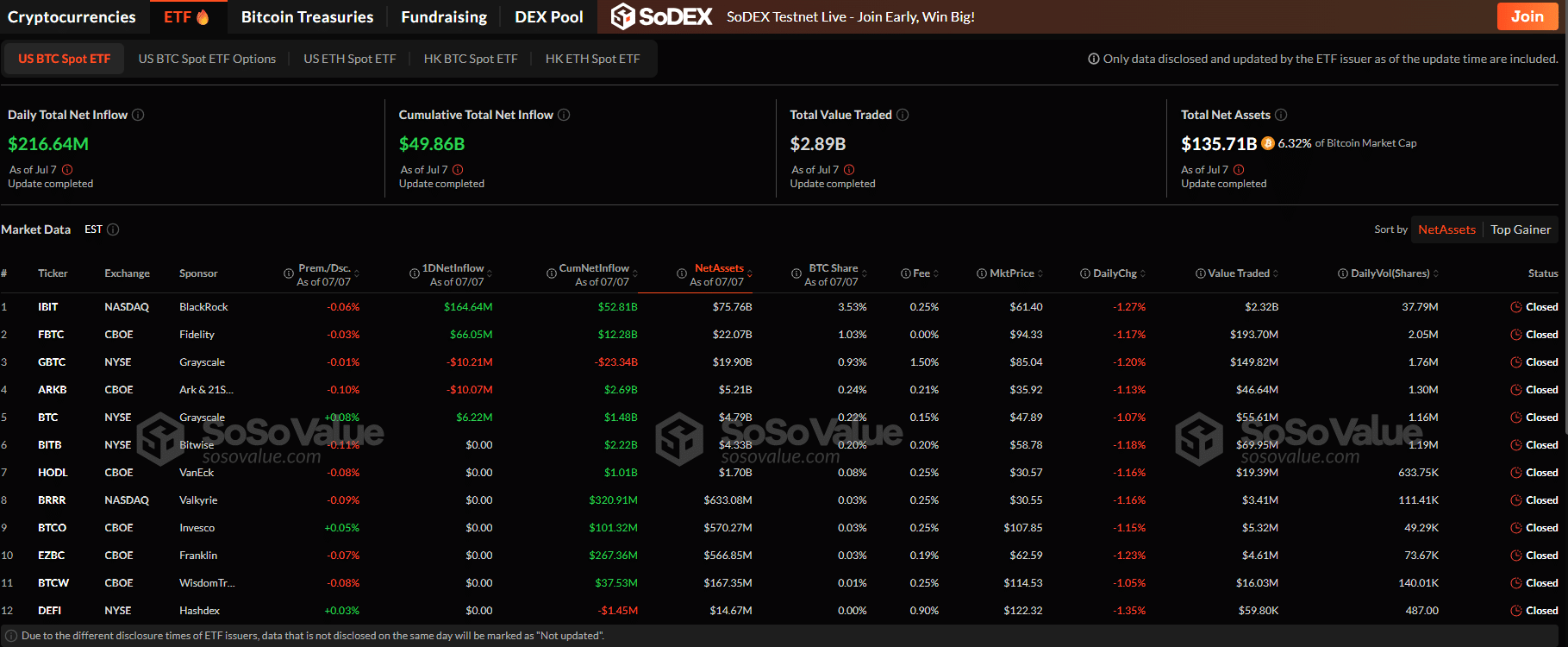

Although some more newcomers may have found their way to crypto since Trump’s reelection and reforms, as market prices reached new record high levels in Q1 and Q2, and as BlackStone leads Wall Street to hoover up BTC and ETH, stablecoins may be a leading indicator of the multi-year seismic shift in crypto values to continue into the foreseeable future.

How Stablecoins Like Tether and USDC Work

How it works is a stablecoin issuer holds a vast reserve of dollars or some price stable commodity or cash like instrument.

Then, the stablecoin company issues its reserve to the blockchain layer of the Internet as serialized digital tokens with a unique ID number that computers can read in a split second and recognize very quickly, even if a human can’t.

The stablecoin owner can then use their tokens to buy things with their phone or computer. When they spend the tokens, they sign over their ownership to the next owner in a chain of signatures, like a block of text on the computer screen.

Some very large chain of blocks like these, bundled together and batch processed by a network’s servers and users, is rapidly updated by the second to a very large number of different computers around the world.

They independently cooperate to run the network (e.g. Bitcoin or Ethereum), usually in consideration for new tokens generated by these blockchain networks and signed to the blockchain node operator on some defined, regular, transparent, open network schedule.

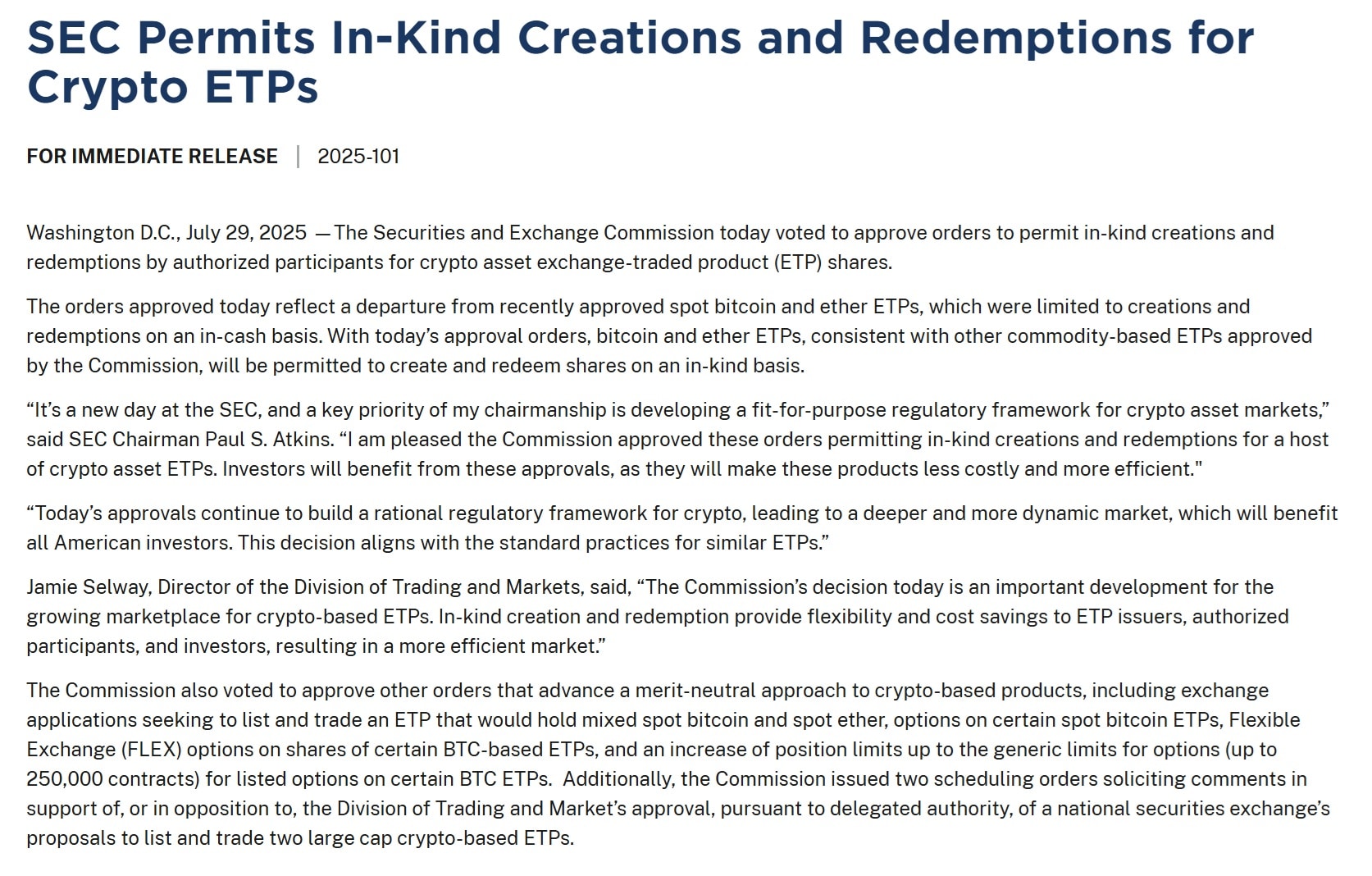

The US government, with the GENIUS Act passed by Congress and signed by President Donald Trump in July, regulates stablecoins to require a 1-to-1 ratio of reserves to back them.

Additionally, the new law provides overwhelming reassurance from Washington to users, markets, investors, and businesses that the blockchain sector is legitimate and that the government is safeguarding national interests in its wake.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!