What altcoins are is often the first question people ask after learning about Bitcoin and the wider cryptocurrency market. Rather than relying on speculation, it helps to focus on practical insights backed by real use cases and fundamentals. Clear information is essential before considering any altcoin investment.

In this guide, we walk you through what altcoins are, their pros and cons, and how altcoins differ from Bitcoin. You will learn about the main types of altcoins and their real use cases. We also cover a list of top altcoins, how to buy them, and key factors to consider before investing. Keep reading to comprehend the full potential of altcoins and make informed decisions in the crypto world.

What are Altcoins?

What altcoins are about is understanding the range of cryptocurrencies outside Bitcoin. These alternative digital crypto assets include everything created after Bitcoin with goals that go beyond simple digital cash. Altcoins often aim to improve certain features or serve specific functions such as payments, governance rights, or network utility. They vary widely in design, purpose, and risk, and each project has its own model and community behind it.

Knowing the altcoin definition helps you separate hype from legitimate options and gives you a base to evaluate potential investments. Investors choose these alternative coins for diverse reasons, including exposure to new technology and portfolio diversification, but this comes with higher volatility and unique risks you need to assess before you invest. For example, you can understand Dogecoin to learn how meme coins evolved into a widely recognized digital asset.

Pros and Cons of Altcoins

Pros

- Innovation: Altcoins often improve upon Bitcoin’s limitations, introducing new features like faster transactions or enhanced privacy.

- Diverse Use Cases: They cater to specific needs, such as decentralized finance (DeFi), gaming, or governance.

- Lower Costs: Many altcoins are more affordable than Bitcoin, making them accessible to a wider range of investors.

- Variety: With thousands of altcoins available, investors have a broad selection to diversify their portfolios.

- Utility: Some altcoins, like Ethereum, power decentralized applications and smart contracts, adding real-world value.

Cons

- Volatility: Altcoins are often more volatile than Bitcoin, leading to higher investment risks.

- Lower Liquidity: Many altcoins have smaller market caps, making them less liquid and harder to trade.

- Scams and Failures: The altcoin market includes many projects that lack long-term viability or are outright scams.

- Complexity: Understanding the technology and use cases of altcoins can be challenging for new investors.

- Regulatory Risks: Altcoins may face stricter regulations, impacting their adoption and value.

What Are the Key Differences Between Bitcoin vs Altcoins?

| Aspect | Bitcoin | Altcoins |

| Use Case | Used as digital gold, a value-preserving asset, and a peer-to-peer payment method | Varies by use case, including stablecoins, smart contracts, governance, privacy, and DeFi. |

| Technology | Proof-of-Work (PoW) | Often rely on alternative or modified consensus models, such as Proof of Stake or Proof of Authority. |

| Volatility | Still volatile, though typically less than most altcoins. | Higher volatility, especially among native and low-cap tokens. |

| Adoption | Widely recognized and held by institutional investors. | On the rise, though practical uses and regulatory status depend on the project. |

| Supply | Total supply capped at 21 million BTC | Supply varies by coin; some are inflationary (e.g., ETH). |

Types of Altcoins and Their Real Use Cases

Altcoins are designed to solve specific problems and offer unique benefits. If you’re exploring altcoin investment or thinking about which altcoins to buy, understanding their types and uses can help you make better decisions.

Here are the different types of altcoins and their real use cases.

1. Platform Coins

Platform coins are the foundation of blockchain networks. They power their own blockchains and support decentralized apps (dApps) and smart contracts. Ethereum is a great example, widely used for smart contracts and decentralized finance (DeFi). Other platform coins like Cardano, Solana, and Polkadot also play key roles in advancing blockchain technology. If you’re a developer or someone who interacts with blockchain-based applications, platform coins are essential.

2. Stablecoins

Stablecoins focus on price stability. Their value is tied to assets like the US dollar, which helps reduce sudden price swings. You might use stablecoins to move funds, lock in gains, or manage risk during volatile periods. Many people also start with stablecoins before buying other altcoins. They’re a key part of most altcoin investment strategies because of their liquidity and ease of use.

3. Utility Tokens

Utility tokens give you access to services within a blockchain network. You use them to pay fees, access tools, or interact with apps. As more people use the network, demand for these tokens often grows. If you’re looking for altcoins to buy based on real activity and demand, utility tokens are worth considering.

4. Governance Tokens

Governance tokens give you voting rights in a blockchain project. You can help decide upgrades, fee changes, and protocol rules. This structure supports community-led projects and decentralized decision-making. Governance tokens are perfect for long-term altcoin investment plans where your influence and participation matter as much as the price.

5. Security Tokens

Security tokens link digital tokens to real-world assets like equity or revenue rights. These tokens follow financial regulations and focus on transparency. They’re often seen as a bridge between traditional finance and crypto markets, offering a structured way to invest in blockchain technology.

6. Privacy Coins

Privacy coins focus on protecting your transaction details. They limit public tracking of balances and transfers, making them a good choice if you value financial privacy. Monero and Zcash are well-known examples. Privacy coins do face higher regulatory attention, so it’s important to weigh the risks before buying.

7. GameFi Tokens

GameFi tokens support blockchain-based games and virtual worlds. You earn or spend tokens through gameplay, upgrades, and digital items. Their value depends on active users and strong game design. If you enjoy gaming and want to combine it with crypto, GameFi tokens might be a good fit.

8. Meme Coins

Meme coins grow through online communities and social momentum. They often start without much utility, but strong community support drives attention and trading volume. Dogecoin and Shiba Inu are popular examples. If you’re considering meme coins, keep in mind that they carry high risk and sharp price swings. It’s best to treat them as speculative altcoins to buy rather than core investments.

9. Exchange Tokens

Exchange tokens belong to crypto trading platforms. You use them for lower fees, rewards, and access to platform features. Their value often tracks platform growth and user activity. If you’re a frequent trader, exchange tokens can be a smart addition to your altcoin investment approach.

10. Payment Tokens

Payment tokens focus on fast and low-cost transfers. You can use them for peer-to-peer payments and cross-border transactions. Speed and low fees drive their adoption. These tokens aim to improve daily crypto payments and compete with traditional money transfer systems.

Altcoins offer a wide range of opportunities, whether you’re interested in platform coins for their technology or stablecoins for their practicality. Each type serves a purpose, so there’s something for everyone. Altcoin investment can be rewarding when you understand how these Bitcoin alternatives work and what they bring to the table.

List of Top Altcoins

- Ethereum (ETH): Ethereum is the second-largest cryptocurrency by total crypto market cap and a pioneer in smart contracts and decentralized applications. It powers decentralized finance and non-fungible tokens. The transition to Ethereum 2.0, which uses a proof-of-stake consensus mechanism, has made it more energy-efficient and scalable.

- Solana (SOL): Solana is known for its high-speed transactions and low fees, making it a popular choice for developers building decentralized apps and NFT marketplaces. Solana blockchain can handle thousands of transactions per second, making it one of the fastest in the crypto space. It’s often seen as a competitor to Ethereum.

- Cardano (ADA): Cardano is a research-driven blockchain platform that focuses on sustainability, scalability, and security. It uses a proof-of-stake consensus mechanism and supports smart contracts and decentralized applications. Cardano’s emphasis on peer-reviewed research and a phased development approach sets it apart from other blockchains.

- Ripple (XRP): Ripple is designed for fast and low-cost cross-border payments. It is widely used by financial institutions to facilitate international money transfers. Ripple’s focus on bridging traditional finance and blockchain technology has made it a key player in the crypto space, despite ongoing regulatory challenges.

- Litecoin (LTC): Litecoin is one of the oldest cryptocurrencies and offers faster transaction times and lower fees compared to Bitcoin. It is a practical choice for everyday transactions and is widely accepted by merchants. Litecoin has a strong community of supporters and remains a reliable option in the crypto market.

How to Buy Altcoins

Buying cryptocurrency altcoins can seem overwhelming at first, but it’s a straightforward process when broken down into simple steps. Here’s a detailed guide to help you get started:

Step 1: Choose a Reliable Crypto Exchange

The first step is to select a cryptocurrency exchange where you can buy altcoins. Popular exchanges like Binance, Coinbase, and Kraken offer a wide range of cryptocurrency altcoins. When choosing an exchange, consider factors like security, fees, and the variety of altcoins available. Make sure the platform is reputable and supports the specific altcoins you’re interested in.

Step 2: Create and Verify Your Account

Once you’ve chosen an exchange, you’ll need to create an account. This typically involves providing your email address, setting a password, and completing identity verification. Verification may require you to upload a government-issued ID and proof of address. This step ensures compliance with regulations and helps protect your account from fraud.

Step 3: Deposit Funds

After your account is set up, you’ll need to deposit funds to buy cryptocurrency altcoins. Most exchanges allow you to deposit fiat currency (like USD or EUR) via bank transfer, credit card, or other payment methods. Some platforms also let you deposit other cryptocurrencies if you already own them. Be sure to check the deposit fees and processing times for your chosen method.

Step 4: Research and Select Altcoins

Before making a purchase, take some time to research the altcoins you’re interested in. Look into their use cases, market performance, and future potential. Whether you’re considering Ethereum, Solana, or lesser-known cryptocurrency altcoins, understanding their value and purpose will help you make informed decisions.

Step 5: Place Your Order

Once you’ve decided which altcoins to buy, navigate to the trading section of the exchange. You’ll typically find options to place a market order or a limit order. A market order buys the altcoin at the current market price, while a limit order lets you set a specific price. Enter the amount you want to buy and confirm the transaction. The altcoins will be added to your exchange wallet once the purchase is complete.

Step 6: Transfer Altcoins to a Secure Wallet

For added security, it’s a good idea to transfer your altcoins from the exchange to a private wallet. Cryptocurrency wallets come in two main types: hot wallets (online) and cold wallets. Hot wallets are designed for quick, frequent transactions, while cold wallets provide stronger protection for long-term storage. Always keep your wallet’s private keys safe and never share them with anyone.

Step 7: Monitor and Manage Your Investment

After buying cryptocurrency altcoins, keep track of their performance and market trends. Use tools like portfolio trackers to monitor your holdings. Stay informed about news and updates related to your altcoins, as this can impact their value. Whether you’re holding for the long term or planning to trade, managing your investment is key to success.

If you’re looking for the best altcoin exchange to support your investment journey, platforms like Binance, Coinbase, and Kraken are highly recommended. They offer a wide selection of altcoins, user-friendly interfaces, and robust security features, making them ideal for both beginners and experienced traders.

Things to Consider Before Investing in Altcoins

Altcoin investment demands careful review before you commit funds. Each factor below helps you avoid common mistakes and protect capital.

- Project purpose and demand. Start with the problem the altcoin solves. A clear use case tied to real demand matters more than promises. Tokens linked to active users, payments, or services show stronger foundations than projects driven by attention alone.

- Team credibility and track record. Look at who runs the project. Public teams with proven experience reduce risk. Past work in crypto, software, or finance adds confidence. Anonymous teams raise questions around accountability.

- Token supply and distribution. Review total supply, release schedules, and ownership concentration. Large insider holdings increase sell pressure. Fair distribution supports healthier price action over time.

- Liquidity and trading volume. Low liquidity leads to sharp altcoin price swings and poor execution. Higher trading volume improves entry and exit prices. Liquidity plays a major role when choosing altcoins to buy.

- Security and audits. Check whether the project has completed third-party security audits. Past hacks or unresolved flaws signal danger. Strong security protects funds and user trust.

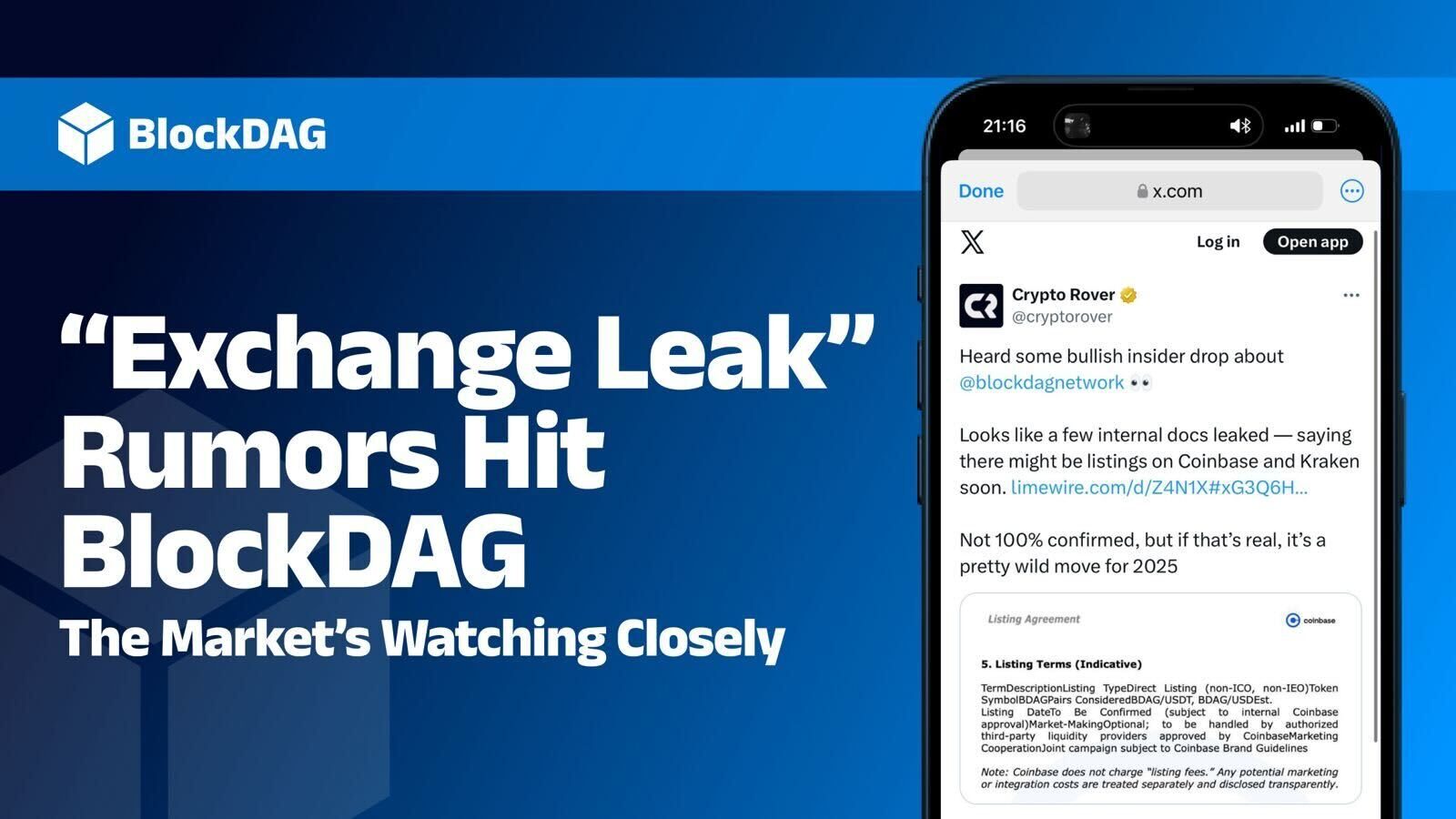

- Regulatory exposure. Some altcoins face higher scrutiny due to privacy features or financial claims. Regulatory risk affects exchange listings and access. Research this risk before adding an asset to your altcoin investment plan.

- Market conditions and timing. Broader market trends influence altcoin performance. Entering during extreme hype increases downside risk. Patience and timing help preserve capital.

- Risk management. Never invest funds you need for daily expenses. Spread exposure across multiple assets. Clear limits protect you from emotional decisions during market swings.

The Future of Altcoin Investment

The world of cryptocurrency altcoins is constantly evolving, and the future looks promising for those who invest wisely. As blockchain technology continues to grow and diversify, altcoins are expected to play an even bigger role in shaping the financial landscape. Here’s what you can expect in the future of altcoin investment:

1. Increased Adoption of Blockchain Technology

Altcoins are at the forefront of blockchain innovation. As more industries adopt blockchain for applications like supply chain management, healthcare, and finance, the demand for altcoins that power these networks will grow. Coins like Ethereum, Solana, and Cardano are already leading the way, and their ecosystems are likely to expand further.

2. Growth of Decentralized Finance (DeFi)

Decentralized finance is revolutionizing how people access financial services. Altcoins that support DeFi platforms, such as Ethereum and Avalanche, are expected to see increased usage. DeFi allows users to lend, borrow, and trade without relying on traditional banks, making it a key driver for altcoin growth.

3. Expansion of Non-Fungible Tokens (NFTs)

NFTs have gained massive popularity, and many altcoins are integral to this market. Ethereum, for example, is the backbone of most NFT transactions. As NFTs continue to evolve beyond digital art into areas like gaming, real estate, and intellectual property, altcoins that support these ecosystems will likely benefit.

4. Focus on Sustainability

Environmental concerns have pushed the crypto industry to explore more sustainable solutions. Altcoins that use energy-efficient consensus mechanisms, like proof-of-stake, are gaining traction. Cardano and Solana are examples of altcoins that prioritize sustainability, making them attractive to environmentally conscious investors.

5. Regulatory Developments

As governments around the world introduce regulations for cryptocurrencies, the altcoin market will become more structured and secure. While this may create short-term volatility, it will also build trust and attract institutional investors in the long run. Altcoins that comply with regulations and offer transparency are likely to thrive.

6. Diversification of Use Cases

Altcoins are no longer limited to just being digital currencies. They now power a wide range of applications, from decentralized apps to gaming and virtual worlds. GameFi tokens, privacy coins, and utility tokens are examples of altcoins with unique use cases that cater to specific markets. This diversification will continue to drive innovation and investment opportunities.

7. Institutional Interest

Institutional investors are increasingly exploring altcoins as part of their portfolios. This trend is expected to grow as altcoins like Ethereum and Ripple gain recognition for their utility and potential returns. Institutional involvement will bring more stability and liquidity to the altcoin market.

8. Integration with Traditional Finance

Altcoins are gradually bridging the gap between traditional finance and blockchain technology. Security tokens, for instance, represent real-world assets like stocks and real estate, making them appealing to traditional investors. This integration will open up new opportunities for altcoin investment.

Conclusion

Altcoins offer access to a wide range of crypto use cases, from altcoin payments and trading to apps and governance. Each type carries its own risks, rewards, and role within the market. Understanding how altcoins function, where demand comes from, and how they differ from Bitcoin helps you make informed choices. A thoughtful altcoin investment approach relies on research, risk control, and clear goals. When you focus on use cases, liquidity, and long term viability, you improve your ability to choose altcoins to buy with purpose instead of speculation.

FAQs

An example of an altcoin is Ethereum (ETH). Ethereum is one of the most popular altcoins and is widely used for smart contracts, decentralized applications, and NFTs. Other examples include Solana (SOL), Cardano (ADA), and Ripple (XRP).

Altcoins refer to any digital currency other than Bitcoin, and they often serve specific purposes, such as powering decentralized apps, enabling fast transactions, or supporting blockchain-based games.

Whether altcoins are better than Bitcoin depends on your goals. Bitcoin blockchain is the most established cryptocurrency and is often seen as a store of value. Altcoins, on the other hand, offer diverse use cases like smart contracts, decentralized finance, and gaming. Each has its strengths, so the choice depends on what you’re looking for in a cryptocurrency.

The best altcoins to invest in include Ethereum (ETH), Solana (SOL), Cardano (ADA), Ripple (XRP), and Litecoin (LTC). These altcoins are known for their strong use cases, active development teams, and growing adoption. However, always conduct your own research before investing.